Come Diwali, it’s not just gold that attracts the investor’s attention. Silver is slowly gaining momentum in Indian portfolios, thanks to the launch of silver exchange-traded funds (ETF).

Motilal Oswal Mutual Fund closed its Motilal Oswal Gold & Silver ETFs Fund of Funds for initial subscription on October 7.

HDFC Mutual Fund, India’s third-largest with assets worth Rs 4.35 lakh crore, just opened the HDFC Silver ETF Fund of Fund. The offering closes on October 21.

With more fund houses expected to follow, here’s a look at silver’s potential as an investment.

Reaching the common manSilver is one of the important precious metal investments for savvy, high net worth individuals. However, not many retail investors queue up to invest in silver because it was not easily accessible.

Then, there’s the problem of storage. The metal is bulky and beyond a point, it cannot be kept at home safely. Investing in silver futures involves leverage and continuous monitoring, which make it unattractive.

However, the Securities and Exchange Board of India last year allowed the launch of exchange traded funds investing in silver, which were launched in January 2022. This has made silver available to small investors, with a minimum investment requirement of only Rs 60 – one unit of an ETF trades at less than Rs 60.

Why invest in silver?First things first: Just because there is a new option in the market, it doesn’t mean one should rush into it. Gold ETFs have been around for more than a decade.

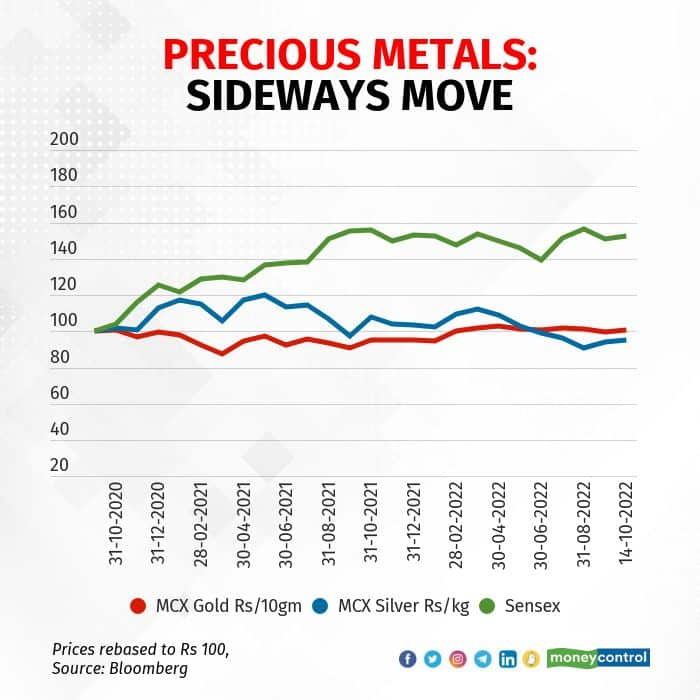

Gold as an asset class has exhibited low correlation with Indian stocks. It has outperformed in difficult times. Gold has emerged strong as a store of value many times in history and hence is an effective hedge against inflation.

When volatility increases in the financial markets, gold offers support to your investment, making it your portfolio’s insurance in difficult times. Gold held through financial assets such as gold ETF units can be sold quickly as needed.

On all these parameters, silver comes a close second to gold.

Silver, unlike gold, is an industrial metal. It is estimated that more than 50 percent of the demand for silver comes from industrial usage. Emerging sectors such as electronic gadgets, solar energy, and batteries use silver as a key input.

As demand for smartphones, electronic gadgets and electric cars goes up, demand for silver is expected to grow. Rising demand and constrained supply make a perfect recipe for silver prices to advance.

“The strong dollar has pushed silver prices down along with other commodities. Fears of an economic slowdown are already discounted in silver prices. As the gold-silver ratio indicates relatively cheaper silver, it is attractive to buy silver at current prices,” said Manish Banthia, senior fund manager - fixed income, at ICICI Prudential Mutual Fund.

Retail investors are seen accumulating silver through mutual funds.

From two ETFs holding silver worth Rs 123 crore in January, there are now six managing silver worth Rs 1,299 crore, according to data from ACE MF.

An investor needs a demat account to buy ETFs. However, fund houses with silver ETFs also typically launch a fund of funds that don’t require a demat account.

Also, fund houses have begun to launch schemes that combine gold and silver. Edelweiss Gold & Silver ETF Fund of Fund (EGS) and Motilal Oswal Gold & Silver ETFs Fund of Funds (MGS) aim to invest in a mix of gold and silver through ETFs tracking these metals.

While EGS intends to allocate equally between gold and silver with periodic rebalancing, MGS will start by allocating 70 percent of the money to gold and 30 percent to silver.

“These weights will then vary on account of relative price movements and will be reviewed every quarter. If the weight of any asset goes beyond 90 percent on the rebalance date, it will be capped at 90 percent,” said Pratik Oswal, president, passive funds, at Motilal Oswal AMC.

What should you do?Though silver may appear attractive at current prices, it is more volatile than gold. Not everyone is comfortable holding a volatile asset, especially when prices are trending lower. Oswal offers a perspective.

“Silver tends to do well during the expansionary business cycles, while gold does well during economic uncertainties. Hence combining these two helps reduce volatility, and the portfolio can ride out two different business cycles,” he said.

Silver prices have come down and silver ETFs have lost about 15 percent in the past six months. Silver may take time to recover if interest rates keep climbing.

“Ten-year US bond yields crossed the 4 percent mark, indicating that inflation is here to stay. As the dollar continues to become strong across the board, bullion will continue to face pressure,” said Megh Mody, commodities and currencies research analyst at Prabhudas Lilladher.

He expects silver prices to tumble to Rs 55,000 and then to Rs 52,000 per kg over the short to medium term. Silver’s price was Rs 57,195 per kg on October 14.

Simply put, there is no need to be in a hurry to load up on silver. You may want to accumulate it slowly in addition to your gold exposure. Put together, silver and gold should not account for more than 10 to 15 percent of portfolio.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.