Bhavana Acharya

If there is one trend that’s sparking investor interest, it is passive investments. With returns of many equity mutual funds slipping behind key benchmarks, the draw of passive funds has increased. AMCs (asset management companies), too, are now rolling out index funds and ETFs.

While the passive space is evolving, what are the available options today? Is it possible for you to build a passive-only portfolio? Here is a brief on what index funds and ETFs are available today and how you can use them.

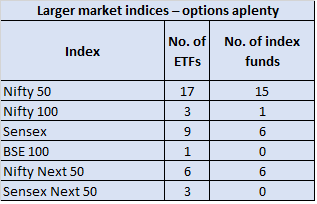

#1: Main market indices

These primarily are the Nifty 50 and the Sensex. Now, 21 of the 36 index funds, and 26 of the 80 ETFs (not including gold) are based on these two indices. These aside, the indices that are most featured are the Nifty 100 and the Nifty Next 50. ETFs additionally offer the little-known Sensex Next 50 – this index is another large-cap gauge, housing the 50 largest stocks that rank after the top Sensex 50 in the BSE LargeMidCap index.

Given that these indices contain highly liquid stocks, and that they are large-cap, tracking error for most index funds and ETFs are on the lower side. On an average, the index funds and ETFs built on the Nifty 50, for example, have a tracking error of -0.53 based on one-year returns. Sensex-based funds/ETFs have a tracking error of 0.58 on an average.

More, indices such as the Nifty 100 or the Nifty 50/Sensex can comfortably take up the role of large-caps. These indices are a great representation of large-caps. Most active funds in this category lag the Nifty 100, and therefore going passive here can both save costs and improve portfolio return. The Nifty Next 50, though large-cap in nature, is a high-return delivering index that can add some zing to your portfolio. The index’s three-year returns, for example, beat the Nifty 50, 70 per cent of the time since 2008.

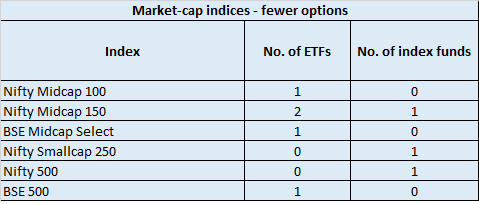

#2 Other market-cap indices

Outside the Nifty 50 and the Sensex, indices tracking the mid-cap and small-cap segments find place. These are the Nifty MidCap 100, the Nifty Midcap 150, the Nifty SmallCap 250, the BSE Select MidCap, and the BSE 500/Nifty 500. These indices represent either small-caps, mid-caps, or the broad market.

Together with the main market indices, they offer access to the entire market capitalisation range. As a result, you don’t miss opportunities in different segments of the market – and therefore, you will be better able to build a portfolio that is balanced and diversified across market capitalisations.

On the flip side, though, active funds are still delivering higher returns. Unlike in large-caps, most mid-cap and small-cap funds are able to comfortably beat their indices. Large-and-mid cap funds and multi-cap schemes are able to beat the Nifty 500. There is some opportunity loss to be had in going for the mid-cap/small-cap indices.

These index funds and ETFs are also new – most have been launched in the past two years. This gives limited understanding of their tracking error. And unlike the larger indices, fund/ETF choices in these segments are fewer.

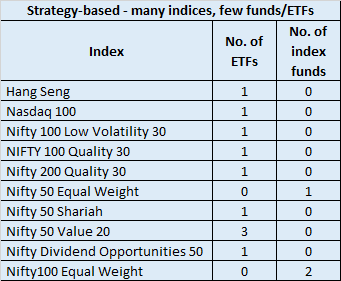

#3 Strategy indices

To hold a diversified portfolio, it isn’t just enough to have allocations to different market caps. You need different strategies. Besides, the risks in holding only market indices is that they don’t protect you from downsides and you miss the opportunity of earning market-plus returns. Though you may be willing to forgo gains for more stable portfolios, you don’t necessarily have to.

This leg-up to returns can come from strategic smart-beta indices. These indices use defined metrics to select and weight stocks, unlike market-cap based indices, which use free-float market cap as the deciding factor. Metrics could be designed to capture value stocks, growth firms, and so on.

On this front, the ETF space is seeing some development; index funds are yet to catch up. There are two quality-based ETFs; for example – one on the Nifty 100 Quality 30 and the second on the Nifty 200 Quality 30. Value-based indices include the Nifty 50 Value 20.

