RBI MPC Meeting Highlights: Repo rate unchanged at 5.5%, Sanjay Malhotra says 'Don't see major impact of US tariff'

RBI Monetary Policy Meeting Highlights: The Reserve Bank of India’s Monetary Policy Committee (MPC) has unanimously decided to keep the policy repo rate unchanged at 5.5% and the stance at 'Neutral'. This comes after a three consecutive rate cuts during the previous three months, resulting in a cumulative cut of 100 bps so far this year. The MPC held its meeting between August 4 and August 6. RBI Governor Sanjay Malhotra made his fourth monetary policy announcement, since taking over from Shaktikanta Das.

-330

August 06, 2025· 15:48 IST

RBI MPC Meeting LIVE: 'Indicates confidence in the current economic environment'

Shravan Shetty, Managing Director at Primus Partners, said, "The RBI has retained the repo rate at 5.5%, indicating confidence in the current economic environment. While inflation is currently low, it is expected to rise gradually to around 4.9%, and GDP growth is projected to remain on target. The governor also underscored the resilience of the banking and NBFC sectors, with key indicators such as GNPA and NIMs remaining within healthy ranges.

At the same time, the RBI is advancing financial inclusion through measures like grassroots re-KYC camps and the introduction of additional products such as insurance. The launch of a direct retail investor portal, enabling SIP-based investments in treasury bills, is another step aimed at broadening access to investment and insurance products, particularly at the grassroots level.”

-330

August 06, 2025· 15:18 IST

RBI MPC Meeting LIVE: 'sStable borrowing costs are likely to support housing demand'

"The RBI's decision to maintain the repo rate at 5.5% with a neutral stance brings much-needed continuity and stability to the financial environment. For the real estate sector, especially in a time when buyer sentiment is gradually improving, this move ensures that home loan rates remain attractive and predictable. As we approach the festive season, stable borrowing costs are likely to support housing demand across segments, particularly among first-time buyers and the mid-income group. It also sends a positive signal to developers and institutional investors looking at long-term commitments," said Vishesh Rawat, VP & Head of Marketing, Sales & CRM, M2K Group.

-330

August 06, 2025· 15:07 IST

RBI MPC Meeting LIVE: 'Steady approach will help anchor economic sentiment'

"The RBI’s decision to maintain stability in the repo rate was anticipated and comes at a crucial time, especially in light of recent global tariff hikes. This steady approach will help anchor economic sentiment and indirectly benefit the real estate sector. While a rate cut could have further lowered home loan interest rates—encouraging more first-time buyers and end-users to enter the market—the current environment still supports growth. Developers, too, are likely to stay bullish on new launches, especially in emerging corridors. Overall, this move reinforces market stability and contributes to the broader economic momentum," said Prateek Tiwari, Managing Director, Prateek Group.

-330

August 06, 2025· 14:55 IST

RBI MPC Meeting LIVE: 'No rate cut allows time for the previous rate cuts to take full effect'

"The Reserve Bank's decision to pause the rate cut cycle was in line with our expectations, allowing time for the previous rate cuts to take full effect. With liquidity improving and inflation within the target, the central bank has preserved space for future actions amid global uncertainty. Inflation projections for the current fiscal year have been revised lower, for the next two quarters, largely due to base effects and softer food prices. However, the projection for Q1 FY27 remains above 4%, suggesting that inflation could firm up over the medium term owing to the surplus liquidity. As a result, long-term bond yields may see upward pressure in the coming months," said Vinayak Magotra, Founding Team, Centricity WealthTech.

-330

August 06, 2025· 14:16 IST

RBI MPC Meeting LIVE: CREDAI expects potential rate cut during the upcoming festive season.

"Looking ahead, CREDAI anticipates a potential rate cut during the upcoming festive season. Such a move would provide a timely boost to housing demand, particularly for first-time buyers and those seeking budget-friendly homes—thereby supporting broader economic growth and employment generation through the real estate and allied sectors," Shekhar Patel, President, CREDAI.

-330

August 06, 2025· 14:01 IST

RBI MPC Meeting LIVE: 'Balanced and supportive macroeconomic environment'

"The RBI’s decision to maintain the repo rate at 5.5% while projecting a stable GDP growth of 6.5% for FY26 signals a balanced and supportive macroeconomic environment. With headline inflation easing to a 77-month low of 2.1% and core inflation steady around 4.4%, consumer sentiment and purchasing power are poised to strengthen. These factors directly benefit the real estate sector by improving home affordability and enabling long-term investment confidence. At Great Value Realty, we are optimistic that this economic stability will accelerate housing demand across both residential and commercial segments in the coming quarters," said Payas Agarwal, Director, Great Value Realty.

