Systematic Investment Plans (SIP) in mutual funds have become popular in recent years. In fact, after sedated inflows via SIPs since June 2020, the month of March saw a surge in inflows. According to the Association of Mutual Funds of India (AMFI), inflows into MFs via SIPs stood at Rs 9182 crore last month.

Last week, Parul Maheshwari, a Mumbai-based certified financial planner was a guest on Simply Save, Moneycontrol’s personal finance podcast. She spoke about the unknown facets of SIPs and how investors can use these instalments to their advantage.

You don’t need to be rich to start an SIPDid you know just one share of MRF costs Rs 81,884? One share of Honeywell Automation is valued at Rs 43312. So, how do you go about buying these ‘pricey’ stocks?

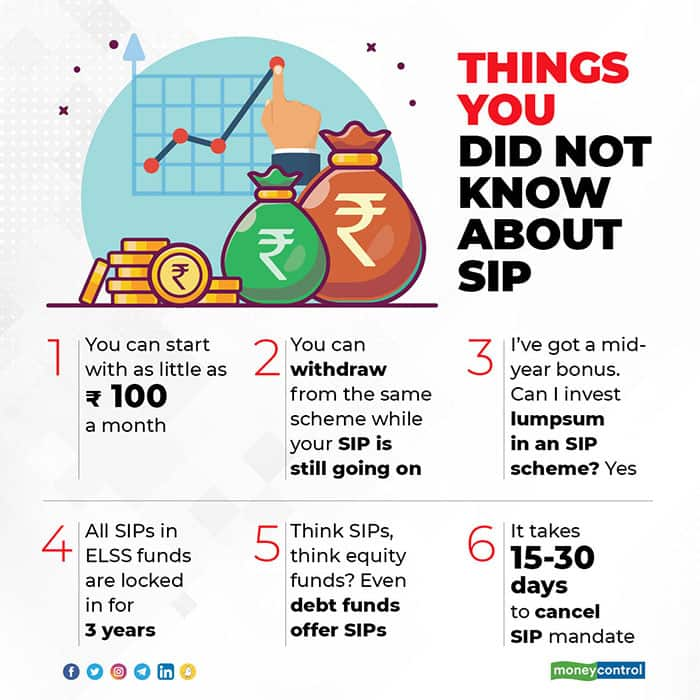

Investing in mutual funds takes as little as Rs 5,000 to open an account. If you wish to start an SIP – which calls for a monthly commitment – it takes as little as Rs 500 to start an SIP. Some fund houses allow you to start an SIP with Rs 100.

Withdraw funds without stopping SIPsIf you MF scheme is an open-ended one, you can withdraw money from it anytime. You can continue your SIPs and still withdraw from the accumulated balance. Typically, fund houses follow a FIFO (first in first out) method for withdrawal. So, units that had got invested first get withdrawn first. This is done to ensure that you don’t pay short-term capital gains tax (15 percent, if you withdraw before year) as far as possible.

Last year, due to the surge in COVID-19 cases, many people saw a fall in their income. Some lost jobs. In such times, you could ’pause’ your SIP for a few months. Once your cash flow situation eases, you can resume your SIPs. “You have to fill up a simple form and there are options. You can pause SIPs for 3-6 months depending on what you wish. The maximum time fund houses now allow is a six-month window.

You can also invest a lump-sum in the same fund in which you have an existing SIP running.

Just as with lump-sum investments, your SIP instalments are also subject to capital gains tax and lock-ins. Now, in an equity-linked saving scheme (ELSS), all investments are locked in for three years. This applies to your SIPs also.

“For example, if we start an SIP in an ELSS fund in this financial year, the April 2021 SIP becomes lock-in-free in April 2024. The next instalment, which comes in May 2021, gets out from lock-in from May 2024,” says Maheshwari.

In other words, if you wish to withdraw the entire accumulated amount in your ELSS, you can only do so after all your SIP instalments complete three years’ lock-in.

SIPs are also possible in debt fundsThink SIPs, and you think equity funds, right? Maheshwari says that you can invest via SIPs in debt funds. “Since investors aren’t aware of this, they usually invest in fixed deposits for their emergency funds. But you can run an SIP even in a liquid fund for your emergencies,” says Maheshwari. Even gold mutual funds low you to make SIP investments.

Cancelled your SIP, but the instalment still goes outSometimes, despite cancelling your SIP, money still goes out of your bank account. Why?

Typically, it takes about 15 to 30 days to cancel the SIP. This is because any SIP is done through a mandate, which is registered with the bank. Now, the bank takes some time to register that mandate as well as to cancel it. So, if the next SIP instalment date is first of the coming month, and you cancel your SIP on the 20th of the previous month, your next instalment would still go through.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.