After a brief lull, the Life Insurance Corporation of India — the country’s largest insurance company — has renewed its legal battle against ACESO, a lesser-known firm, founded with the stated aim of ‘monetising’ the assets of LIC policyholders.

On August 13, LIC issued advertisements in national dailies seeking to caution policyholders against assigning their policies to third parties (such as ACESO).

Genesis of the legal battle

At the heart of the ‘battle’ is the concept of policy assignment, which allows policyholders to transfer their rights and benefits under the policy to an ‘assignee’, which in this case will be a trust established by ACESO.

Instead of surrendering — terminating before maturity for reduced payouts — their policies to LIC, ACESO’s offering allows them to assign their policies to the trust, in return for a payout equal to the surrender value they would have received from LIC, as per the firm's website.

LIC maintains that the act falls under the realm of ‘trading of policies’, which is not permissible under law.

“This is nothing but trading in policies. It is against the interests of the policyholder who has sought protection, whatever the (ACESO) ads may say. In principle, we oppose this. We will explore all options,” LIC chairman Siddhartha Mohanty said in response to Moneycontrol’s question about policy assignment to third parties, at the company’s post-results conference.

Also read: LIC warns policyholders over alleged offers to acquire existing policies

Assignment or trading?

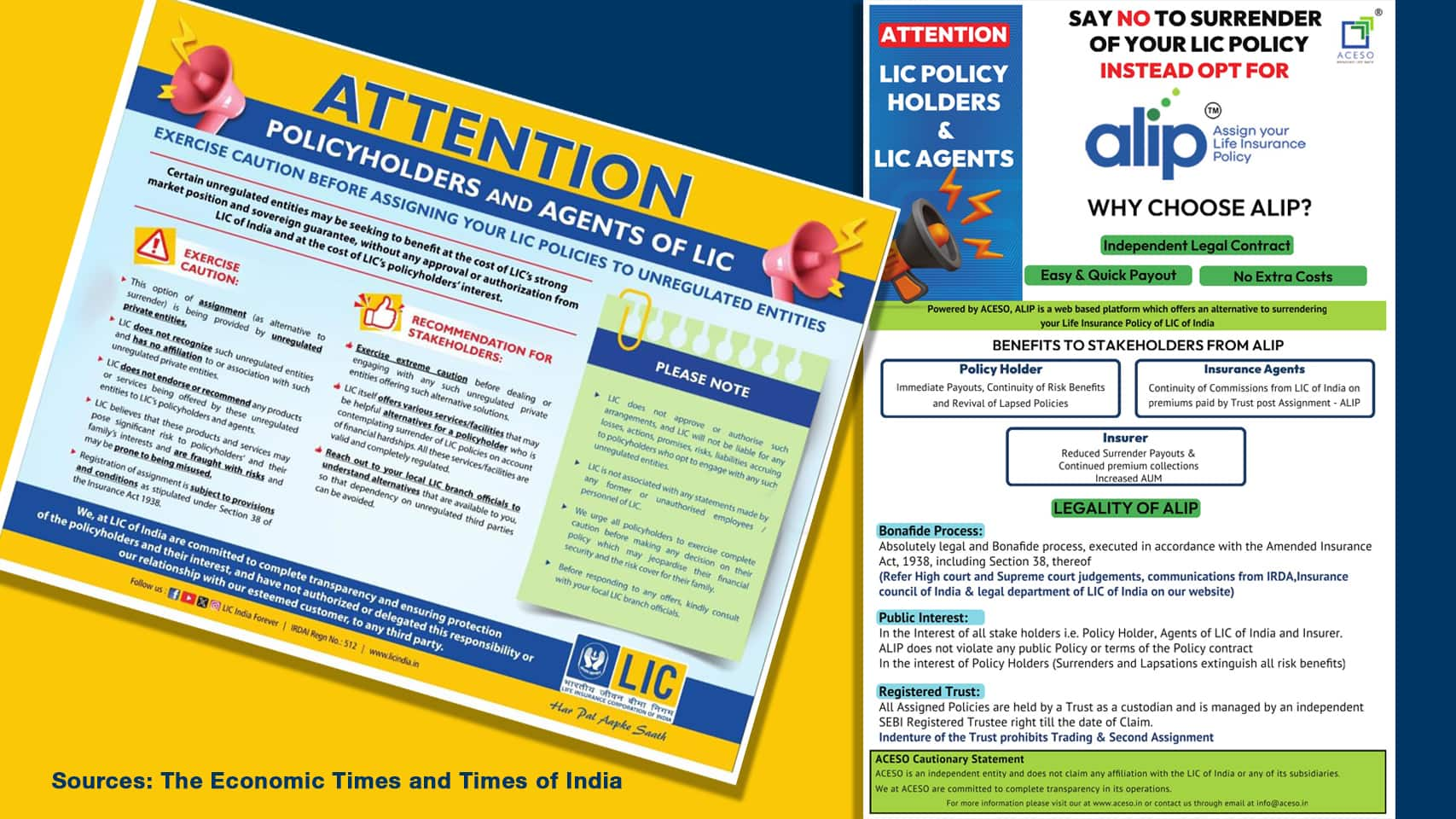

“Certain unregulated entities may be seeking to benefit at the cost of LIC’s strong market position and sovereign guarantee, without any authorisation or approval from LIC and at the cost of policyholders’ interests,” the LIC’s advertisement says. It categorically states that the assignment option is being provided by unregulated entities with which LIC has no affiliation. “LIC believes that these products and services may pose a significant risk to policyholders’ and their families’ interests…are fraught with risks and may be prone to being misused,” the advertisements claim.

The rebuttal follows advertisements placed by ACESO on August 5, inviting LIC policyholders to assign their endowment or money-back policies to the company instead of surrendering them to LIC. The life insurance behemoth’s stance is that this amounts to the ‘trading’ of policies, which is not permissible under the Insurance Act, of 1938 (amended in 2015).