-330

August 06, 2025· 13:58 IST

RBI MPC Meeting LIVE: 'Home loan continues to be affordable'

"The announcement by the RBI to hit the pause button after a 100-bps rate cut in the last 6 months will bring cheers to the sector. At 5.50% the home loan continues to be affordable, and given the fact that the festive season is merely two months away, it will boost the market's prospects and lead to the real estate sector's growth," said Gurpal Singh Chawla, Managing Director, TREVOC Group.

-330

August 06, 2025· 13:17 IST

RBI MPC Meeting LIVE: How will RBI's latest policy impact retail sector?

Ridhima Kansal, Director of Rosemoore, said, "Good times for India's digital shops if RBI stays on the path of a stable monetary policy Personal borrowing remains cheap, so the shoppers cruising websites of e-commerce platforms have reasons and incentives to buy new things with EMIs and loan-generated sales getting non-buyers on their bandwagon. This also means logistics and fintech partners can chart their growth paths while being certain that the cost of funds is not going to spike upwards in quick time. That said, the absence of higher deposit rates suggests that customers will lean towards essentials and tested value, potentially forcing e-commerce players to provide attractive deals and customer-centric experiences. But it is a phase where an online business can improve its core and should look to cover the most market share in this as many businesses move toward digital first ecosystem."

-330

August 06, 2025· 12:58 IST

RBI MPC Meeting LIVE: How will no rate cut affect personal finance?

"Stability of the repo rate, though, keeps both individuals comfortable and cautious. EMIs for home and auto loans are retained identical, making budgeting easier. But deposit rates are unlikely to rise swiftly, so those looking for better returns than the other options would still need to explore beyond traditional FDs in bonds or mutual funds. That is a time of recalibration less so than of risk — a time to be deleveraging, building liquid savings for emergencies and diversifying investments. While there are not a lot of opportunities for major windfall returns, this stability allows people to build their financial base in a methodical manner without spending too much now and saving just enough without risking the present," said Siddharth Maurya, Founder & Managing Director of Vibhavangal Anukulakara Private Limited.

-330

August 06, 2025· 12:47 IST

RBI MPC Meeting LIVE: 'Didn't mean to say UPI cannot remain free forever for users, costs need to be paid by someone'

RBI Governor Sanjay Malhotra said that he didn't mean to say earlier that UPI will not be free forever. "There are costs, and these have to be paid by someone. Who pays is not so important. It is important for the sustainability that someone pays for that. Even now, government is paying for it through it subsidies," he explained. "The government policy has helped in expnading the use of UPI," he added.

-330

August 06, 2025· 12:38 IST

RBI MPC Meeting LIVE: 'Reserves are strong, confident of meeting needs from external sector'

RBI Governor Sanjay Malhotra said that the central bank is confident that its reserves are enough. It has 11 months of merchandise exports reserved. "We are confident of meeting needs from external sector," he said.

-330

August 06, 2025· 12:24 IST

RBI MPC Meeting LIVE: 'We are hopeful for an amicable solution'

"We are hopeful that we will have an amicable solution," said RBI Governor Sanjay Malhotra on rising trade tensions between India and US.

-330

August 06, 2025· 12:17 IST

RBI MPC Meeting LIVE: 'We don't see a major impact of US tariff on Indian economy unless you have retaliatory tariff'

'We don't see a major impact of US tariff on Indian economy unless you have retaliatory tariff,' said RBI Governor Sanjay Malhotra.

-330

August 06, 2025· 12:11 IST

RBI MPC Meeting LIVE: 'Direct impact evolving uncertainties on India's inflation likely to be very limited'

"Direct impact of these evolving uncertainties on India's inflation is likely to be very limited. Nearly half of our inflation basket consists of food which does not get impacted directly by global developments. A significant part consists of non tradable, which, again, does not get impacted by global developments," said Poonam Gupta, Deputy Governor of RBI.

-330

August 06, 2025· 12:05 IST

RBI MPC Meeting LIVE: 'Still a lot of uncertainties, very difficult to predict what the impact will be,' Malhotra on Trump tariffs

RBI Governor Sanjay Malhotra said that the RBI didn’t revise GDP forecast as the previous change had already factored in some of the global uncertainties. However, still a lot of uncertainties still prevail and it is very difficult to predict what the impact will be, he added. He was replying to a question on Trump tariffs.

