Diwali is here and your joy in festivities would already be high. Traditional Diwali celebrations have many costumes – embracing the joy of giving and gifting sweets, clothes, electronic devices, jewellery, etc. However, such gifts also mean spending and increased stress on your finances.

There are no alternatives to Diwali gifting and shopping, but you can always make smart choices about how you spend your money to avoid a lousy aftertaste once the festivities are over.

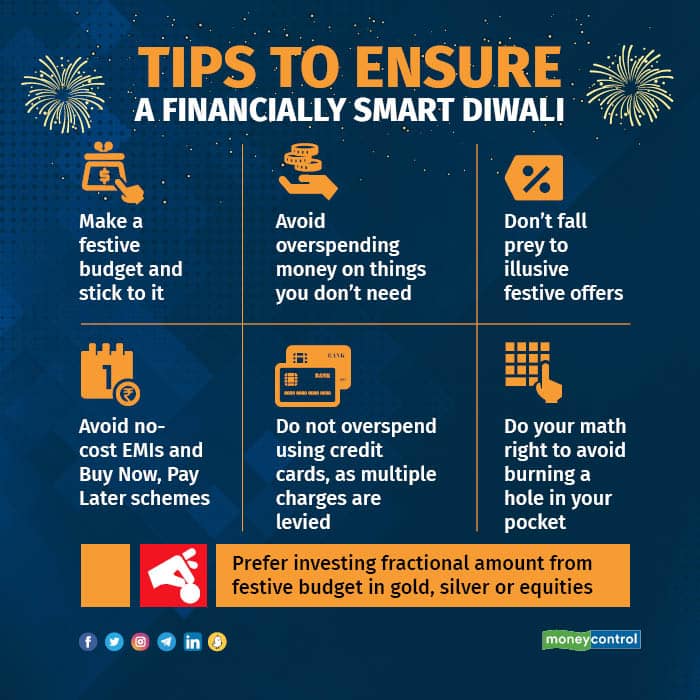

Make a festive budget to avoid overspending

One of the major causes of disruption in finances, post-Diwali, is overspending, especially on things you don’t need. “To avoid that, having a festive budget and a festive fund are musts,” says Anup Bansal, Chief Business Officer, Scripbox.

He suggests breaking up all the items you wish to buy and then prioritising them. Allocate more money to priority items and a lower sum to items as you move down the priority ladder. You can also save money by spending it prudently, such as taking advantage of bulk-buying opportunities for household items, sweets, etc., or any special seasonal offers.

Also, keep track of your budget to avoid getting deviated from it.

Say yes to festive discounts, but don't fall for illusive offers

Banks and fintech firms are all too happy to offer you money to borrow. That doesn’t mean you should just take loans blind-sided.

What’s more, often online and offline stores market for festive bonanza sales with lucrative no-cost EMI schemes and Buy Now Pay Later (BNPL) options.

No-cost EMI schemes are loan offers in which the buyer of a product or service just pays the selling price of the product in equal installments. When you opt for ‘no-cost EMI’ schemes, depending on the product and the offer, you may not get certain upfront cash discounts associated with them when you purchase it from retailers.

A BNPL scheme is a personal loan given by a fintech firm. There are few-e-commerce giants and fintech lending firms such as Amazon Pay Later, Flipkart Pay Later, LazyPay, Simpl, ZestMoney etc., which allow consumers to pay later while shopping. All purchases during a billing cycle get added up, for which you can pay later.

“Some offers might be an illusion as often retailers increase the price and apply discounts,” says Bansal.

“If you plan to shop for a high amount during festive offers, compare the prices among retail outlets to figure out if they offer an upfront discount and if the total cost is lower than that on e-commerce websites,” Harshil Morjaria, a certified financial planner at ValueCurve Financial Solutions, said.

Say NO to overuse of credit cards

Credit cards are a boon, only if used sensibly. It provides you a much wider range of rewards, such as cashback, air miles, reward points and facilities such as special discounts.

“But overspending the credit card limit can put you in a debt trap,” says Morjaria.

On credit cards, there are interest charges while converting the outstanding amount into EMIs. There are also late-payment charges for payments beyond due dates and a convenience fee for partial payment of outstanding dues.

“Nowadays, credit cards provide you with the convenience of easy EMIs, but that raises your debts,” Bansal warns. Once the festive season is over, you are the one left with paying EMIs and/or interest. “Overspending and easy EMIs will affect your budget post-Diwali. So, avoid it,” he says.

Also read | Buying gold and jewellery this Dhanteras: Things to avoid, things to know

Do your math right for calculating offer benefits

Most banks and e-commerce sites have launched cashback offers on debit/credit cards to tap the festive sentiment. These offers are primarily provided in conjunction with certain brands or department stores. “Customers looking to buy gadgets, apparels, home and kitchen essentials, furniture, and electronic appliances can bundle these offers on cards to get the maximum advantage,” says Raj Khosla, founder of MyMoneyMantra.

Banks/e-commerce companies may earn a commission for such sales, but remember you are spending your hard-earned money. “Offers like gift vouchers or accelerated reward points are likely to tempt you to spend more during festive season,” says Bansal. However, remember that your shopping budget should not be determined by these offers.

Not spending Rs 1,000 is an actual saving than saving Rs 1,000 on a Rs 2,000- purchase.

Opt for savings and investments

In the season of expenses, you can also incur expenses in a way that can help you increase your wealth. For example, you can purchase assets such as gold or silver; it is also a tradition of buying such assets on Dhanteras.

Ultimately, these are investments as their value tends to increase with time. Alternatively, you can also invest in equity this festive season. If you do your spending on investments right this year, there is a possibility that you can use the returns earned on them to buy gifts in the coming years – think long-term.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.