“The insurer may accept the transfer or assignment, or decline to act upon any endorsement made under sub-section (1), where it has sufficient reason to believe that such transfer or assignment is not bona fide or is not in the interest of the policyholder or in the public interest or is for trading of insurance policy,” section 38(2) of the amended Insurance Act states. On August 14, The Economic Times, quoting unnamed LIC officials, reported that the company was contemplating legal action against such campaigns.

Also read: Want to take out a life insurance policy? Here are the term plans on offer

A string of allegations and rebuttals

However, Ketan Mehta, Founder, ACESO, said that LIC’s advertisements could amount to contempt of the Supreme Court (SC) order – filed by LIC against Insure Policy Plus Services — in December 2015. The SC dismissed LIC’s appeal, which cleared the decks for the launch of products like ALIP. “Any refusal by the insurer to assign policy lodged by policyholders will negate the SC judgement, which will amount to contempt of court,” Mehta said.

Moreover, LIC has not been rejecting such applications from policyholders, contrary to the stand it has taken, he said. “LIC has been registering policies since 2018 in favour of the trust. More than 100 registrations have been done in the last four months, including the last one on August 3, 2024,” Mehta said.

According to him, the interests of policyholders or their nominees are not compromised — the trust issues a risk-benefit certificate that needs to be produced by the nominee upon the policyholder’s death. “This is an alternative to surrendering to LIC. The process is quicker and transparent and the policyholder gets her money (equal to the surrender value that LIC would have paid) within two days. Death benefits will go to the nominee as per the indenture of the Trust managed by SEBI-registered trustee,” he said.

As per ACESO’s website, the policies are assigned to a special purpose entity named India Endowment Policy Trust, which acts as the custodian of policies and looks after the interests of policyholders. The trustees for the Trust are Beacon Trusteeship Ltd, SEBI-registered independent trustees.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.