Some of us tend to compare our career scenario with that of previous generations. We see only the difference in the salary amount, not realising that the Rs 100 in the 1960s is Rs 8,858 in 2022! (This is assuming an inflation rate of 7.5 percent.) The prices, background, socio-political situation, investment avenues and job scenario of Gen Z—everything is different from those of the bygone era.

So, using the same old scale to measure success or efficiency in investing is simply erroneous. This is why Gen Z should look at building their portfolio in a manner that is a bit different from how well-established investors of the past would have.

Here are some of the ways for zoomers to construct ‘The Perfect Portfolio’.

1. Don’t just think about your future. The present also matters

While we all are in a hurry to avail the benefit of time in compounding our wealth for the future, don’t lose your sight of the ‘now’. The role of having an emergency fund in place cannot be stressed enough. Your emergency fund should be enough to cover your lifestyle for six months, at the minimum. And having it liquid is equally important. Fixed deposits (FDs) or liquid funds are ideal for building your emergency fund.

2. Debt-free is truly free

If you have dues to be paid off, that should be one of your first priorities.

If you let that debt accrue in parallel with your wealth, your wealth building will not be as meaningful. Letting debt accrue will only result in you paying a higher amount eventually.

3. It’s never too early to think about retirement

Don’t let your peers fool you into thinking that retirement planning is an ‘after 40’ job. The sooner you start, the more comfortable your retirement will be. Moreover, who’s stopping you from planning for an early retirement?

4. Categorise and prioritise

Random investments may not prove effective in covering all your goals. Firstly, based on the time of fulfilment, categorise your goals into short-term (less than 10 years away), mid-term (10-20 years) and long-term (20 years-plus). Next, prioritise them within those categories so that you can find the right investment for each.

5. Consistency

We’re sure that Gen Z will agree that the brilliance of systematic investment plans or SIPs lies in their sheer simplicity. When started early, and empowered by consistent investments, SIPs can prove to be a force-multiplier in building wealth. But without consistent investments, you may miss out on much of the growth potential of SIPs. Legendary investor Warren Buffett said it best: “We don’t have to be smarter than the rest; we have to be more disciplined than the rest.”

6. Five important steps to diversify

It is important to have a strategy in place for asset allocation that can help you with proper diversification. Your portfolio should have a mix of all these five investment styles:

· Quality — Stocks that have and are likely to maintain high value

· Value — Undervalued stocks that may gain momentum in the future

· Growth at a reasonable price — A blend of the two styles above. This philosophy suggests investing in companies with potential for good earnings growth and are available at reasonable valuations.

· Mid- & small-cap — This is based on the evidence that historically, mid- and small-cap companies give better yields than large-cap companies over the long run.

· Global — This is to provide geographical diversification to your portfolio

Also read | MC30: The best mutual funds to invest in

Why this strategy?

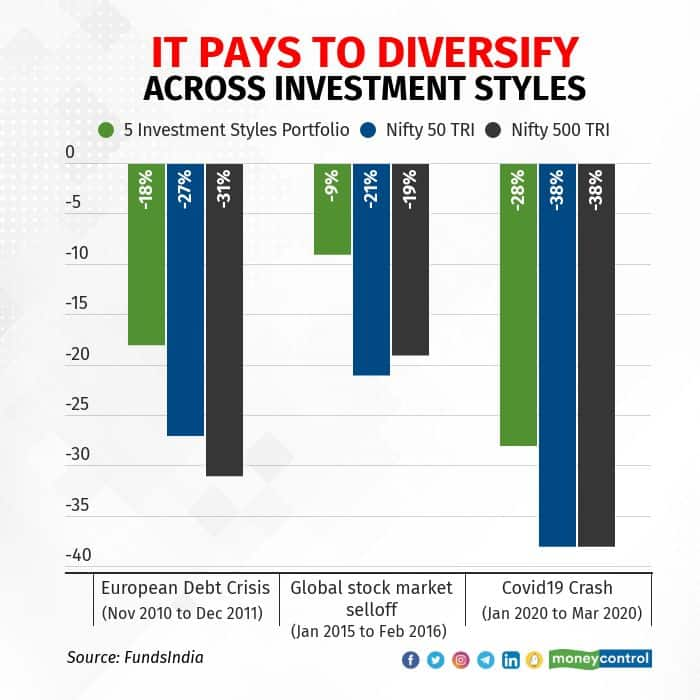

Historically, such a plan has led to solid long-term annualised outperformance of 4 percent over the last 10 years, when compared to the Nifty 50 TRI or total returns index as on 29, July, 2022. Moreover, there have been far lower declines during major market falls, as compared to the Nifty 50 TRI and Nifty 500 TRI.

If you feel it’s a lot to take in, do remember that you can never go wrong with an SIP. Start small and build your journey thereon.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.