-330

August 06, 2025· 11:59 IST

RBI MPC Meeting LIVE: Sanjay Malhotra, other key officials set to address media personnel

-330

August 06, 2025· 11:30 IST

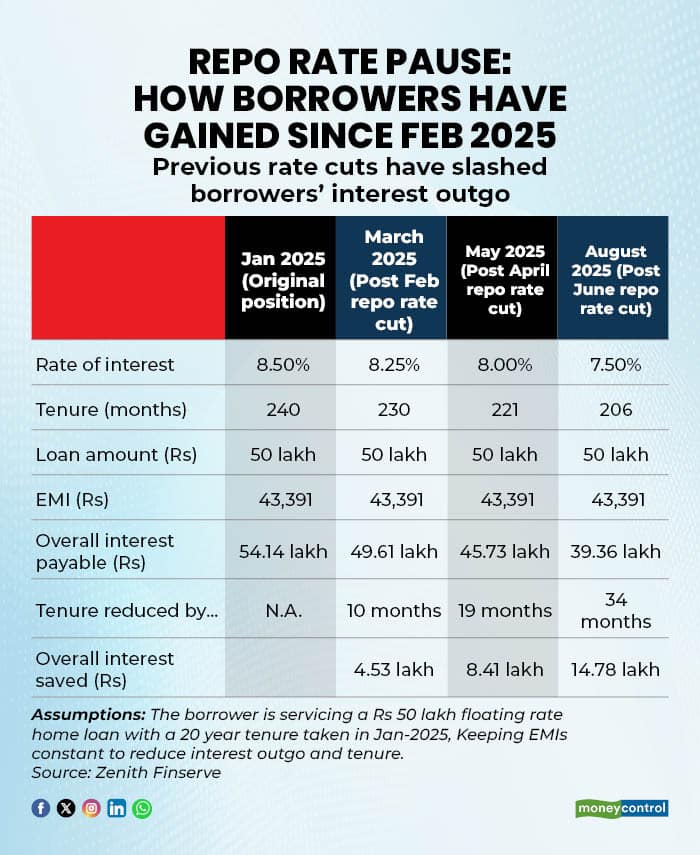

RBI MPC Meeting LIVE: How borrowers have gained from previous rate cuts?

-330

August 06, 2025· 11:15 IST

RBI MPC Meeting LIVE: A classic case of prudent 'wait-and-watch' approach'

Samantak Das, Chief Economist and Head of Research & REIS, India, JLL, says, "After delivering a cumulative 100 bps of rate cuts already this year, the Reserve Bank of India’s decision to hold the repo rate steady is a classic case of prudent "wait-and-watch." With inflation trends remaining benign, the RBI is in a comfortable position to pause and assess the impact of its previous actions. Given the significant uncertainty around global trade and tariffs, the central bank is choosing to keep its powder dry and observe how things unfold. This move sends a message of stability and confidence in the economy's current trajectory, suggesting that it’s resilient enough to handle external pressures without immediate intervention. For businesses and international investors, this predictability is invaluable, reinforcing India's reputation as a mature and steady-handed economy."

-330

August 06, 2025· 11:05 IST

RBI MPC Meeting LIVE: 'Rates remain at comfortable levels, current policy ensures affordability'

"The RBI's decision to maintain the repo rate at its current level reflects a steady approach to supporting economic recovery amid stable inflation. With borrowing costs significantly reduced following three consecutive rate cuts, the current policy stance ensures continued affordability, as rates remain at comfortable levels. This is expected to sustain consumer confidence and support ongoing momentum in key sectors, including real estate.

The RBI's decision to maintain the repo rate at its current level reflects a steady approach to supporting economic recovery amid stable inflation. With borrowing costs significantly reduced following three consecutive rate cuts, the current policy stance ensures continued affordability, as rates remain at comfortable levels. This is expected to sustain consumer confidence and support ongoing momentum in key sectors, including real estate.

The unchanged policy stance is set to keep the real estate sector's growth momentum on track. With steady interest rates and strong consumer confidence, developers are expected to meet the sustained demand for quality housing through greater focus on new offerings. This sustained activity will further strengthen the real estate sector’s contribution to GDP growth, job creation, and the expansion of urban infrastructure in the coming quarters," said Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd.

