Note to readers: When it comes to money management, women have skilfully manoeuvred finances – of their families and those of investors on a larger scale. But the number of such women professional managers remains low, though. Of all registered investment advisors with SEBI (securities and exchange board of India), just about 10 percent are women. In this special five-part series, Moneycontrol personal finance profiles five women who are not only in control of their own personal finances but also guide several other women and families in managing their wealth.

One of the common threads that runs through most of Renu Maheshwari’s clients is that they do not come to seek high returns alone. A single-mother client, for instance, who has become confident about her ability to bring-up her two daughters and take care of her retirement. Another woman client simply asks her bank’s relationship manager to speak to Renu every time he calls her to sell any financial product. Renu says that women tend to seek trustees of money in their financial planners and not merely investment advisors.

Helping clients in life decisions

Investors need a fiduciary who could help them take life decisions while ensuring financial security at the same time, says Renu. She advises more than 100 families, of which 40 percent are women. Her women clientele came about because of her women-only ‘Workshop on Personal Finance’ offered to working women in Chennai over the past several years. The social fabric of the city, with more educated women and better inheritance rights, also aided her in expanding in this segment.

Also read: How to decide whether you require a financial planner or not

As women become financially independent, they usually deal with various complex financial problems such as property inheritance, separation and divorce on their own. The pandemic has burdened them with job loss or fear of job loss, reduced income and family care. According to McKinsey & Company’s predictions, globally, one in four women is likely to take a step back from work or may leave her job altogether.

It’s in these times when women need someone to address their anxieties that it helps to have a woman as an advisor. Women can empathize, listen carefully, address their fears and make decisions for the long-term. Renu strongly believes that women have all these natural capabilities that this profession demands. “It’s an ideal career for women, as it also offers flexibility and an opportunity to add value to other people’s lives.” says Renu.

Also watch: Financial actions that impact a woman’s well-being

Lending a listening ear

In her first meeting with the clients, Renu lends an ear without an eye on the clock. Clients talk about fears, their current financial status, their future expectations and goals. This meeting helps Renu understand their mindset. Renu is a fee-only investment advisor and offers financial planning, investment advisory and portfolio management services with no commission income at all. Although the recurring revenue on small portfolios is low, that doesn’t stop Renu from taking on new clients for financial planning and advisory services though their ticket-size may be small. Good word-of-mouth recommendations among women, too, have helped Renu expand her practice among women investors.

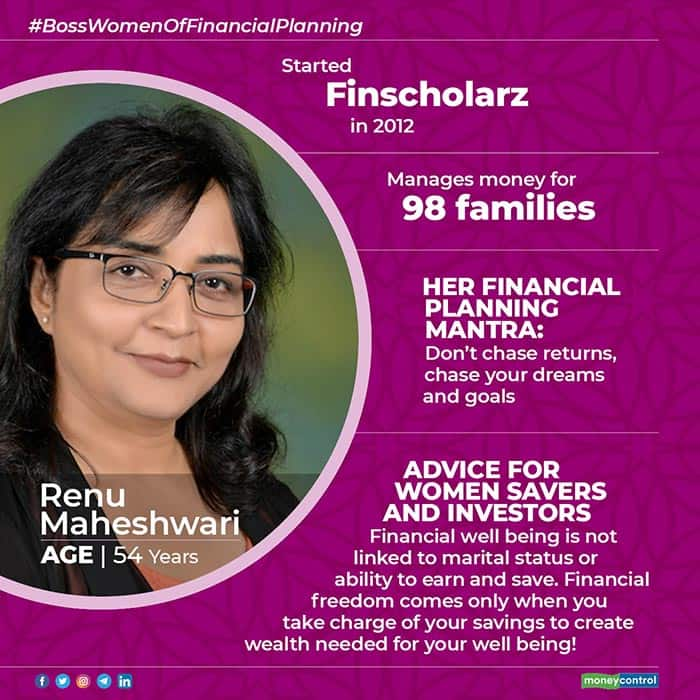

As a woman, Renu knows all too well about taking a break from a bustling career to raise a family. She often advises her clients to re-skill themselves during the break. In 1988, after completing her post-graduation in management, Renu worked in corporate finance for six years. Then, her son was born and by that time Renu and her family shifted abroad for a brief period. After Renu and her family came back, she wanted a permanent job, but couldn’t find one with flexible working hours. She took the opportunity to study personal finance; later, she got herself a certification in financial planning and finally started her own practice of fee-only financial advisory in 2012.

Having achieved success in her second career, Renu wanted to reach out to young girls with a message: Like her, they too could consider financial advisory as an alternative career in future. For more than six years, her firm, Finscholarz, offered certification courses in financial planning and wealth management at Stella Maris College Chennai. Between 2013 and 2019, she saw a marked difference in financial knowledge among girls.

In 2013, girls were fascinated with the idea of managing their own money, but by 2019 they had a far better understanding of their financial rights and need for personal financial management, adds Renu.

The course also helped her firm get fresh talent that she could train as fiduciary advisors. A few graduates joined her advisory team; some of them continue to work with her. Her firm also sponsors them to gain relevant qualifications and certifications required for the financial advisory role.

Now with the change in the qualification requirements for registered investment advisers (RIAs), Finscholarz hires postgraduates and trains them for the advisory role. The seven-member steam at Finscholarz is a diverse group of people with five women.

Her parting piece of advice to every woman is “Enjoy your career-break, fulfilling a different responsibility. Never let a career-break go waste! Re-skill and reach newer heights.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.