Motilal Oswal Mutual Fund has launched India’s first passive scheme, which offers exposure to microcap stocks by investing in companies from the 501 to 750 spot in terms of market capitalisation.

According to the classification of the Securities and Exchange Board of India (SEBI), the top 100 companies in NSE or BSE are considered large-caps, the firms in the 101-250 rank are considered mid-caps, companies ranked between 251-500 are small-caps and the rest are micro-caps.

Microcap companies, which comprise approximately 3 percent of the market capitalisation of listed stocks, have distinct characteristics that make them good investment prospects, but with a much higher risk profile.

About the scheme

The Nifty Microcap 250 Index, the benchmark for the Motilal Oswal Nifty Microcap 250 Index Fund, is designed to measure the performance of the top 250 microcap companies.

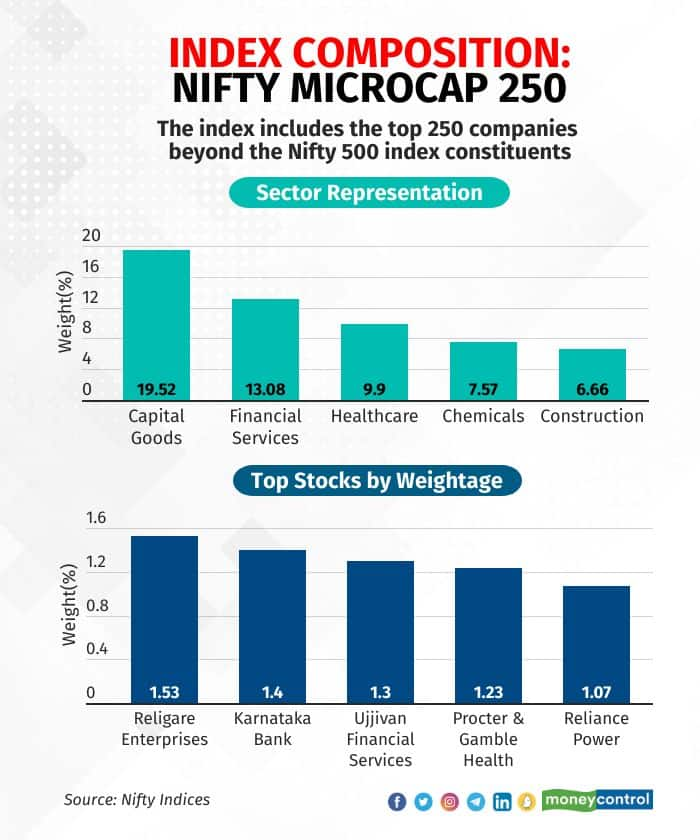

The top five constituents of this index by weightage are Religare Enterprises (1.53 percent), Karnataka Bank (1.40 percent), Ujjivan Financial Services (1.30 percent), Procter & Gamble Health (1.23 percent), and Reliance Power (1.07 percent).

In terms of sectoral weightage, the top five sectors are capital goods (19.52 percent), financial services (13.08 percent), healthcare (9.90 percent), chemicals (7.57 percent), and construction (6.66 percent).

The index is well-diversified, with its top 10 holdings accounting for only 11 percent as against 59 percent in the Nifty 50 index.

Pratik Oswal, Head of Passive Funds, Motilal Oswal Asset Management Company said, “Microcaps have a compelling track record of delivering higher returns, albeit at a higher risk.”

Also read | Should you opt for higher pension per EPFO’s new formula? It’s complicated

The indicative base total expense ratio of the fund is 1 percent for the regular scheme and 0.40 percent for the direct variant.

The fund managers for the scheme would be Swapnil Mayekar and Rakesh Shetty (for the debt component).

What works

Motilal Oswal Nifty Microcap 250 Index Fund is the first scheme to offer exposure to micro-cap stocks in India.

Micro-caps often fly under the radar of research analysts, with more than 40 percent of companies receiving no analyst coverage at all and only 12 percent being covered by five or more analysts.

In fact, less than 4 percent of the mutual fund industry’s assets under management (AUM) are invested beyond the top 500 companies. This creates a higher likelihood of finding hidden opportunities.

Also read | Will direct plan expenses of MFs go up with execution-only platforms?