-330

August 06, 2025· 11:02 IST

RBI MPC Meeting LIVE: How did stock markets react?

Indian stock markets remained in red after RBI MPC announced its key decisions. At 11 am, Sensex was down over 218 points (0.27%) at 80,492.08 while Nifty fell 88 points (0.36%) to 24,561.95. Rate sensitive stocks declined significantly, with real estate index tumbling more than 2.5%.

-330

August 06, 2025· 10:58 IST

RBI MPC Meeting LIVE: 'Policy stability and cheaper loans poised to fuel India’s property market'

Commenting on the RBI MPC’s announcement, Shishir Baijal, Chairman and Managing Director, Knight Frank India, said- "The RBI’s decision to hold rates steady underscores its calibrated approach amidst a complex economic backdrop. While inflation has moderated, it remains uneven, and the central bank is understandably cautious given the persistent risks from global commodity prices, geopolitical tensions, and volatile capital flows. For the real estate sector, the continuation of stable policy rates and surplus liquidity conditions provide much-needed predictability and helps preserve affordability for homebuyers. Notably, some banks have already reduced consumer home loan rates - a move that supports housing demand, especially in the mid-income and low-income segment – and more transmission in interest rates is underway. This policy continuity, coupled with easing credit conditions and steady economic growth can provide a boost to the affordable housing categories."

-330

August 06, 2025· 10:52 IST

RBI MPC Meeting LIVE: 'Trump tariffs make RBI's steady policy stance even more relevant'

"By maintaining the repo rate at 5.5 per cent, the Reserve Bank of India is signalling a continued focus on balancing growth and inflation. With retail inflation cooling to a six-year low around 2.1 per cent in June and price pressures under control, the decision appears prudent and timely. Moreover, the recent imposition of a 25 per cent U.S. tariff on Indian exports adds uncertainty to global trade flows, making this cautious, steady policy stance even more relevant. For the real estate sector, a stable rate means continued affordability of home loans, especially critical in a market already seeing robust interest among mid- and premium segment buyers. As we progress into FY26, this policy pause is likely to maintain homebuyer confidence and support sustained demand in high-growth micro-markets. Combining rate stability with strong urban infrastructure momentum and growing aspirations for lifestyle-driven housing, we expect this period to attract new buyers and investors alike, reinforcing long-term sector resilience," said Manju Yagnik, Vice Chairperson of Nahar Group and Senior Vice President of NAREDCO- Maharashtra.

-330

August 06, 2025· 10:42 IST

RBI MPC Meeting LIVE: Will no rate cut impact luxury real estate sector?

"For luxury real estate, interest rates aren’t the main trigger—buyers are more focused on long-term value and lifestyle. In a market like Goa, where people invest for heritage, exclusivity, and quality of life, demand from NRIs, HNIs, and serious investors is unlikely to slow. A steady monetary policy also sends a message of stability, which is just as important as lower rates when it comes to making high-value investment decisions," said Lincoln Bennet Rodrigues, Chairman and Founder, Bennet & Bernard.

-330

August 06, 2025· 10:40 IST

RBI MPC Meeting LIVE: 'Prudent policy action by the MPC'

"Keeping the Repo rate unchanged is the most prudent policy action taken by the MPC. Given that the Indian Rupee is weakening and narrowing of the global interest rate differentials, the scope for rate reduction was slim. In the interest of stability of the currency given the volatile trade conditions, status quo on interest rate is the best that the monetary authority can do," said Umesh Kumar Mehta, CIO, SAMCO Mutual Fund.

-330

August 06, 2025· 10:39 IST

RBI MPC Meeting LIVE: Has RBI kept policy unchanged amid worries over Trump tariff jitters?

"While recognizing uncertainties surrounding the geopolitical environment and awaiting the result of transmission of previous rate cuts, RBI’s MPC decided to keep rates unchanged. On inflation front, despite 60bps undershooting of the inflation projection for FY26, RBI assessed this as largely led by volatile food items. Though we expected MPC to cut rates amid soaring tariff related uncertainties and easing inflation dynamics, today’s decision to maintain the pause may also be suggestive of MPC keeping its powder dry, should things worsen on the trade and tariff front," said Garima Kapoor, Economist and Executive Vice President, Elara Capital.

