In a recent interview to a business daily, Keki Mistry, CEO of HDFC Ltd, indicated that the Reserve Bank of India may have limited ability to reduce rates further. Currently the repo in the economy, which is the main indicator of commercial lending and borrowing rates, is at 4 percent. This has led banks to reduce deposit and lending rates.

As a result, the yield on money market securities and short-term debt instruments is down too. State Bank of India is now offering 2.75 percent interest on its savings account. On one-year fixed deposits, the rate is down to 4.4 percent.

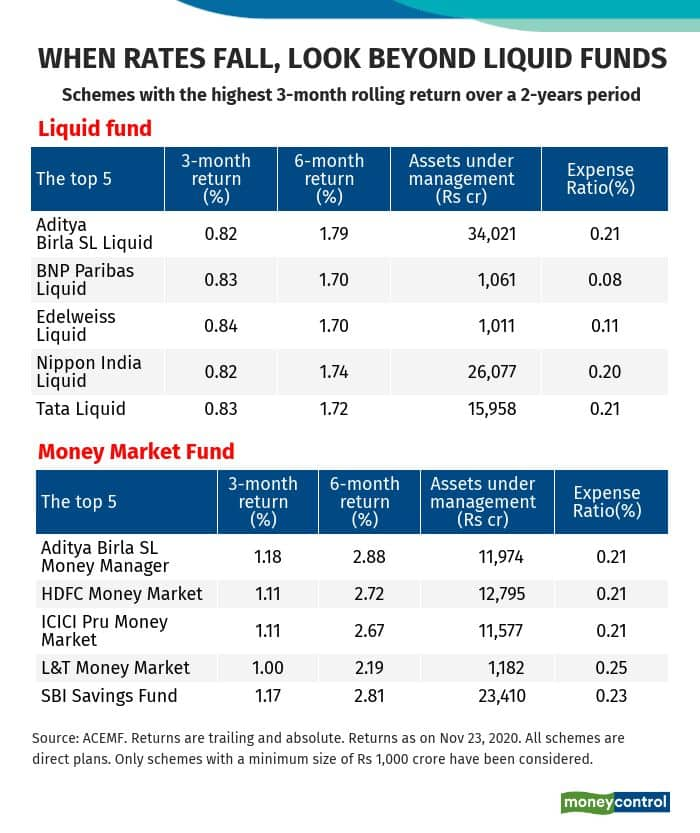

It is no different when it comes to liquid funds. One-year yields on these schemes have fallen to a range of 3.5-4 percent. Despite the low returns, you can’t really replace short duration debt funds, given the stable and low-risk investment option they provide. At the same time, you can’t rely just on liquid funds to park short-term money.

Liquid funds should not be your only choice

The advantage of using liquid funds over fixed deposits for very short-term parking of money is the flexibility of anytime withdrawal and one-day credit. Operationally too, redeeming from your liquid fund is as easy, as a click of a button allows instant redemption.

What you need to watch out for in times of low interest rates is allocating too much in one go. Where earlier you could be careless about how much is lying in your liquid fund and keep money there for a year even, now you need to manage this allocation a bit more actively.

According to Prateek Pant, co-founder and head, products and solutions, Sanctum Wealth Management, “The trajectory for returns from fixed income is looking downward and one way to manage this is doing a time-based allocation for short-term funds.”

Allocate amounts to be parked for 1-3 months or emergency fund sums in liquid schemes; for everything else, find an alternative. Re-evaluate what’s already parked in liquid funds and if you find that you don’t need as much money in short term funds, then move it to other schemes or investment options.

Make sure that the money you need after more than six months is allocated to slightly longer duration short term funds rather than liquid funds, that will help you maximise return. Bonds with residual maturity of 3-6 months, with high credit quality are also an alternative, but only for big-ticket investments from ultra HNIs, says Pant.

According to Vishal Dhawan, founder and chief executive officer, Plan Ahead Wealth Advisors “Arbitrage funds are an option too for six-month kind of parking of funds for those in the highest tax bracket, but be prepared for lower pre-tax returns in that segment too. Consider bond funds with high quality portfolios if you are willing to hold for at least a year.”

Direct plans

Even within the category look for plans which can give you that extra bit. For large amounts to be kept in liquid funds, go for the direct plan, which can give you 10-15 bps higher return as compared to the regular option. Keep in mind that most liquid fund schemes will have an exit load for up to seven days of investment. In times when returns are low, an exit load – even if it is a small portion and only there for withdrawals of seven days or less – matters and can dent your returns.

For short-term parking of cash, don’t get adventurous

Do not take risks with your short-term funds. You may be tempted to look for higher return options or at least the possibility of it through other funds such as short term income schemes or even high yield bond funds. However, this will not solve your purpose; short-term funds can be more volatile on daily returns as compared to liquid funds and credit risk funds are volatile.

Pant says, “There is a fair amount of discipline amongst the ultra HNI investors and they don’t tend to chase returns. Sometimes, when the investment corpus is limited, the temptation to maximize return may be there. One has to be careful not to burn their fingers in investments such as high yield bonds.”

Along with the lower interest rates in the economy, the recent brush with credit risk for the debt funds has meant even lower risk for certain categories, pulling down returns. Nevertheless, liquid funds provide a kind of flexibility along with competitive returns in the very short-term category, which is useful for working capital requirements in your personal or business portfolio. Be more nimble and active in managing this, but take care not to get too adventurous in looking for alternatives as you might end up taking on risk you don’t need.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.