ICICI Bank's iShop, an accelerated rewards portal that allows cardholders to earn enhanced rewards on flights, hotel bookings and gift vouchers, has led to considerable chatter on social media platforms and the credit card enthusiast community.

The private sector lender’s premium credit cards - Emeralde Private Metal Credit Card and Times Black Credit Card - allow users to accumulate points via iShop, which was launched in February. Using third-party apps for flights or hotel bookings with these cards will earn users significantly lower reward points.

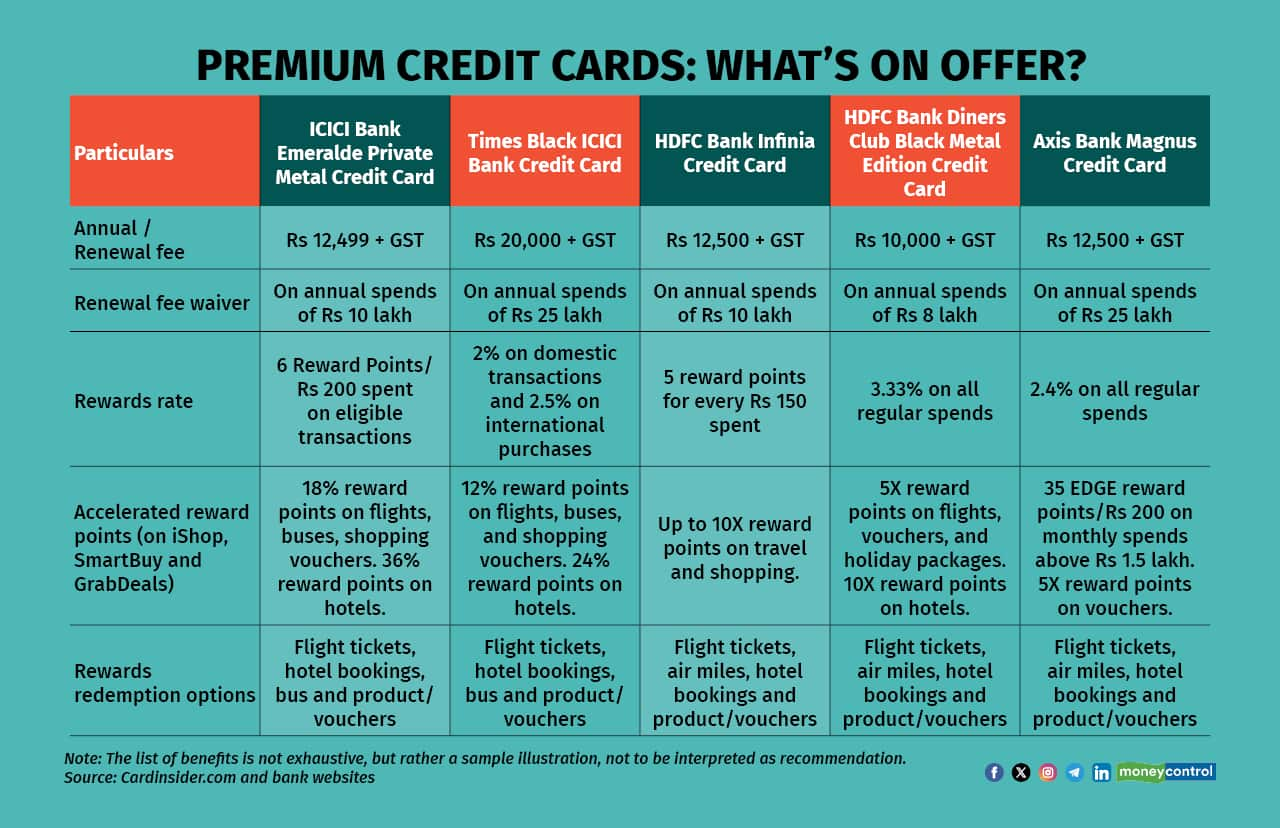

What’s on offer?

iShop is a rewards-based shopping and travel portal targeted primarily at premium card holders. For instance, Emeralde Private Metal Credit Card customers can accumulate 18 percent rewards on flight bookings and 36 percent on hotel bookings through iShop. Similarly, Times Black Credit Card users get to earn 12 percent on flights and 24 percent on hotels.

