The Government of India had introduced a new regulation via Finance Act 2020, effective from the financial year 2020-21. With this regulation, employer contributions to Provident Fund (PF), Superannuation fund (SAF) and National Pension scheme (NPS; now onwards referred to as ‘specified funds’) in each financial year, in excess of Rs 750,000, shall be considered taxable in the hands of employees.

Additionally, any accretion (i.e., interest, dividend, etc.) on the taxable contribution (in excess of Rs 750,000) would also be considered taxable perquisite in the hands of the employee.

It was observed by the government that employees earning high salary incomes would structure their salary package in a manner where a large part of their salary was paid by the employer as contributions to these three funds, which was not considered as taxable. The above provision was added in the Act with the view of restricting the benefits availed by such high salary earning individuals.

Recently, the Central Board of Direct Taxes (CBDT) issued a circular inserting a new Rule 3B, prescribing the manner of computing the taxable perquisite, for the accretions received on employer contributions made exceeding Rs 7,50,000 (towards the specified funds). Further, an employer would be required to deduct and deposit taxes on the same.

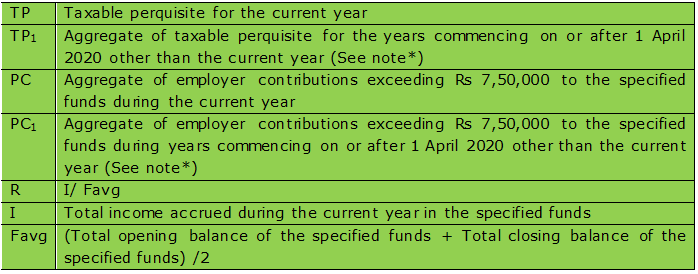

Rule 3B provides a formula to calculate the taxable perquisite value:

TP= (PC/2)*R + (PC1+ TP1)*R

*Note: Where the amount of TP1 and PC1 exceeds the opening balance of the specified fund, then the amount in excess of opening balance shall be ignored for the purpose of

computing the amounts of TP1 and PC1.

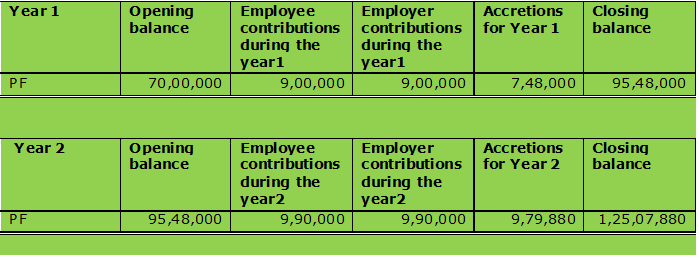

In view of the above formula, an example has been given below as reference:

(Amounts in Rs)

Applying the definitions in the above example:

Conclusion:

Employers should consider Rule 3B while computing the taxable perquisite and determining TDS applicable from FY 2020-21 onwards.

(With inputs from Niji Arora, Senior Manager, Zalak Shah, Deputy Manager with Deloitte Haskins and Sells LLP)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.