-330

August 06, 2025· 10:38 IST

RBI MPC Meeting LIVE: 'This 'dovish pause' to let households and businesses absorb 100 bps rate cut made so far'

"After a cumulative 100 bps easing earlier in FY26, this ‘dovish pause’ lets households and businesses absorb rate cuts made so far. We expect segments like Consumer Durable, Car, Personal, and Home Loans to remain resilient amid stable borrowing costs," said Chintan Panchmatya, Founder, Switch My Loan.

-330

August 06, 2025· 10:36 IST

RBI MPC Meeting LIVE: 'Steady interest rates help preserve affordability'

"We welcome the Reserve Bank of India’s decision to maintain the repo rate at 5.50%, reinforcing its regulated approach towards managing inflation while supporting growth. With a cumulative rate cut of 100 basis points since February 2025, the ongoing monetary policy transmission is gradually taking effect, and the full impact on the broader economy, including the real estate sector, is still unfolding.

From a housing perspective, especially in the affordable and mid-income segments, the current rate environment continues to offer conducive conditions for homebuyers. Steady interest rates help preserve affordability and sustain buyer sentiment, encouraging long-term investment in homeownership.

At Shapoorji Pallonji Real Estate, we believe this measured stance by the central bank strikes the right balance and will continue to support momentum in housing demand, particularly as we head into the festive season which is a traditionally strong period for real estate purchases," said Venkatesh Gopalakrishnan, Director Group Promoter’s Office, MD - Shapoorji Pallonji Real Estate (SPRE).

-330

August 06, 2025· 10:35 IST

RBI MPC Meeting LIVE: Sanjay Malhotra's address ends

RBI Governor Sanjay Malhotra has concluded his statement. He announced that the MPC unanimously decided to keep the policy repo rate unchanged at 5.5%, and the stance as 'Neutral'. Notably, the RBI has now snapped its 3-meeting long session to slashing rates. The Governor and other key officials from the central bank will soon address media personnel. Keep following this LIVE blog to know how experts decode RBI's latest decision.

-330

August 06, 2025· 10:31 IST

RBI MPC Meeting LIVE: RBI to standardize procedure to settle claims on bank accounts, safe deposit locker of deceased bank customers

RBI will be standardizing the procedure for settlement of claims with respect to bank accounts and articles kept in safe custody, or in other words, safe deposit lockers of deceased bank customers, said RBI Governor Sanjay Malhotra.

-330

August 06, 2025· 10:29 IST

RBI MPC Meeting LIVE: 'Large corporates increasingly have relied on market based instruments such as bonds to source funds'

As transmission to money markets have been faster, large corporates increasingly have relied on market based instruments such as bonds to source funds, said RBI Governor Sanjay Malhotra, while adding that the profitability of the banks have increased.

-330

August 06, 2025· 10:28 IST

RBI MPC Meeting LIVE: 'Overall flow of financial resources to the economy increased to Rs 34.8 lakh crore last year'

Although the overall bank credits growth slowed last year, the overall flow of financial resources to the economy increased from Rs 33.9 lakh crore in FY23-24 to Rs 34.8 lakh crore last year, said RBI Governor Sanjay Malhotra. He added that this trend continues in the ongoing FY25-26.

-330

August 06, 2025· 10:25 IST

RBI MPC Meeting LIVE: CRAR of scheduled commercial banks more than 17%

Capital adequacy ratio (CRAR) of scheduled commercial banks is currently more than 17 percent, while their NIM stands at 3.5%. Liquidity at 132%, GNPA at 2.2%. Credit deposit (CD) ratio for the banking systems at 78.9%, said RBI Governor Sanjay Malhotra.

-330

August 06, 2025· 10:22 IST

RBI MPC Meeting LIVE: 'We will endeavour to maintain a sufficient liquidity in the banking system'

"We will endeavour to maintain a sufficient liquidity in the banking system so that the productive requirements of the economy are met and transmission to money markets and the credit markets remains smooth," said RBI Governor Sanjay Malhotra. "The internal working group was set up by RBI to review our liquidity management framework. The group has submitted its report and we will shortly be publishing the same on the RBI website for public consultation," he added.

-330

August 06, 2025· 10:20 IST

RBI MPC Meeting LIVE: System liquidity at Rs 3 lakh crore a day

"System liquidity has been in surplus, on an average of about Rs 3 lakh crore a day since the last MPC meeting. This is in contrast with the average system liquidity of Rs 1.6 lakh crore per day during the previous two months," said RBI Governor Sanjay Malhotra. He further noted that the 100 CRR cut announced after the previous meeting will further improve liquidity conditions.

