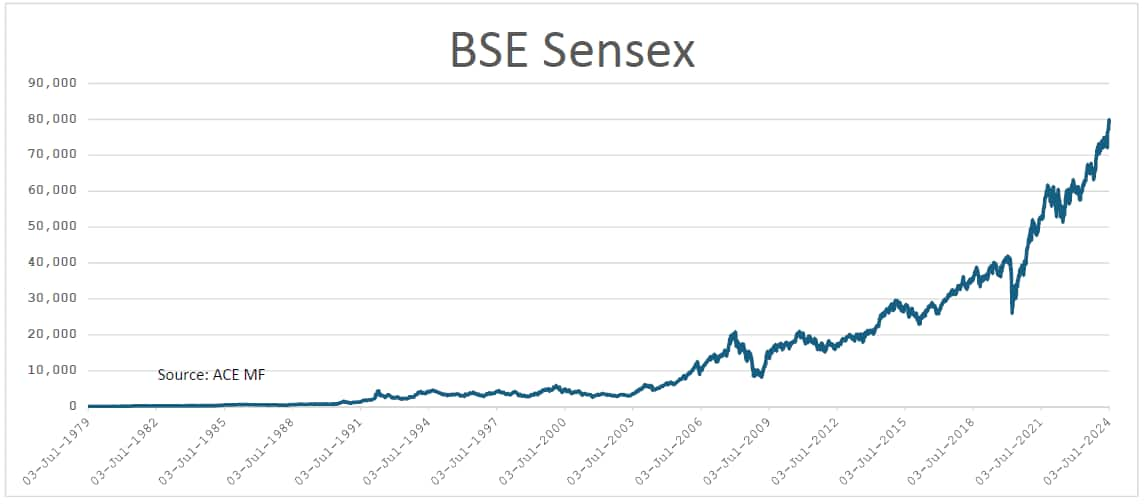

BSE Benchmark Sensex on July 3 touched the 80,000 mark in the intra-day trading for the first time ever. The milestone comes after the index added the last 10,000 points in under seven months, having first hit 70,000 on December 11, 2023.

The Indian equity markets showed a positive start, drawing strength from robust global sentiments and favourable undertone.

“The benchmark index opened at record highs but experienced some correction due to a lack of sustained buying. However, the bulls made a modest recovery and the tug of war continued throughout the session,” said Sameet Chavan, Head of Research, Technical and Derivative - Angel One.

The NSE benchmark Nifty was also in positive territory and was trading above the 24,000 level.

With the ongoing surge in Indian equity markets, financial experts advise mutual fund investors to exercise caution and refrain from making substantial investments in the riskier segments of the market.

Secular rallyData available with ACE MF shows that BSE Sensex Total Return Index has gained 24.33 percent, 16.25 percent and 16.21 percent, respectively, on a one-year, three-year and five-year basis.

Meanwhile, data shows that the broader markets have outperformed the headline index. The BSE 500 TRI has gained 39 percent, 20.07 percent and 19.86 percent on a one-year, three-year and five-year basis, respectively.

Thanks to the equities rally, domestic inflows have become durable and consistent due to a structural shift in investor behaviour. “Higher inflows are witnessed during market falls while it moderated during intermittent highs,” said brokerage ICICI Securities in a note.

Also read | Why central banks are buying gold and what retail investors can learn from it

Meanwhile, monthly systematic investment plan (SIP) flows have remained above the Rs 20,000 level for May and April.

“Sustenance of these flows is likely to drive overall SIP flows to Rs 2.3 lakh crore in calendar year 2024. Total inflows into equity schemes and ETFs have seen two times rise since the start of the year 2024 indicating the rising strength of domestic investors,” said ICICI Securities.

More milestones to comeAccording to Nilesh Shah, Managing Director, Kotak Mahindra Asset Management Company, Sensex milestones are a journey, and not a destination.

“This journey is both forward as well as backward. Nasdaq went so backwards that it took 17 years to come back to the previous peak. Invest in the market as per your risk appetite, have a long-term horizon, significantly moderate your return expectations and follow the dharma of asset allocation,” said Shah.

Arvinder Singh Nanda, Senior Vice President at Master Capital Services believes that India’s gross domestic product (GDP) growth, credit expansion, and policy continuity have instilled confidence among investors.

“In addition to this, positive cues from global markets have helped the Sensex to reach these levels. While the long-term outlook remains positive, it is prudent to be cautious at current levels,” said Nanda.

Shrikant Chouhan, Head of Equity Research at Kotak Securities highlighted that Sensex was at around 26,000 level four years ago during the time of Covid.

“This seems unrealistic but it is true. It gives confidence that equity markets did perform well in the long run, we need patience and confidence while investing and even after it. Based on the current domestic macros, our advice is to continue investing systematically in equities with a long-term perspective,” said Chouhan.

Stick with SIPsMutual fund strategies differ from direct stock investing. You don't typically aim to book profits, halt new investments, or heavily invest in stocks based on market movements.

Long-term investors who have well-diversified portfolios and have their long-term monthly investments through SIP should continue to stay invested.

“These investors understand markets tend to move upwards over the long term despite the short-term fluctuations. Frequent rebalancing just looking at the index can bring in more anxiety and may reduce the compounding impact in the long term," said Ravi Kumar T V, Founder of Gaining Ground Investment Services.

"Finally, how you as an investor react to all-time highs in equity markets should align with individual financial goals, risk tolerance and their time investment time horizon. Investors should understand the potential of equities in the long term and should consult their distributors or advisors to know the current situation before acting on their portfolios,” said Kumar.

Also read | Should you invest in ICICI Prudential Energy Opportunities Fund? A Moneycontrol review

India is currently experiencing sustainable growth, continuity in government, and more clarity on reforms that translate into multi-year growth in the GDP.

For people who have not invested in the past, this should not be a sign of worry or a cause of worry.

“You could still build a good portfolio adjusted for your risk-return. There are various means that even with high levels in the market, through asset allocation and the method of investing, one could manage the so-called perceived all-time highs of the market. Not to be worried and not to have the fear of missing out, especially at a high level coming at one go. Even at high levels, you can invest prudently to make the most of the markets,” said Santosh Joseph, CEO and Founder, Refolio Investments and Germinate Investor Services.

Finally, it’s all about how we behave with our investments during market extremes that determine the outcome of the returns on investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.