Sometimes, the biggest revolutions in finance don’t make the headlines. Yet they quietly shift the way capital flows. India’s investment ecosystem is undergoing such a shift, and it’s called SIFs.

As traditional mutual funds reach saturation point and risk appetite among Indian investors matures, a new breed of investment products is emerging. Specialised investment funds (SIFs) are breaking ground not just for institutional capital but potentially for retail investors too.

Also read | Why global luxury real estate is becoming a top pick for wealthy investors

So what’s happening with SIFs in India?

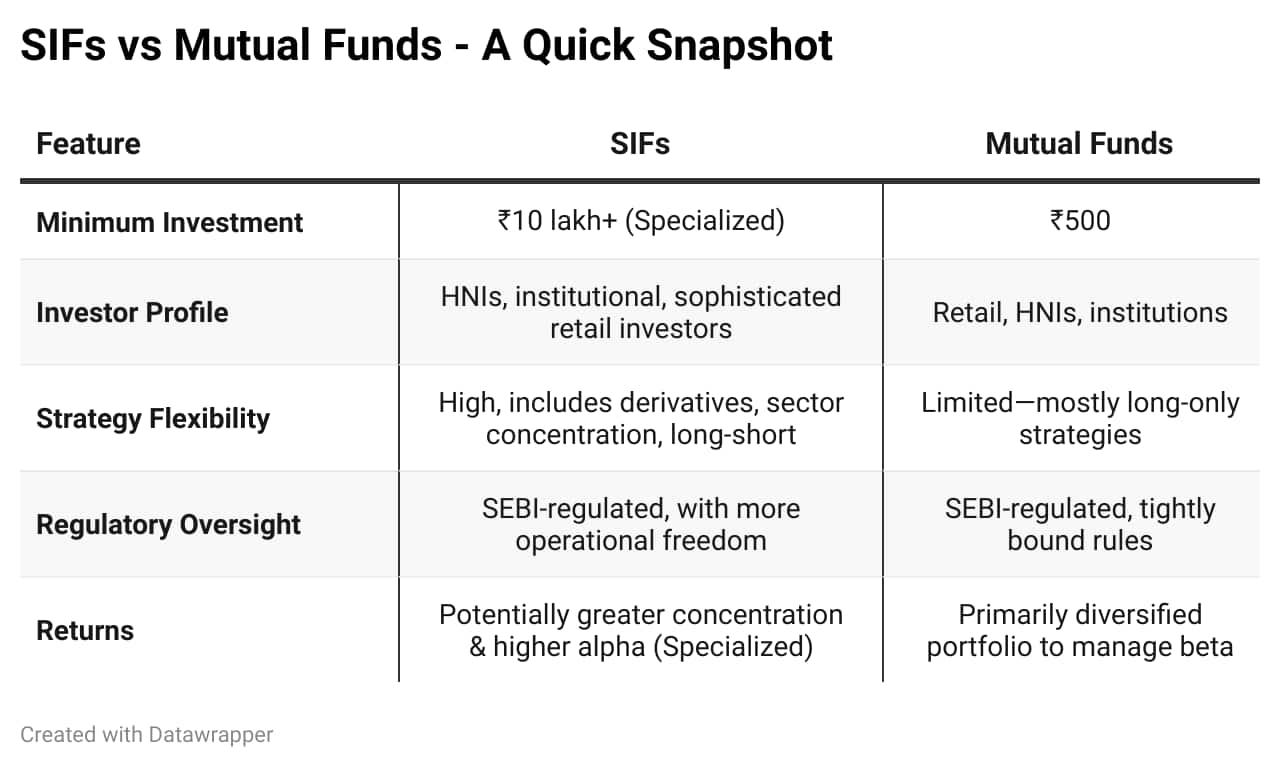

At the core, SIFs represent two distinct yet interconnected vehicles: SIFs—a Securities and Exchange Board of India (SEBI) innovation bridging mutual funds and portfolio management services —and social impact funds, a sub-category under alternative investment funds aiming to deliver financial as well as measurable social returns.

Let’s break this down

What are specialised investment funds? Think PMS-level flexibility and mutual fund-like accessibility. 'They are designed to give fund managers far more room to manoeuvre:

● More concentrated bets (up to 15 percent in a single stock versus 10 percent for regular mutual funds)

● Freedom to go long-short, use derivatives, or focus heavily on niche themes

● Targeted sector exposure—think AI, defence tech, green energy clusters

These aren’t your traditional systematic investment plan or SIP-friendly funds. But for high net-worth investors (HNIs) and market-savvy individuals, they promise better alpha generation (outperformance compared to the benchmarked index) and diversification in a rapidly changing economy.

Advantages of SIFs

These are the advantages or the edge that SIFs can now provide retail investors:

● Tactical flexibility with complex and concentrated strategies

● Higher return potential for sophisticated investors with higher risk appetite

● Exposure to underrepresented sectors or new segments, unlike traditional funds

Risks associated with SIFs

Of course, no innovation is without risk, and SIFs are no different. SIFs can be volatile and have a higher beta (or more volatility than the market) when compared to traditional mutual funds due to concentrated bets and derivative use, with some also posing liquidity concerns due to lock-ins.

Also read | Precious metal funds inflows at all-time high in June; experts favour blended approach

However, these risks do come with the potential to create a higher alpha and higher risk adjusted returns. Therefore, as a good hygiene check, it is important to pay attention to risk adjusted ratios like the Sharpe ratio — which measures the risk-adjusted return — to give the complete outlook.

Are retail investors being left out?

Historically, yes, with minimum ticket sizes (Rs 10 lakh and above) ruling it out for many. But things are changing. The reduction in the minimum required for ZCZP or zero coupon, zero principal instruments on social stock exchanges marks a democratisation of impact investing. And as more asset management companies (AMCs) launch SIFs, broader access could follow.

For retail investors who can cross the threshold, these funds offer a rare combination: exposure to hedge fund-like strategies within a regulated structure.

What’s live in the market?

Several AMCs have started making moves into the SIF space. For instance, Edelweiss Mutual Fund has announced the launch of its SIF platform under the brand name Altiva SIF, which will follow a hybrid long-short strategy. The fund is currently in the process of filing the necessary documents with SEBI, signalling the early but growing momentum in this emerging investment category.

Also read | Buying property abroad? What Indians need to know about the rules, risks and restrictions

While the SIF landscape is still evolving, several key players are already shaping the narrative across different fund categories:

● SIFs: Leading AMCs like HDFC AMC, ICICI Prudential and Nippon India are preparing to launch thematic and long-short strategies under the SIF banner, targeting niche opportunities and greater portfolio flexibility.

● Social impact funds (AIF Category I): Focused on sectors like affordable healthcare, clean water and rural fintech, firms such as Aavishkaar, Omnivore,and Elevar Equity are pioneering impact-driven investments.

● Venture capital funds: These funds are backing early-stage technology and socially focused startups, with major players including Sequoia India, Accel and Blume Ventures.

● Private equity funds: Concentrating on investments in mature, unlisted companies, the heavyweight firms active in this segment include KKR, Carlyle and Blackstone.

India’s capital markets are maturing. Investors are getting more discerning. And SEBI is responding with frameworks that blend innovation with oversight.

Also read | A bet on urban India: How municipal bonds are slowly gaining traction

SIFs can be accessed via AMCs through your demat account but need careful risk assessment. SIFs are not meant for everyone. But for those who understand the game—and the risks—they represent a bold new frontier.

Whether you seek higher returns or purposeful impact, SIFs are not just a trend—they’re a signal of how India’s financial future will be built.

The author is the founder of Money Honey Financial Services.

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.