DSP Mutual Fund — India’s 10th biggest asset management company (AMC) — has launched the country’s first mutual fund scheme based on the Nifty Top 10 Equal Weight Index. The index tracks top 10 Indian companies of the Nifty 50 index in equal weightages. The fund house has launched two variants of this scheme; an index and an Exchange Traded Fund (ETF).

The New Fund Offers (NFO) for DSP Nifty Top 10 Equal Weight Index Fund and DSP Nifty Top 10 Equal Weight ETF opened for subscription on Friday (August 16) and will close on August 30.

Among all the mutual fund schemes, DSP Nifty Top 10 Equal Weight Funds will have the lowest number of stocks for a diversified equity-orientated fund. To be sure, there are other schemes having 10 stocks, but they belong to hybrid or sectoral/thematic categories.

What’s on offer?

The Nifty Top 10 Equal Weight Index tracks the performance of the top 10 stocks selected based on six-month average free-float market capitalisation from the Nifty 50. Each stock in the index is equally weighted. The weight of stocks may vary between two rebalancing periods due to movement in the stock prices. The index is reconstituted semi-annually and rebalanced quarterly.

Also read | Should young earners repay loans first before they start investing?

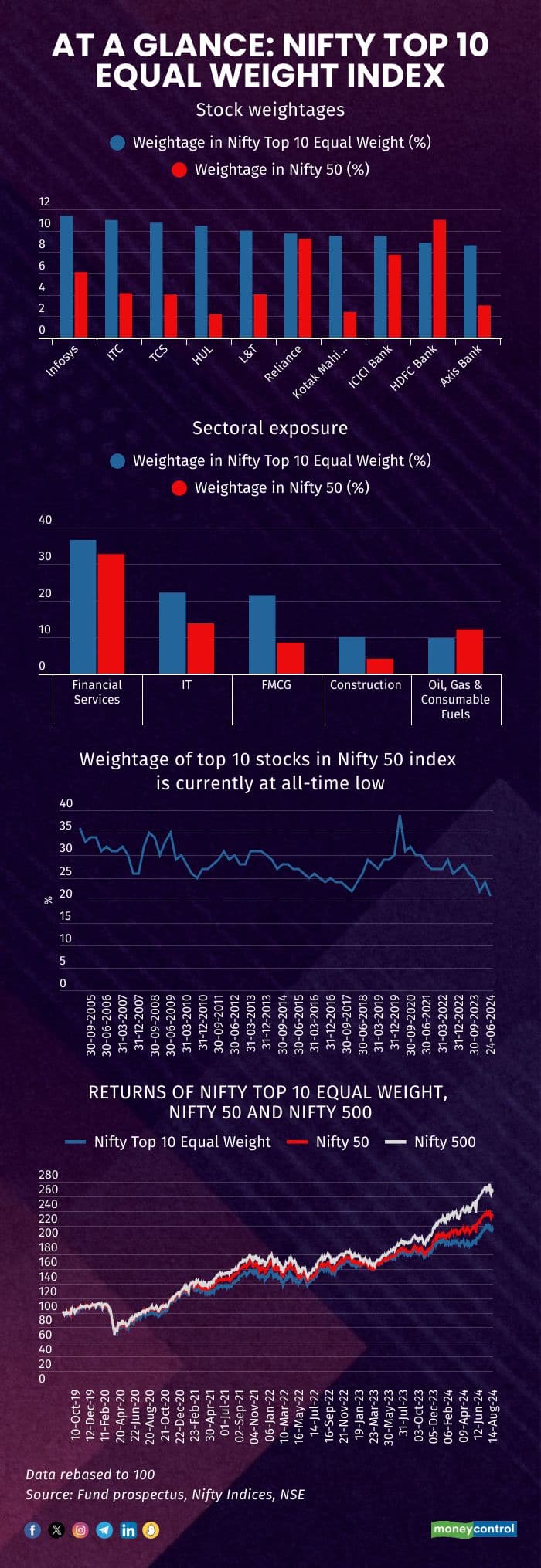

The 10 stocks in the index are Axis Bank, HDFC Bank, Hindustan Unilever, ICICI Bank, Infosys, ITC, Kotak Mahindra Bank, Larsen & Toubro, Reliance Industries and Tata Consultancy Services.

The companies have a combined market capitalisation of Rs 87.76 lakh crore, which is around 40 per cent of the top 50 companies in India.

The five sectors and their respective weightage in the index are — Financial Services (36.61 per cent), Information Technology (22.16 per cent), Fast Moving Consumer Goods (21.48 per cent), Construction (10.01 per cent) and Oil, Gas and Consumable Fuels (9.74 per cent).

What works?

According to the fund house, the DSP Nifty Top 10 Equal Weight Funds aim to capitalise on the relatively better valuations of top 10 stocks compared to Nifty 50 and Nifty 500 based on metrics such price-to-earnings (P/E) ratio, return on equity and return on assets ratios.

"We have seen an increasing level of interest in small and mid-cap stocks, the very large and mega cap stocks appear to be trading at relatively more attractive valuations. Sound investing principles suggest that it is always better to invest where there is a relatively lower valuation and margin of safety," said Anil Ghelani, Head – Passive Investments and Products, DSP Mutual Fund.

Also read | Why are Sovereign Gold Bonds trading at 5-12% premium?

Data shows that the Nifty Top 10 Equal weight index has outperformed Nifty 50 Index and Nifty 500 Index on a very long term and also on a rolling basis across different time periods. Nifty Top 10 Equal Weight Index has outperformed the broader markets in nine out of 16 years.

Also, top 10 stocks have underperformed in the last four years versus other broader indices/ active funds. However, data suggests that when the three-year historical alpha is negative, the forward alpha for the Nifty Top 10 Equal Weight Index tends to be positive, indicating potential for a turnaround.

What doesn’t work?

Since the investable universe of the fund is narrow by following only top 10 stocks, investors may miss out on the growth in the broader markets. Also, broader market sectors such as automobiles and pharmaceuticals are missing in the fund as of its latest construction.

Data also shows that the Nifty Top 10 Equal Weight Index has a correlation of 0.97 per cent with the Nifty 50 index on a five-year period, which means that both the indices largely move in tandem.

The figures reveal that over the five-year period, Nifty Top 10 Equal Weight Index has underperformed both Nifty 50 and Nifty 500 indices.

As per the DSP Mutual Fund, the weight of top 10 stocks in Nifty 50 index is at all-time low.

“Wherever we have seen that there is a relative valuation differential between the Nifty 50 and the Nifty top 10 Equal Weight, then subsequent to that, during such a polarisation sort of phase, this top 10 does much better,” said Ghelani.

What should investors do?

As per Ravi Kumar T V, Founder, Gaining Ground Investment Services, this strategy may have challenges during a strong uptrend in the market as rebalancing is not easy to keep the same weights. “This strategy may underperform a fund, which follows a market-cap weighted index,” he says.

Also read | Why army veterans are becoming a prime target for financial frauds

Further, Nifty Top 10 Equal Weight Index has a beta of 0.99 against Nifty 50, meaning both the indices have delivered similar returns amid equal volatility over the past five years. Plus, the Nifty 50 index gives wider exposure to sectors such as telecom, auto and pharma.

Retail investors are better off with a broader diversification, which can be met by a Nifty 50 index fund.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.