Among index funds, the most differentiated they get is when they offer equal-weight indices. These indices give equal weights to the stocks in the Nifty 50 or the Nifty 100; stocks with smaller weights in the Nifty 100 or the Nifty 50 get a bigger role to play. In the event of a broad-market uptrend, these higher weights to many stocks can potentially improve returns compared to just the Nifty 50 or the Nifty 100.

These indices could – depending on the factors that go into construction – beat the main market-cap indices. Consider the Nifty 50 Value 20, which is built with value metrics using the Nifty 50 as the base. This index beat the Nifty 50 a good 81 per cent of the time when rolling three-year returns since 2012.

It is not a given that all smart-beta indices beat the parent index (the index that it draws from) or the closest comparable index. For example, while the Nifty 100 Quality 30 uses metrics to pick stocks with low leverage and high return ratios, the index has beaten the Nifty 100 just 56 per cent of the time when rolling three-year returns since 2013. Similarly, with the recent market trend where the Nifty 50 and Nifty 100’s returns are coming from their top stock weights, equal weight indices are lagging.

This means, in strategy indices, you necessarily need to check how the index is constructed, whether holding that index could help returns, whether the same strategy could be had better in an active funds, and whether you could instead make tactical investments in these indices.

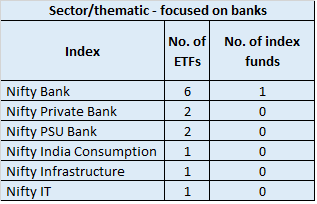

#4 Sector indices

Sector options are centred mostly on banking and financial services. They are either pure bank ETFs or a subset such as PSU banks or private banks. But other than these, sector choices are limited. More, sector-based indices are found in ETFs and not in index funds; there are sector/thematic funds aplenty, just not built on indices. Therefore, ETFs and index funds do not offer much by way of sector-specific exposure – which you could otherwise have used tactically to boost returns if you are able to call trends correctly.

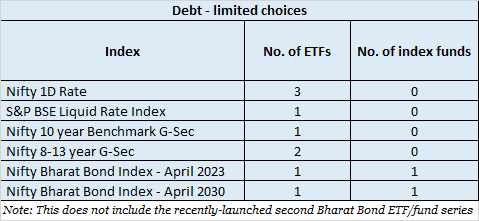

#5 Debt indices

By and large, outside of the Bharat Bond ETFs/ funds, passive debt options are limited and can largely be ignored. The most you have liquid ETFs, which are primarily used by, and more suited to traders and other short-term investors park money temporarily.

This apart, you have gilt indices, but volumes in these debt ETFs are poor. The average daily traded value for SBI MF’s 10-year g-sec ETF, for example, was just Rs 81,000 in the year to date while that of LIC MF’s daily traded value was Rs 2.83 lakh.

What to look for and how to use

While there are pros to investing in ETFs and index funds as explained above, there are aspects you need to look out for.

-One, the tracking error. A high tracking error should be avoided, even if the index fund has lower expense ratios. In ETFs, there is a difference between NAV and market price. Tracking error on the NAV may be low but the picture can look very different when comparing market price deviations.

-Two, volumes in ETFs. While indices may look promising, most ETFs lack steady trading or reasonable turnover. While highly traded ETFs can have turnover of over Rs 30 crore a day, for others it can dip to Rs 50,000. There may even be days when the ETF is not even traded.

-Three, the potential of the index. This is especially true in sector and strategy ETFs. If the index is unable to beat the main market indices across market cycles, then plain-vanilla indices or active funds are the better bets.

-Four, your convenience. If you’re using passive investments as part of your main portfolio, it could be cumbersome to maintain if it is split between funds and ETFs. In index funds, you can also bypass the troubles of identifying liquid and consistently trading ETFs.

So how should you use ETFs or index funds?

-On the debt side, active funds are still the better option. Quite apart from liquidity and tracking error issues in ETFs (barring the Bharat Bond), there is just not enough variety in debt indices to offer a good alternative to quality bond funds.

-You can use only ETFs and index funds to build a market-cap allocated portfolio if you want to avoid active funds, as you do have enough basic options to do so. But you need to know enough to choose the right fund or ETF, using different evaluation criteria such as size, liquidity, and costs. In addition, layer these market-cap based indices with smart-beta ETFs/index funds and keep an eye out for more such options. You need this to round out your portfolio and improve returns.

-Else, blend index funds/ETFs with your active portfolio to achieve a better-built and lower-cost portfolio. In this, don’t duplicate your portfolio or invest in indices just because they are popular. Use those funds/ETFs where they challenge active funds, such as in large-caps. Use where they can provide a differentiation to your portfolio, such as in strategy indices or international indices. Use them where they address a gap in active funds.

(The writer is Co-founder, PrimeInvestor)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.