Baishnab Chand, 35, from Odisha, is currently pursuing a one-year Master of Business Administration (MBA) course from a business school in France. He began his foreign education in September 2021. But, the journey to arrange finances for his higher education was not smooth. Thanks to the COVID-19 pandemic, he couldn’t liquidate his investments in two (property) plots.

“I expected to sell my plots or keep them as collateral with financial institutions and go for my higher studies. But it didn’t work,” says Chand. He adds that he had reached out to multiple banks to take an education loan of Rs 30 lakh but the applications got rejected.

“The key reason for rejection of education loan application was investment in plots and market-linked investments. Typically, banks don’t consider these investments as collateral,” he adds. Despite having investments of around Rs 44 lakh in property and Rs 15 lakh in equities, Chand was worried.

“Agricultural land, and open plots aren’t considered as collateral by lenders. The same goes for equities and mutual funds as they are extremely volatile assets and not as liquid as fixed deposits (FDs) that guarantee returns,” says Akshay Chaturvedi, Founder & CEO of Leverage Edu.

Baishnab Chand, 35, from Odisha, is currently pursuing a one-year MBA course at a business school in France. He faced rejections from multiple financial institutions because he had plots and investments in equities for collateral which are not accepted by lending institutions.

Baishnab Chand, 35, from Odisha, is currently pursuing a one-year MBA course at a business school in France. He faced rejections from multiple financial institutions because he had plots and investments in equities for collateral which are not accepted by lending institutions.

To avoid such a situation and delay in getting the education loan sanctioned from a financial institution, it’s important you do your research about the eligibility criteria, collateral required, need for co-applicant, documents to be submitted, etc.

Like Chand, other students going abroad also face multiple issues while applying for an education loan. Let’s take a look at the important issues that need to be considered while applying for an education loan, so as to make the process smooth.