While microcaps are considered riskier than large-caps and even small-caps, low allocation to a single stock (1.53 percent max) reduces the risk to the index in case of a failure of a company in the index.

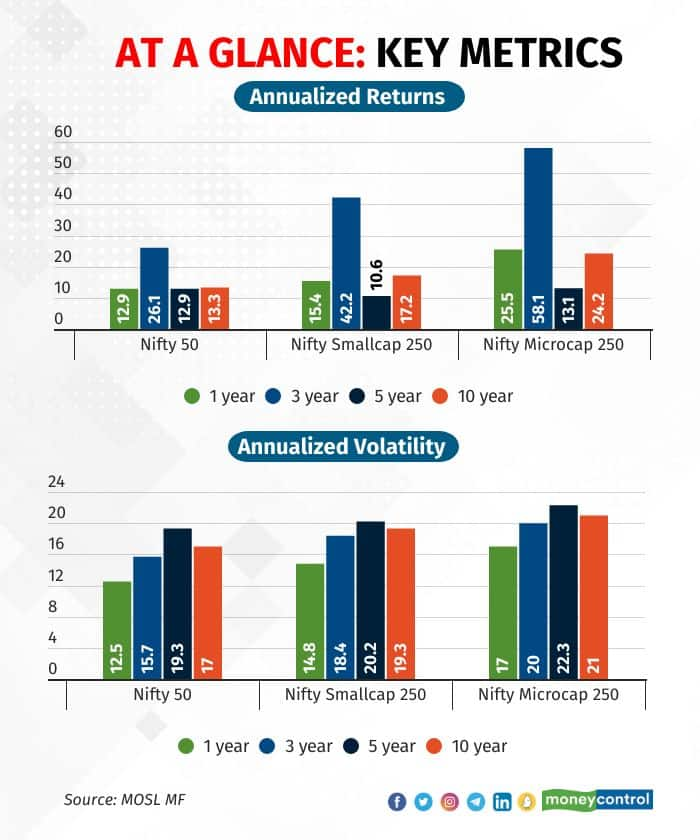

Further, over the last three years, the Nifty Microcap 250 Index has delivered 58 percent on an annualised basis, which beats returns delivered by the Nifty 50 and the Nifty Smallcap 250 index.

What doesn’t work

As per a report released by S&P Dow Jones Indices, over 88 percent of active Indian equity large-cap funds underperformed their benchmarks in 2022. The underperformance was much worse on a three and five-year basis.

However, when it comes to mid-cap and small-cap schemes, only 45 percent of active schemes underperformed their benchmark. Data shows that in the small-caps space, investors are better off with active funds.

However, given the liquidity constraint in micro-cap stocks, an active fund is unlikely in this segment.

Further, investors should note that drawdowns in microcaps are longer than in small-caps and large-caps. Also, this set of stocks is much more volatile than small-cap or Nifty 50 stocks.

Also read | Old is gold: Income tax exemptions & deductions that senior citizens can claim

While the index is well diversified, it may come with its own set of issues.

“So much diversification may not also add value for investors. Also, the market environment has to be very good for this category to perform. So, microcaps may work when the equity sentiment is good, but if the equity sentiment is bad, this category may not work. Which is why it is a very high-risk, high-return proposition,” said Kirtan Shah, Founder of Credence Wealth Advisors LLP.

Another key concern with the fund is that with the increase in size, managing liquidity will become tougher, given the nature of micro-caps.

Also, the index comes with a very high churn of around 40-45 percent, which is a negative for the scheme.

What should investors do?

“There can be a small set of investors who would want to invest in micro-caps, and because there is no mutual fund product right now, this may be a good entry point for them. However, investors should keep in mind that if the fund becomes large, then there are going to be challenges on the tracking error front, because of the liquidity crunch in this space,” said Shah.

From an overall perspective, a large-cap or flexi-cap fund is sufficient in terms of portfolio diversification for most retail investors. Also, there are many active small-cap funds available in the market for investors with a higher risk profile.

Since this is a new category, the Motilal Oswal Nifty Microcap 250 Index Fund may appeal to certain types of investors who may otherwise not take the portfolio management service (PMS) route for taking exposure to microcap stocks.

However, bear in mind that micro-caps are still unexplored from a mutual fund perspective, and research is thin when it comes to identifying good microcap names.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!