Your home loan equated monthly installments (EMI) and interest burden will stay unchanged, with the RBI Monetary Policy Committee (MPC) deciding to maintain the status quo on repo rate at 5.50 percent on August 6.

The decision is in line with Moneycontrol’s poll of economists that had projected a status quo on interest rates. Between February and June this year, the RBI MPC had lowered the repo rate by 100 bps, ensuring the lowest home loan rates at close to 7.30 percent, with several lenders offer interest rates starting from around 7.50 percent for eligible borrowers.

Adhil Shetty, CEO of BankBazaar.com says, "With inflation well below the RBI’s upper tolerance level, a rate pause gives the central bank breathing room to gauge the full impact of the 100 basis points cut since February."

RBI MPC Meeting LIVE: RBI keeps repo rate unchanged at 5.5%, maintains stance as neutral

Leading lenders like State Bank of India (SBI), Bank of Baroda, Canara Bank, HDFC Bank and ICICI Bank currently offer home loan rates starting at 7.3-8 percent.

Since October 1, 2019, banks have linked floating-rate retail loans to an external benchmark, which is the repo rate in most cases. So, any changes in the repo rate directly influence the interest rates on these loans.

Impact on Existing BorrowersAccording to the external benchmark lending rules, banks have to pass on the policy rate changes entirely to existing borrowers. However, this time the RBI kept the repo rate unchanged, which means that your interest rates and EMIs will remain constant. Typically, unless explicitly asked, banks keep the EMIs unchanged post repo rate revisions -- tenures are shortened in the case of rate cuts. When rates go up, banks are mandated by the RBI to give borrowers the option to choose between higher EMIs, longer tenure, or a combination of both to adjust to the higher rates.

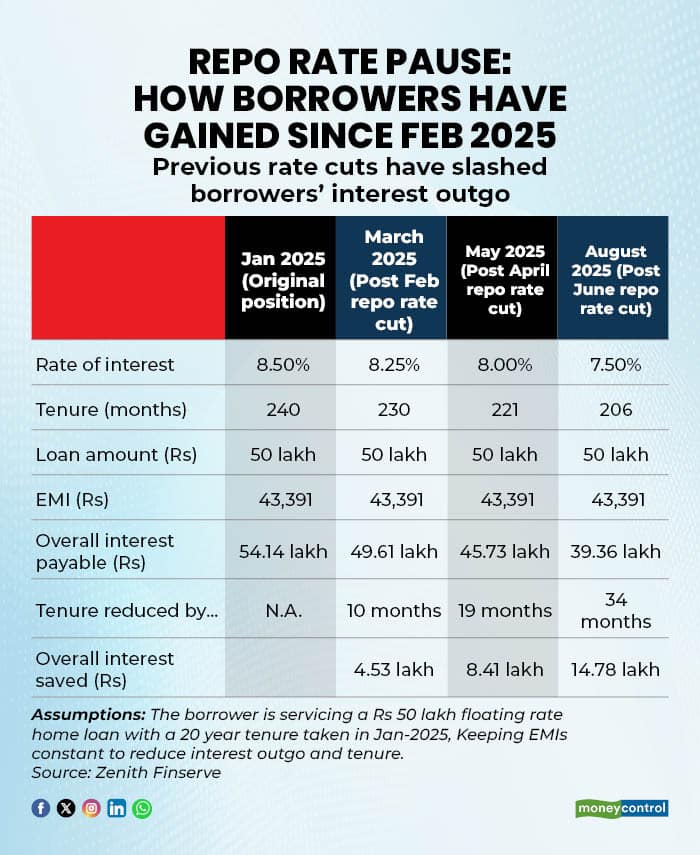

For instance, if your Rs 50 lakh, 20-year home loan at 8.5 percent interest was disbursed in January, you would have gained significantly from a 100-bps rate reduction. This would shorten your loan tenure to 206 months and save around Rs 14.78 lakh in interest payments.

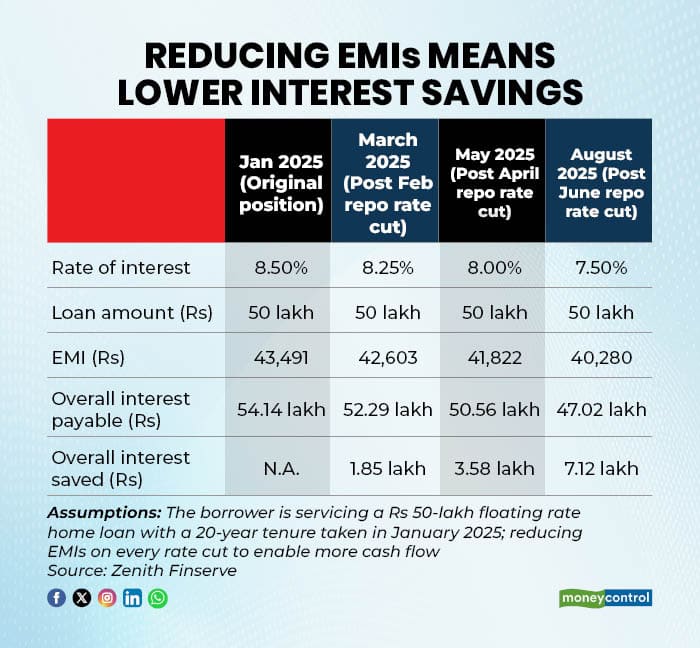

If you choose to reduce your EMI amount instead, your interest savings will be relatively lower. You will save around Rs 7.12 lakh instead of Rs 14.78 lakh by keeping EMIs constant.

"Home loan rates have already fallen below 8 percent for prime borrowers, particularly in refinance and balance transfer cases," says Shetty.

A BankBazaar comparison of home loan rates as on January 31 and July 31 shows that most public sector banks have reduced interest rates for fresh home loans by 100 bps, in line with the RBI policy action on June 6. However, some private sector banks have not transmitted the entire benefit to new borrowers, choosing to adjust the spread over the repo rate instead.

"Borrowers still servicing loans at significantly higher rates should consider switching to repo-linked products to reduce long-term interest costs," Shetty adds.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.