As India celebrates 78 years of independence, it is also a good time to reflect on our own financial freedom. Many younger professionals today harbour the ambition of Financial Independence, Retire Early (or FIRE), which is a growing movement.

The core concept of FIRE is that instead of working till one is 58 or 60 years, the official retirement age in most companies, you save and invest in such a way that you build enough funds to live off instead of relying on a salary.

FIRE is a new concept in India and not easy to pull off. Here are some ways to commence your journey towards achieving this goal of retiring early.

Start earlyBegin aiming for this goal at an early stage and with discipline; give enough time for your money to generate wealth and consistently take full advantage of the power of compounding.

Factor in inflation, lifestyle and health expensesTo arrive at what the corpus needs to be for early retirement, you need to consider different factors, such as inflation, healthcare, the cost of higher or foreign education for children, marriage expenses of children, maintaining the family’s current lifestyle, planning for annual vacations, life expectancy estimates and the age by which the retirement corpus would be exhausted.

“There will be other factors that might come up as recurring expenses. For instance, house renovation, upgrading to a new car, etc. These recurring expenses need to be factored in when you're thinking about your retirement corpus,” says Vishal Dhawan, founder and CEO, Plan Ahead Wealth Advisors.

Steps to build early retirement corpusCreate an Excel template and list actual expenses. This includes spending on house rent, medicines, insurance premium, monthly groceries, utility bills, entertainment, income taxes, etc “It’s better to identify the actual expenses in the last couple of years rather than just going by round numbers while calculating your required retirement corpus,” says Dhawan. He adds that you need to build in some buffers, account for miscellaneous expenses, etc, as a provision. Next, figure out which of these expenses will increase or decrease when you retire.

Also read | Financial Freedom: 7 easy steps to build a secure futureInvest in the right instrumentsThe investment made solely for a retirement corpus could be in equity for the long term in order to reach the target corpus. “The equity component in the portfolio has to be dominant as there is a long life span,” says Kalpesh Ashar, founder of Full Circle Financial Planners and Advisors.

“Don’t take unnecessary risks and get swayed to invest in speculative investments, cryptocurrencies or exotic investments. If you lose it, you will not be financially independent anymore,” says Rishi Piparaiya, author and financial mentor. Keep the retirement corpus aside and don’t gamble with it in the equity market post-retirement, he adds.

“You need to plan the portfolio strategy for the pre-retirement phase and the post-retirement phase,” says Dhawan. If you run a conservative strategy in both these phases, you may end up needing a larger corpus at retirement to support your living expenses, he adds. If you are comfortable with a more aggressive portfolio, the returns may be able to beat inflation over time. Therefore, the corpus required may be lower.

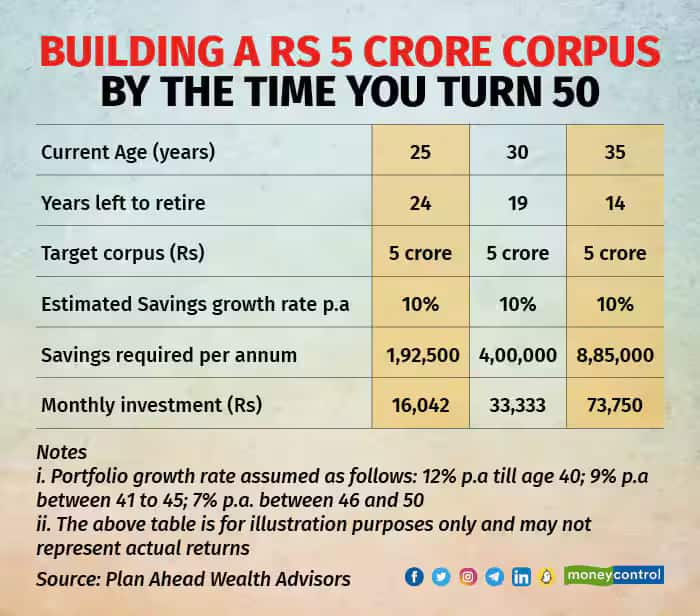

Say you want to retire at 50 and the corpus required is Rs 5 crore, as derived through actual annual expenses, future goals and life expectancy of 80-85 years. Then, if you start saving at age 30, the monthly investment required is Rs 33,333 and if you start saving at age 35, the monthly investment required is more than double, to Rs 73,750 (see graphic).

If you have anyone who's dependent on your income, it is important to continue a term plan. “It's not expensive, and it’s a good safety net to continue even after early retirement,” says Piparaiya. If you're going to have outstanding loans after your early retirement, you need to continue the term insurance to cover the liabilities.

Adequate separate health insurance for elderly dependent parents and a floater plan, including your spouse and children, are very important, especially for anyone who's retired. “While calculating the retirement corpus, keep in mind the premiums to be paid for these insurance policies,” says Ashar.

Also read | 6 money tips for women seeking financial freedomClear outstanding debtIn the post-retirement age, there will be several expenses to take care of without having a regular source of income. “So, one must clear all the loans and liabilities in the short term since it would be difficult for an individual to provide for paying an EMI from the corpus in the post-retirement age,” says Ashar.

Advice for people planning to retire earlyA financial plan is one prerequisite for early retirement. But you should also have a plan in place to fulfil your aspirations. Retirement is not a financial decision, it’s more of an aspirational decision. Back it up with strong financial support to ensure smooth sailing.

“Focus on creating skill sets to start multiple income streams, including passive income post-retirement,” says Piparaiya.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.