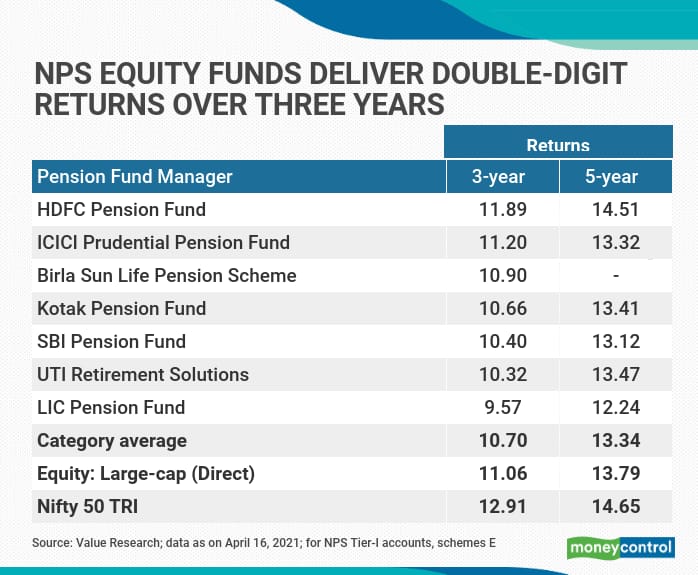

HDFC Pension Fund’s equity scheme delivered the highest returns across three- and five-year periods, beating large-cap equity funds in the process. It posted 11.89 percent and 14.51 percent returns respectively across the two time-horizons, followed by ICICI Prudential Pension Fund with 11.2 percent and 13.32 percent during the same period.

However, both failed to beat Nifty 50 TRI, which recorded 12.91 percent and 14.65 percent returns respectively over three- and five-year periods. LIC Pension Fund brought up the rear with 9.57 percent returns and 12.24 percent returns over three and five years respectively, pulling down the category’s average returns.

The National Pension System (NPS) is set for an overhaul once the Pension Fund Regulatory and Development Authority (PFRDA) amendment bill, introduced in the parliament, is passed. It seeks to separate the NPS Trust from PFRDA, the pension regulator. Also in the pipeline is a minimum guarantee pension product that offers assured returns to NPS subscribers. At present, NPS scheme returns are market-linked.

Available options

Subscribers can choose between equity, government securities and corporate debt funds offered by seven pension fund managers. These are UTI Retirement Solutions, LIC Pension Fund, SBI Pension Fund, ICICI Prudential Pension Fund, HDFC Pension Fund, Kotak Pension Fund and Aditya Birla SunLife Pension Scheme. Soon, more fund managers are set to come aboard, and fund management fees will go up as well.

If you are under the age of 50 years, can look at 75 percent exposure towards equities under the active choice. For those over 60, the ceiling is 50 percent. You can also let the fund managers make the calls for you by selecting auto choice, also known as the lifecycle fund. Under this plan, your corpus’ exposure to equity and corporate debt will shrink, and government securities’ share will increase as you grow older. The purpose is to ensure that your corpus is not affected by volatility as your retirement approaches.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.