Starting retirement planning in your 30s isn't just smart—it's transformative. With decades ahead for compounding to work its magic, this decade offers the ideal launchpad for financial freedom.

Yet, many overlook it, mistaking youth for endless time. It’s a primary mistake people in their 30s make and procrastinate retirement planning goals. This false sense of comfort delays the start of compounding.

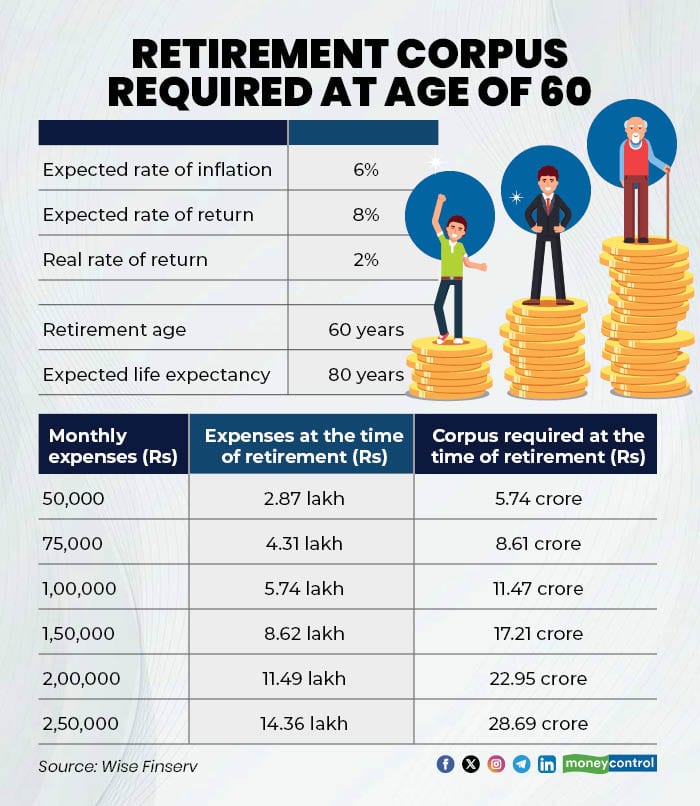

How to calculate your target retirement corpus

Assess your current monthly expenses, then inflate them for future needs and project how much you will need annually. For instance, if you spend Rs 50,000 today and retire at 60 with 6% inflation, that balloons to Rs 2.87 lakh monthly. Factor in longevity (plan for 20 to 25 post-retirement years).

Harness compounding's power

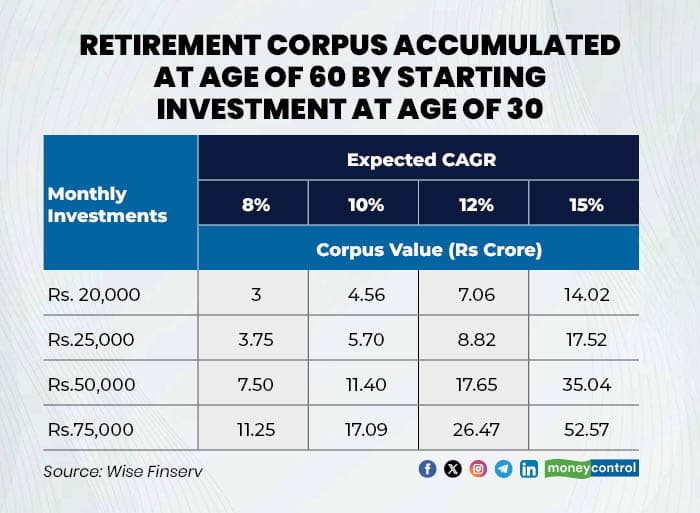

Compounding turns modest investments into fortunes over 30 years.

Ajay Kumar Yadav, CFP, Group CEO & CIO at Wise Finserv said, "The power of compounding is what truly builds wealth. Regular and disciplined monthly investments, even of moderate amounts, can create substantial wealth when allowed to compound at consistent rates of return."

For instance, investing Rs 20,000 monthly from age 30 can grow to Rs. 3 crore (8% CAGR), Rs. 4.56 crore (10% CAGR), Rs. 7.06 crore (12% CAGR), or Rs. 14.02 crore (15% CAGR) by age 60.

Build and safeguard your retirement corpus

Maintain an emergency fund separate from retirement savings, and secure health and term insurance to shield against shocks. Monitor inflation, health costs, and asset allocation.

Shavir Bansal, Founder and CEO of Kifaayat, a FinTech start-up, emphasizes, "Make your retirement SIP a non-negotiable monthly commitment, like an EMI for your future self. Invest consistently, regardless of market conditions, and review your portfolio every 3-5 years to adjust your equity allocation as you age."

For a 30-year-old, Yadav recommends, "Equity Mutual Funds (60–70%) – SIPs in diversified and flexicap funds for long-term growth; Debt Mutual Funds (20–25%) – for stability; NPS/EPF (10–15%) – for additional retirement security and tax benefits." Bansal adds a gold sliver (5-10%) via ETFs for diversification.

This asset mix offers an optimal balance between growth and stability for long-term goals such as retirement. Over time, the allocation can be gradually rebalanced, reducing equity exposure and increasing debt investments as one approach retirement age.

Also read | Smart Planning: How to make your retirement fund last a lifetime

Debt vs. Investing: Strike a Balance

For most 30-year-olds, deciding whether to repay debt early or invest for retirement is a crucial financial crossroad. The right approach depends on the cost of debt versus potential investment returns. If you have high-interest debt like credit cards or personal loans above 12%, clear it first. But if it's a low-cost, tax-deductible loan like a home loan (7-8%), you can balance repayment with investment.

It's often wiser to start retirement investing early, even if you continue paying EMIs. SIPs in diversified equity schemes can deliver higher long-term returns than the interest saved by early repayment. “The best approach is to split your cash flow: pay EMIs regularly while contributing at least 15-20% of your income to long-term investments, building discipline and wealth simultaneously,” said Yadav.

Debunking retirement planning myths

Putting off investing with the expectation of higher future earnings can be a costly mistake. As Bansal puts it, "Money you don’t invest in your 30s never gets those extra compounding years back. Even a small SIP now beats a big SIP that starts too late.

Relying solely on EPF or NPS for retirement might not be enough. They're a good starting point, but likely won't be sufficient for urban city lifestyles and longer lifespans. "For urban city lifestyles and longer lifespans, you usually need extra equity SIPs on top," says Bansal.

While gold is a good hedge and diversifier, it's best to keep it sensible - around 5-10% of your overall portfolio, not more.

Avoid these common pitfalls

Delaying retirement savings in your 30s can be costly. For instance, building a Rs. 5 crore corpus at 12% returns requires a monthly SIP of Rs. 14,000 if you start at 30, but jumps to over Rs. 50,000 if you wait until 40. Every year you delay can cost you crores in the long run.

“Many also fail to separate long-term retirement goals from short-term needs. They dip into the same savings for buying a car, traveling, or funding children’s education, which breaks the compounding chain and slows wealth creation,” said Yadav.

Another common issue is over-reliance on traditional products such as endowment insurance plans, Public Provident Fund (PPF), or fixed deposits (FDs). They feel safe but rarely beat inflation. Retirement is a 25 to 30 year's goal and needs equity exposure to create real wealth.

Begin investing immediately upon earning. “Segregate a dedicated retirement SIP—untouchable for other needs—and ramp it up annually with salary hikes,” said Yadav.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.