Focused equity funds invest in maximum 30 stocks. There are total 22 such schemes managing Rs 44342 crore, as of May 2020, according to Value Research. Over a five-year period, focused equity funds as a category have outperformed large-cap equity schemes. While focused funds delivered 5.51 per cent, large-cap schemes managed 4.34 per cent over this period on an average.

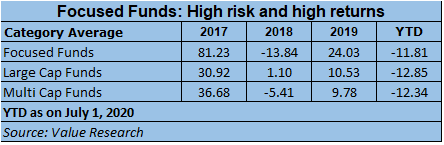

During 2018 and 2019, a small bunch of stocks did well and investors who held those stocks made money. Some focused funds and diversified equity schemes with high exposure to such trending stocks did well too. The table makes it clear that in 2017, focused funds (with 81.23 per cent returns) substantially outperformed large-cap (30.92 per cent) and multi-cap (36.68 per cent) funds. In 2018, the bearish sentiment affected these funds and they underperformed, though not by much relative to other categories.

Concentrated exposure

“In focused equity funds, allocation to individual stocks is generally higher than that in a diversified equity fund. Some focused funds also take higher exposure to specific sectors. It makes the fund manager's role important,” says Anil Rego, founder and CEO of Right Horizons. For example, SBI Focused Equity Fund invests 55 per cent of its portfolio among its top 10 stock holdings. But, on the other hand, SBI Mangum Multi Cap Fund – a plain-vanilla diversified scheme – has its top 10 stocks accounting for only 47 per cent of the portfolio.

Although focused funds have been recognized as a separate category by the Securities Exchange Board of India (SEBI) in October 2017, quite a few managers have followed it as a strategy in their regular schemes for years. Some of them made it to the focused category, whereas some are in other divisions but still take focused exposure to select stocks in search of high returns. For example, Axis Bluechip, a large cap equity fund has consistently taken the focused investment route, has delivered consistently good returns. It had only 23 stocks in its May-end portfolio and the top 10 stocks accounted for 54 per cent of the scheme’s corpus.

Portfolio composition important

Investors should check the portfolio composition of equity funds before deploying sums. Sometimes, diversified equity funds also take concentrated bets to improve performance, which is a risky strategy. In the current market situation, most of these focused funds have invested in large-cap stocks. However, some of them do have exposure to mid and small-cap stocks. A concentrated exposure to mid and small-cap names can lead to high volatility. Investors must keep track of such allocations.

If the fund manager is focused on quality stocks while building such concentrated portfolios, such schemes may outperform the broad markets and other well-diversified peers as well. In the recent fall caused by the expectation of a massive economic slowdown caused by the COVID-induced lockdown, most focused equity funds managed to contain downsides.

But that does not mean focused funds are a prescription of sure success. In case of misadventures of the fund manager or a fall in the broad markets, focused funds could be punished severely. You should be prepared to take such extreme investment results from focused strategies. “Investors should avoid going overboard on focused equity funds. Invest in a maximum of one such scheme,” says Rego.

“Focused funds with high allocation to quality stocks should deliver superior returns than diversified equity schemes. However only investors with an appetite for risk should invest in these schemes,” says Vinayak Savanur, founder and chief financial planner of MoneyMintingMantra.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.