Expenses that education loans cover…and don’t cover

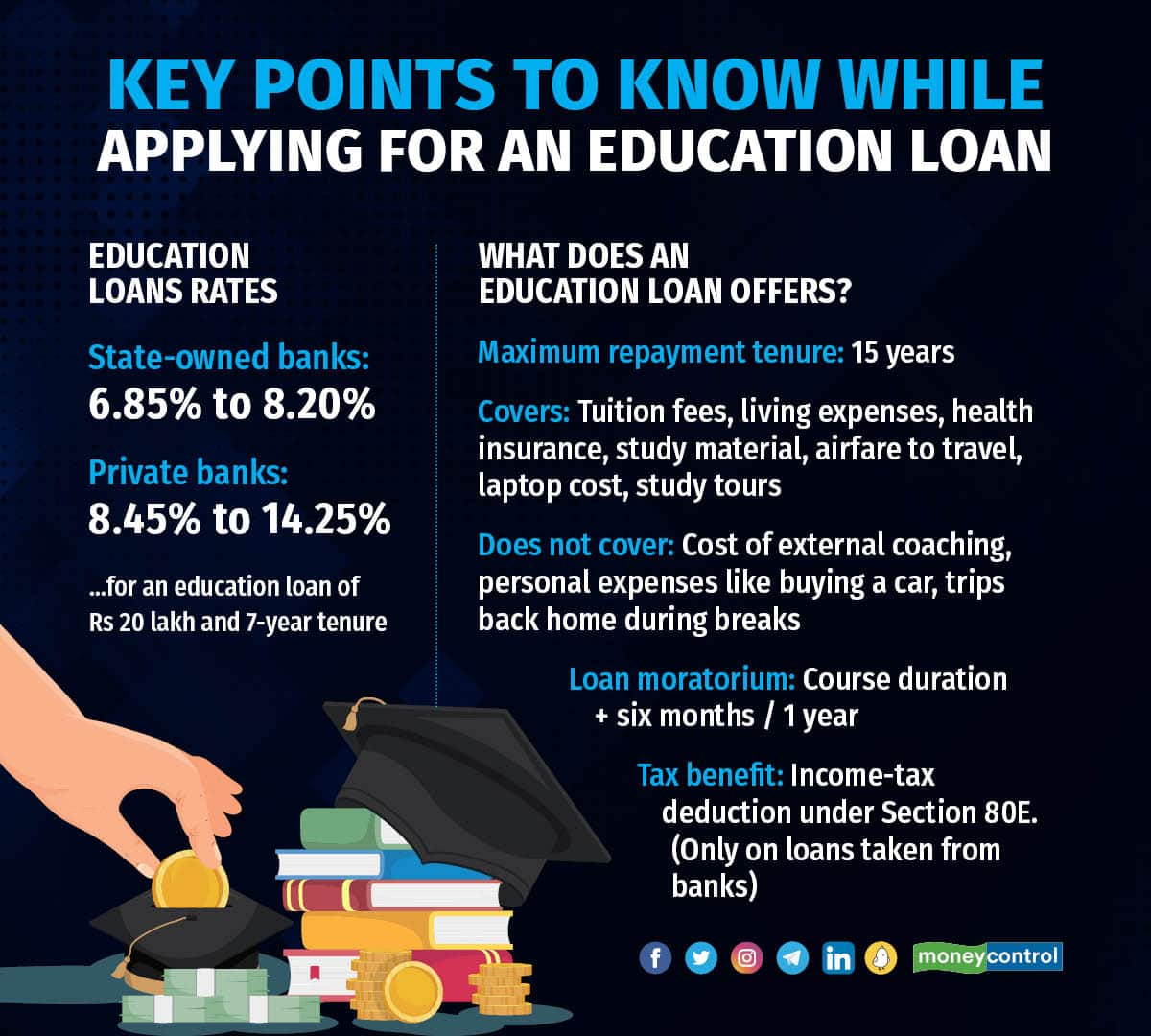

Most banks cover tuition fees, living expenses, health insurance and cost of study material for education loans.

For instance, Bank of Baroda considers all the above expenses as project cost. “Apart from this, we consider airfare, cost of laptop, stationery and any other expenses required for students to complete the course, including study tours, project works, thesis, etc.,” says HT Solanki, General Manager - Mortgages & Other Retail Assets, Bank of Baroda.

He adds, “We do not consider the cost of external coaching in any subjects for an education loan."

Banks or any other financial firms that provide loans process loan applications after evaluating your admission letter because the education loan amount varies with the country, your course, the university, and a few other factors.

“Every financial institution has its own evaluation parameters. Understand them while doing the research,” says Ankur Dhawan, President, upGrad Abroad.

He adds, "financial institutions will not fund personal expenses that do not really affect your education outcome. For instance, buying a car to travel, vacations during the break in program, and so on, are not covered."

Also read | Studying abroad? Be aware of these 5 additional costs linked to your education

Aditya Shah, 22, from Mumbai, is currently pursuing a one-year master's in biotechnology and business studies from a university in Ireland. He had applied for an education loan from a PSB after doing research because it offered a loan at the lower rate of interest and liberalised terms and conditions as compared to NBFCs and fintechs.

Aditya Shah, 22, from Mumbai, is currently pursuing a one-year master's in biotechnology and business studies from a university in Ireland. He had applied for an education loan from a PSB after doing research because it offered a loan at the lower rate of interest and liberalised terms and conditions as compared to NBFCs and fintechs.

Banks or non-bank firms: which offer better loan terms?

For 22-year-old Aditya Shah, from Mumbai, who is currently pursuing a one-year master's in biotechnology and business studies from a university in Ireland, it was a choice between banks, non-banking financial companies (NBFCs) and fintech firms.

After doing research he chose a state-owned bank “because of the lower rate of interest and liberalised terms and conditions as compared to NBFCs and fintechs,” says Shah.