“ICICI Bank's iShop rewards portal is similar to other bank rewards platforms, such as HDFC Bank's SmartBuy and Axis Bank's GrabDeals,” says Pranav Date, founder of Magnify, a platform to simplify reward points across credit cards, hotel and airlines. Through iShop, ICICI Bank credit cardholders can earn enhanced rewards when buying vouchers and making travel bookings (hotel, bus and flights).

“People have viewed ICICI Bank as a credit card issuer with low rewards. However, with the launch of the iShop portal, customers can now earn bonus reward points using their ICICI Bank credit cards," says Sumanta Mandal, founder of TechnoFino, a credit card review platform. He adds that this is an ideal way for the bank to revamp its credit card portfolio.

To access iShop, ICICI Bank credit cardholders can log in using their existing net banking user ID and password. Alternatively, those with only ICICI Bank credit cards can register separately to gain access.

Also read | Equity fund inflow fell by 26% to Rs 29,303 crore in February amid market selloff, shows AMFI data

Capping of bonus rewards

The reward rates and bonus point caps, as shown in the graphics, make the Emeralde Private Metal and Times Black Credit Cards worth considering.

Siddharth Raman, Founder of Card Expert, a platform to simplify reward points, cashback and air miles across credit cards says, “To maximise rewards, Emeralde Private Metal or Times Black cardholders would need to spend over Rs 1 lakh on flights or Rs 50,000 on hotels.”

Accelerated rewards on Flipkart and Amazon shopping vouchers are subject to a cap. The maximum limit for accelerated rewards on these vouchers is Rs 12,000 per month.

The bonus points caps are reset every calendar month. Additionally, ICICI’s reward points and cashback are credited to your ICICI Bank cards within 90 days of the transaction, or 45 days after completing travel or stay, whichever is later.

Also read | Double Delight: How joint home loans can help couples save big on taxes

The redemption process

The ICICI Bank cardholders can redeem their rewards on the iShop portal, partially or fully, with some restrictions. For flights, 95 percent of points can be redeemed, while for hotels, 90 percent of points are eligible. Whereas eVouchers allow redemption of up to 50 percent of points.

A reward redemption fee of Rs 99 plus GST applies to each successful redemption, this fee gets waived off if you hold an ICICI Emeralde Private Metal Credit Card or ICICI Times Black Card.

What doesn’t work

According to Mandal, iShop portal lacks a key feature offered by other banks, i.e. the option to transfer reward points to airline miles. For instance, HDFC Bank’s SmartBuy and Axis Bank’s GrabDeals have an option to transfer reward points to airline miles.

Also read | Have Rs 10 lakh to invest? Flexicap, midcap, gold, US equity funds can make a well-rounded portfolio

Eligibility and charges for premium credit cards

According to Ankur Mittal, co-founder of Card Insider, a platform that tracks the credit card business, ICICI Bank's Emeralde Private Metal Credit Card is available only to select individuals who receive an invitation from the bank, based on undisclosed criteria. Alternatively, a relationship manager can facilitate approval and application upon request. The credit card has a fee of Rs 12,499 plus GST, payable at the time of joining and renewal. However, the renewal fee will be waived on spending Rs 10 lakh or more within a year.

“For Times Black ICICI Bank credit card, the bank has not specified any minimum income eligibility on the website,” says Mittal. But it’s targeted at ultra HNI customers offering benefits across various categories, including luxury hotel stays, travel and lifestyle. The user can apply online on the Times Black website for this card. The credit card has a fee of Rs 20,000 plus GST, payable at the time of joining and renewal. However, the renewal fee will be waived on spending Rs 25 lakh or more within a year.

iShop Rewards: ICICI's Emeralde and Times Black cards just got more attractive

According to Mittal, the introduction of accelerated rewards on the iShop portal is an added advantage for the users of the bank’s premium credit cards. This move now positions ICICI to compete more effectively with Axis and HDFC Bank in the same segment.

For instance, users can benefit from a high reward rate on Emeralde Private Metal of up to 36 percent in specific categories, with a monthly cap of 18,000 accelerated reward points on the iShop portal.

Date points out that the portal’s omission of an airmiles redemption option is a dampener, considering travel-oriented features on Emeralde Private Metal and Times Black. As a result, individuals seeking to redeem rewards for air miles may want to consider alternative card options.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.