Mid-cap focused passive funds are increasing in numbers and for a good reason: Active mid-cap funds have been seen struggling to outperform, despite strong individual performances.

As on September 17, 2024, about half of the active mid-cap funds underperformed their corresponding benchmarks over the past 1-year period.

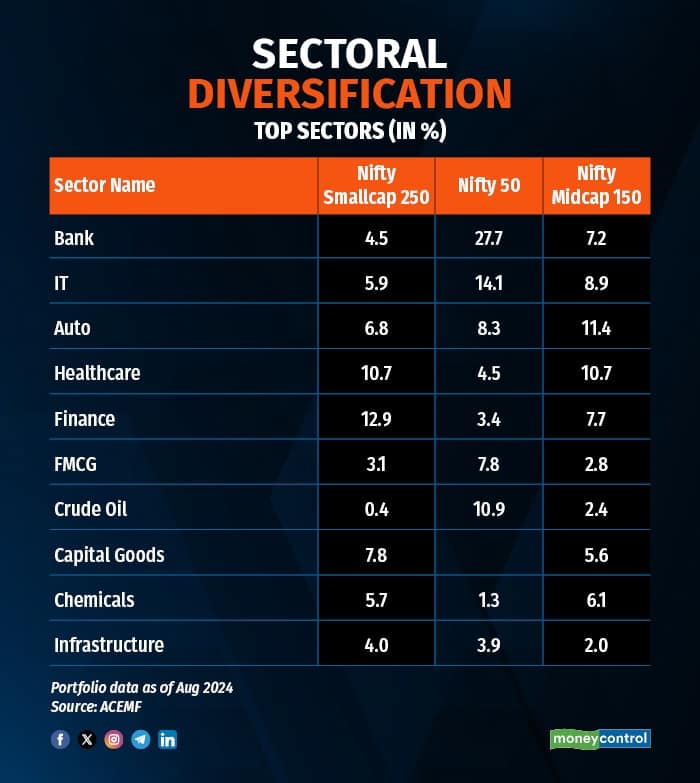

With this, mutual fund distributors and financial advisors are increasingly recommending Nifty Midcap 150 based index funds to investors. Currently, there are 14 passive funds – eight index funds and six Exchange Traded Funds (ETFs) – tracking the Nifty Midcap 150 index. The index represents the 150 companies ranked 101 to 250 by market capitalisation in the Nifty 500. The stocks in the index are future blue-chip companies that have the potential to exhibit better growth prospects over the long run.

Outperformance is a challenge

While large-cap funds found it difficult to outperform their benchmark indices in the last few years, mid- and small-cap schemes have found it easier to outperform their benchmark indices. But now it is becoming increasingly challenging for mid-cap funds to consistently outperform their benchmarks.

This difficulty has arisen due to a couple of reasons:

One, the re-categorisation exercise in 2018 led to a narrowing investment universe. As per the mandate, active mid-cap schemes have to keep investing at least 65 percent in the AMFI defined mid-cap stocks.

Two, with more and more inflows to mid-cap stocks over the last 7-8 years, market efficiency within mid-caps has improved a lot.

“This means there is less room for active managers to find mispriced stocks and generate alpha,” explains Kunal Valia, Founder, StatLane.

Third, actively managed mid-cap funds aim to select high-quality stocks based on rigorous analysis. Many schemes continue to hold them despite those stocks underperforming severely in the short to medium term. Interestingly, the churning ratio of the Nifty Midcap 150 index was an average of 40 percent in a year, which is higher than the turnover ratio of many actively managed mid-cap schemes.

Finally, larger sized mid-cap funds find difficulties deploying significant amounts of capital into mid-cap stocks dynamically due to limited liquidity leading to underperformance, adds Valia.

What makes mid-caps attractive?

Mid-cap companies are fairly established firms with an improving business model.

“Mid-cap companies are often in the growth phase of their business cycle and tend to have higher growth potential compared to large-cap companies, though with higher risk,” says Chintan Haria, Principal Investment Strategist, ICICI Prudential AMC.

With India’s strong economic potential, political stability, growing forex reserves and glide path of fiscal deficit, mid-cap companies are well-positioned to benefit from increased spending and investment, says Valia.

For investors looking to balance risk and reward, mid-cap funds can serve as a strategic component of a well-rounded investment portfolio, offering both growth potential and a buffer against market volatility.

“Mid-cap stocks are more prospective and have ample room for growth” adds Trivesh D, COO, Tradejini.

Also see: Mid-caps beat small-caps in the long term. Here are top performing mid-cap funds

Mid-cap schemes can offer balanced growth while carrying a modest level of risk compared to large-cap and small-cap schemes.

Nifty Midcap 150 beat Nifty 50 and Nifty Smallcap 250 in long term

Moneycontrol’s analysis of the 10-year rolling returns of Nifty Midcap 150 Total Return (TRI) and Nifty Smallcap 250 TRI shows that the mid-cap index beat the small-cap index comfortably over the long term.

Both mid- and small-cap companies often have a higher growth potential than established large-cap firms as they are in their growth phase. Meanwhile, small-cap stocks are more economically sensitive than mid- and large-cap stocks and vulnerable to losses.

One of the reasons that mid-caps typically exhibit growth potential while having lower volatility and drawdowns compared to their small-cap counterpart, which may enhance their overall performance relative to small-caps, explains Arun Sundaresan, Head, Nippon India ETF.

The significant downturn in small-cap stocks during the market corrections of 2008, 2011, 2018 and 2020 has weighed heavily on their overall returns, further emphasising the inherently high-risk nature of small-cap investments.

See here: No new sovereign gold bonds? Check out the most liquid ones on the NSE

Another reason was that the mid-cap universe has seen strong mutual fund inflows over the last 7-8 years contributing to their outperformance over small-caps, ascertains Haria.

Valia feels that mid-caps' stronger growth potential, better access to capital and relative stability during market fluctuations allow them to capitalise on expanding economic conditions more effectively than their smaller counterparts.

Above all, Nifty Smallcap 250 is an incubator of Nifty Midcap. Stocks that performed well eventually moved to Nifty Midcap 150 from Nifty Smallcap 250. Conversely, it is also true that the underperforming stocks dropped from Nifty Midcap 150 to Nifty Smallcap 250.

Best of both worlds: Risk and return

There has been a high probability of calls going wrong in the small-cap space which, in turn, could impact the overall returns. Meanwhile, mid-cap companies are almost established firms with an improving business model. Mid-cap schemes can offer balanced growth while carrying a modest level of risk compared to small-cap funds.

Unlike active mid-cap schemes, passive mid-caps are fully invested in mid-cap stocks. “By investing in the Nifty Midcap 150 index, one is taking exposure to the entire midcap category. Many of these companies could be considered as budding leaders of tomorrow who would graduate from being midcaps to largecaps and one could look at capturing this growth through the index” explains Vishal Jain, CEO, Zerodha Fund House.

Investors looking at market linked returns, reduced chances of underperformance and not wanting a fund manager’s involvement can consider passive mid-cap funds. Make sure that you stay invested for at least 10 years or more to get the best out of it, though a minimal tenure of 5 years is a must.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.