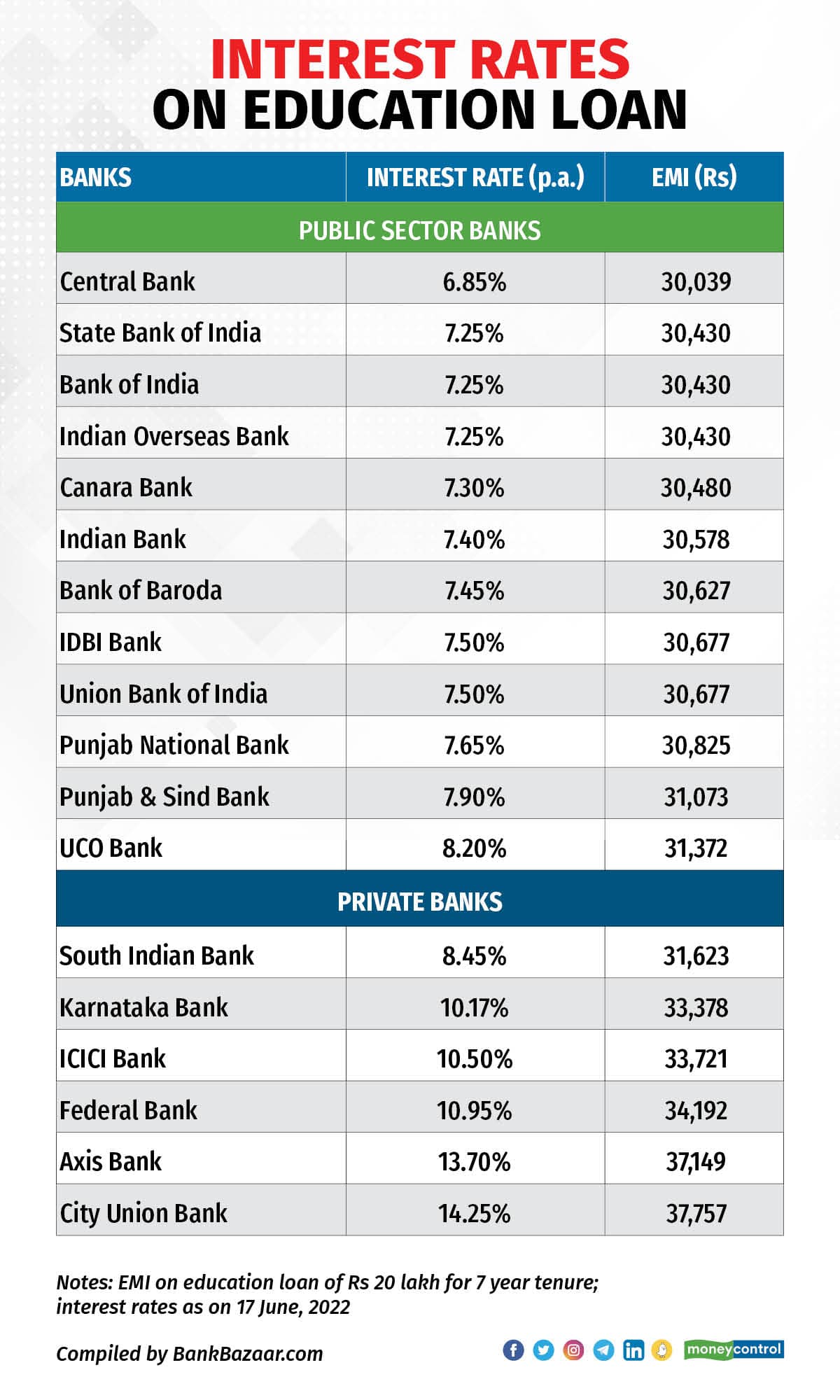

For instance, the interest rate on education loans from State Bank of India (SBI), Canara Bank and Bank of Baroda is 7.25 percent, 7.30 per cent, 7.45 percent, respectively.

Private banks – ICICI Bank and Axis Bank – charge 10.50 percent and 13.70 percent, respectively, for education loans of Rs 20 lakh of seven-year tenure (refer to table).

Loans from overseas firms

Some students also take loans from institutions based abroad. After facing multiple rejections here, Chand reached out to a UK-based fintech company in June 2021 that provides collateral-free education loans. “I researched about it on the website, approached past borrowers to understand their experience, then contacted and applied for an education loan,” says Chand.

He adds that he got 100 percent finance for his tuition fees from the fintech lender without collateral and co-applicant. The interest rates compete with private banks offering education loans.

“Check the reputation and credibility of the foreign lending institution before you apply for an education loan. There are many lenders out there which are not reputed. They might be misguiding the students,” says Mayank Sharma, Country Head India and Head of Global Partnerships, Prodigy Finance.

Like Shah and Chand, you need to shortlist financial institutions by doing research. “You must consider financial institutions which give you the lowest interest rates, convenience in repayment terms, understand your problems in the best way, and suit your needs,” says Sharma.

Collateral that your bank could ask

There are several key factors that students should consider while shortlisting an institution to avail an education loan for studying abroad.

“The rate of interest, margin, collateral security, turnaround time in sanctioning and disbursement of loan, etc. are some of the important parameters to consider,” says Solanki. He adds, softer aspects that play an important role include how customer-oriented the bank is and its ability to respond quickly to student queries, post-loan additional moratorium for further study, etc.

Banks ask for tangible collateral, equivalent to the loan amount, while applying for an education loan. Banks consider residential property, fixed deposits, government bonds, etc., as collateral. “Bank of Baroda does not (as) consider collateral security (assets) which are restricted by any law or not easily realisable. For instance, agriculture land, tax saving deposits, etc.,” says Solanki.

Avinash Kumar, founder of Credenc, a fintech platform offering education loans, explains that banks and finance firms typically check the background of the students, their academic performance, course applied for, and future job potential of that course.

Also read | How education inflation can hurt your child’s future

How soon should you repay it back?

“The ideal advice would be to get a long-tenure education loan. After passing out and joining a firm, save as much as possible, and repay the loan early,” says Ankit Mehra, Co-founder and CEO of GyanDhan.

The maximum repayment tenure offered by banks, such as Bank of Baroda and Union Bank of India, is 15 years (after the moratorium period) irrespective of the quantum of loan. Most NBFCs and fintechs don’t provide education loans for such a long tenure.

Also, before applying for an education loan, you must check whether the bank, NBFC or fintech calculates the interest amount on reducing balance or on flat rate basis. Interest calculation on reducing balance can considerably reduce the effective interest rate.

“If a student wants to stay abroad for around five years or more after graduation, then maybe the education loan in US dollars is a better option,” says Sharma.

Tips to make your loan application stronger

You must have a strong co-applicant who can co-sign your non-collateral-based education loan. “Some financial institutions accept multiple co-applicants. We highly recommend presenting multiple co-applicants if possible to get better interest rates,” says Chaturvedi. He adds, admission offers from renowned universities give a better edge when applying for an education loan.

Further, if you have work experience which establishes your earning potential, then it holds you in good stead in the eyes of a lender.

“Avoid giving false information in the application form or forged documents to process the loan. These can cause delay or rejection of the loan,” says Sharma.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!