-330

August 06, 2025· 10:17 IST

RBI MPC Meeting LIVE: 'Merchandise trade deficit has further widened in Q1'

"Merchandise trade deficit has further widened in Q1," said RBI Governor Sanjay Malhotra while announcing the outcome of RBI MPC meeting. "Gross FDI to India remain during April-May 2025-26, however, net FDI moderated due to higher outward FDI," he added.

-330

August 06, 2025· 10:15 IST

RBI MPC Meeting LIVE: CPI Inflation projections

"Core inflation increased slightly to 4.4%, driven by rally in gold prices," said RBI Governor Sanjay Malhotra. CPI inflation is likely to edge up 4% in Q4.

| CPI Inflation projections: | Earlier | Now |

| FY26 | 3.7% | 3.1% |

| Q2FY26 | 3.4% | 2.1% |

| Q3FY26 | 3.9% | 3.1% |

| Q4FY26 | 4.4% | 4.4% |

| Q1FY27 | 4.9% |

-330

August 06, 2025· 10:09 IST

RBI MPC Meeting LIVE: Real GDP growth projection unchanged at 6.5% for FY 26

Real GDP growth projections remain unchanged at 6.5% for FY26:

- Q1: 6.5%

- Q2: 6.7%

- Q3: 6.6%

- Q4: 6.3%

-330

August 06, 2025· 10:07 IST

RBI MPC Meeting LIVE: Core inflation has remained steady at 4% mark

RBI Governor Sanjay Malhotra said that core inflation remained steady at 4%. The above normal south west monsoon and other congenial conditions continue to support growth, he added while announcing the outcome of MPC meeting.

-330

August 06, 2025· 10:05 IST

RBI MPC Meeting LIVE: RBI keeps repo rate unchanged at 5.5%, stance remains 'Neutral'

RBI kept its repo rate unchanged at 5.5% and stance at 'Neutral'. RBI Governor Sanjay Malhotra said that the MPC unanimously decided to keep the policy repo rate unchanged after a 100 bps rate cut earlier during the year. He further said that inflation is expected to grow further.

-330

August 06, 2025· 10:02 IST

RBI MPC Meeting LIVE: Sanjay Malhotra begins address

-330

August 06, 2025· 09:56 IST

RBI MPC Meeting LIVE: 'RBI may revise its FY26 headline inflation projection downward'

"Analysts anticipate the RBI may revise its FY2026 headline inflation projection downward to a range of 3.40 percent–3.50 percent, from its earlier estimate of 3.70 percent. However, RBI Governor in his recent media interaction has mentioned that monetary policy s forward looking. As per various market estimates, inflation for Q4FY26 is likely to be around 4-4.5 percent (RBI has projected 4.40 percent for this period in last policy).

Liquidity remains abundant. As of July 30, the banking system shows a surplus of Rs 2.68 lakh crore—more than 1 percent of NDTL (Net Demand and Time Liabilities), aligning with RBI’s preferred buffer. The weighted average call rate stood at 5.37 percent, beneath the repo rate. The upcoming policy may unveil a refreshed liquidity framework, including a shift to a 7-day Variable Rate Repo (VRR) in place of the 14-day term, a fixed-rate repo window equivalent to 1 percent of banks' NDTL, and the introduction of a Secured Overnight Reference Rate (SORR) for overnight lending," says Abhishek Bisen, Head of Fixed Income at Kotak Mahindra Asset Management Company.

-330

August 06, 2025· 09:53 IST

RBI MPC Meeting LIVE: Sanjay Malhotra all set to announce MPC meeting outcome

RBI Governor Sanjay Malhotra is set to announce the outcome of the central bank's Monetary Policy Committee from 10 am onwards. Follow our LIVE blog for the latest updates on repo rate cut, inflation projections and more.

-330

August 06, 2025· 09:40 IST

RBI MPC Meeting LIVE: Here's what the housing sector expects

"Developers are monitoring not only the repo rate but also the overall direction of liquidity, credit availability, and rate transmission. What the industry requires at this point is not merely a slowdown, but definitive signals that demand will be rekindled with consistent policy support. A small 25‑basis‑point reduction later in the year can go a long way in lowering home loan EMIs, enhancing loan eligibility, and reviving momentum in mid‑income and affordable housing. Until then, even a balanced stance forces buyers and developers to cope with elevated financing expenses in a delicate scenario," said Aman Gupta from the RPS Group.

-330

August 06, 2025· 09:35 IST

RBI MPC Meeting LIVE: Nifty, Sensex see flat start as investors eye RBI policy

Benchmark indices Nifty 50 and Sensex opened the session on a quiet note to trade neat the flatline on Wednesday, August 6, as investors awaited the Reserve Bank of India's Monetary Policy Committee decision.

At 09:18 a.m., the Sensex was up 60.72 points or 0.08 percent at 80,770.97, and the Nifty was up 8.45 points or 0.03 percent at 24,658.00. About 1,496 shares advanced, 871 shares declined, and 130 shares were unchanged. The broader markets were in the red, with the Nifty Midcap 100 and Nifty Smallcap 100 slipping 0.3 percent each.

-330

August 06, 2025· 09:33 IST

RBI MPC Meeting LIVE: Rupee opens 9 paise up at 87.71 against dollar ahead of RBI's monetary policy decision

The rupee opened 9 paise up against the dollar on August 6 ahead of Reserve Bank of India's (RBI) monetary policy announcement. The currency opened at 87.71 against the dollar after ending the previous session at 87.80. The RBI, which will deliver its interest rate decision at 10 am, is widely expected to maintain status quo.

The rupee will remain under pressure after US President Donald Trump on August 5 issued a fresh threat to "substantially" raise tariffs on Indian imports in the next 24 hours.

-330

August 06, 2025· 09:27 IST

RBI MPC Meeting LIVE: What is the expected rate trajectory?

Most economists believe that the RBI may hold interest rates steady at 5.50 percent, currently the terminal interest rate. This will allow the RBI to assess incoming data on the impact of monsoons on inflation, the impact of past rate cuts on the growth trajectory, and make changes if required in the October MPC meeting. For now, economists are penciling an 25 bps rate reduction in October policy. That said, in June policy, SBI Research had predicted 50 bps rate cut, which turned true. Similarly, SBI Research expect 25 bps rate cut, when other experts or economists are predicting a status quo in the August policy.

-330

August 06, 2025· 08:57 IST

RBI MPC Meeting LIVE: Liquidity measures to be in focus

Market participants are expecting more clarity from the RBI on the amount or level of surplus liquidity to be kept in the banking system. Further, they expect the central bank to release an updated liquidity management framework to ensure its rate decisions are effectively passed through to the broader economy. Currently, liquidity in the banking system is estimated to be in surplus of around Rs 4 lakh crore, as per RBI’s data.

The banking system liquidity, which was in deficit till April, turned in to surplus mode after the central bank started infusing durable liquidity to the banking system through open market operations (OMO) purchases and USD/INR Buy/Sell swap auctions. Along with this, they have also been supporting liquidity through daily Variable Repo Rate (VRR) auctions. All these measures helped banking system liquidity to turn surplus and remain in surplus mode.

Further, in June policy, the RBI cut Cash Reserve Ratio (CRR) to give a boost to liquidity in the banking system. This will add Rs 2.5 lakh crore liquidity to the banking system. The CRR cut is scheduled in four tranches of 25 bps each starting from the fortnight beginning September 6, followed by October 4, November 1 and November 29, 2025.

-330

August 06, 2025· 08:43 IST

RBI MPC Meeting LIVE: Sanjay Malhotra's commentary to be a key watch

The commentary of RBI governor will be key to watch in the August policy because of the uncertainty over the tariffs and its impact on the growth.

In the last monetary policy, RBI Governor Sanjay Malhotra had mentioned that any spillovers emanating from protracted geopolitical tensions, and global trade and weather-related uncertainties pose downside risks to growth.

In the June monetary policy, CPI projections for FY26 were revised down by 30 basis points (bps), Q1FY26 projections were revised downwards by 70 bps, Q2FY26 revised downwards by 50 bps. The RBI has reduced its CPI inflation projection to 3.7 percent from its earlier projection of 4 percent for FY26.

The central bank retains its FY26 GDP growth forecast at 6.5 percent in June policy; with Q1 at 6.5 per cent, Q2 at 6.7 per cent, Q3 at 6.6 per cent, and Q4 at 6.3 per cent.

-330

August 06, 2025· 08:36 IST

RBI MPC Meeting LIVE: Here's what happened in the past few meetings

OUTCOME OF THE PAST RBI MPC MEETINGS

| Rate | Change | Stance | |

| June 2025 | 5.50% | -50 bps | Accommodative |

| April 2025 | 6% | -25 bps | Accommodative |

| February 2025 | 6.25% | -25 bps | Neutral |

| December 2024 | 6.5% | No change | Neutral |

| October 2024 | 6.5% | No change | Neutral |

| August 2024 | 6.5% | No change | Withdrawal of Accommodation |

| June 2024 | 6.5% | No change | Withdrawal of Accommodation |

| April 2024 | 6.5% | No change | Withdrawal of Accommodation |

| February 2024 | 6.5% | No change | Withdrawal of Accommodation |

-330

August 06, 2025· 08:00 IST

RBI MPC Meeting LIVE: Will RBI revise GDP, Inflation projections?

Most economists and experts are of the view that the central bank will revise down the projections on the Consumer Price Index (CPI) inflation in the August policy taking comfort from the lower food inflation and benign outlook.

Experts believe that the RBI may lower the average CPI inflation by 20-30 bps in the August policy, although experts believe an immediate downward revision in GDP projections is unlikely.

“As economic activity remains broadly resilient, but external risks to growth persist, due to evolving tariff related developments, RBI may keep GDP forecasts unchanged for now in the upcoming policy meet. We expect GDP growth in the range of 6.4-6.6 percent in FY26,” said Jahnavi Prabhakar, Economist at Bank of Baroda.

-330

August 06, 2025· 07:28 IST

RBI MPC Meeting LIVE: How can Trump tariffs impact RBI's decision?

Experts are of the view that the recent imposition of the 25 percent tariffs by the US has increased external risk for the Indian economy, which may prompt the RBI to take monetary decisions in a cautious and calibrated manner while announcing the decision of tomorrow's MPC.

This is because, the tariffs are expected to have an impact of 20-30 basis points (bps) on GDP, but economists are yet of the view the RBI may adopt a "wait and watch" approach given ongoing trade negotiations and the uncertainties thereof.

The global uncertainty has heightened after the announcement of the tariffs by the US on July 30, and, contrary to the situation which prevailed in the June policy decision, it is now complicating the policy outlook of the RBI. The move raises concerns over a potential slowdown in external demand, trade tensions, and capital flow volatility—all of which could weigh on India’s economic growth and financial stability.

However, easing inflation below the RBI’s medium-term target of 4 percent may provide some room for policy rate easing. Any commentary from RBI in the matter of this development will be closely monitored by equities, bonds and currency markets to gauge the future moves from a regulatory standpoint. Experts say that the central bank is likely to focus on ensuring a balance between supporting domestic growth and safeguarding against global shocks.

-330

August 06, 2025· 07:21 IST

RBI MPC Meeting LIVE: Here's what economists expect

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) is likely to maintain status quo on interest rates in the upcoming review on August 6, according to the Moneycontrol’s poll of 17 economists, bank treasury heads and fund managers.

This is because a pause will allow the RBI to assess incoming data on the impact of monsoons on inflation, and the impact of past rate cuts on the growth trajectory, experts said.

However, a few experts believe that the central bank may cut rates by 25 basis points (Bps) amid sharp easing inflation numbers.

-330

August 06, 2025· 07:18 IST

RBI MPC Meeting LIVE: SBI Research expects RBI to cut rate by 25 bps

SBI Research, in its report titled ‘Prelude to MPC Meeting: August 4–6, 2025’, has forecast another 25 basis point cut in the repo rate. The report takes into account recent trends like tariff shocks, projected inflation for FY27, and anticipated festive season demand in FY26.

The SBI note warns against policy inaction in the current scenario, stating: “No point in committing a Type 2 error today by not cutting rates in August, as inflation will continue to remain range-bound even in FY27.”

-330

August 06, 2025· 07:17 IST

RBI MPC Meeting LIVE: Where to watch the RBI Monetary policy live?

Governor Malhotra’s policy address will be streamed live on the Reserve Bank of India’s official YouTube channel. It will also be available on the RBI’s social media handles, including X (formerly Twitter) and Facebook. For the latest updates, keep following this LIVE blog.

-330

August 06, 2025· 07:16 IST

RBI MPC Meeting LIVE: When is Governor Sanjay Malhotra expected to reveal the outcome of MPC meet?

The MPC meet began on August 4 and will conclude on August 6. The policy outcome will be revealed by Governor Sanjay Malhotra at 10:00 AM today, marking his fourth monetary policy announcement since taking over from Shaktikanta Das.