For many, the simplest and most cost-effective way of ensuring that all family members have health insurance is to buy a family floater cover.

Under a single health insurance contract, multiple family members like parents, spouse, and children can be covered, ensuring lower, convenient, premium payments. Barring once-in-a-lifetime events such as Covid-19, when family members were at risk of contracting the ailment at the same time, family floaters can, more often than not, serve the needs of a young family fairly well.

“Family floater is one of the unique offerings of India, and is not found in many countries. This also represents the cultural attitude of our country towards family. Some insurers give the option to add parents and even grandparents to a single policy,” says Sudeep Indani, National Head, Health and Benefits, Howden India Insurance Brokers. However, due to the greater likelihood of frequent and larger claims, elderly parents are best covered under separate policies.

Also read: Opting out of a floater health policy for an individual cover? Know the nitty-gritty

For a young couple with kids, to start with, a cover of Rs 10 lakh would be good enough. You could be hospitalised in a particular year, while your spouse might undergo treatment after a couple of years. The Rs 10-lakh sum insured would come in handy on both occasions.

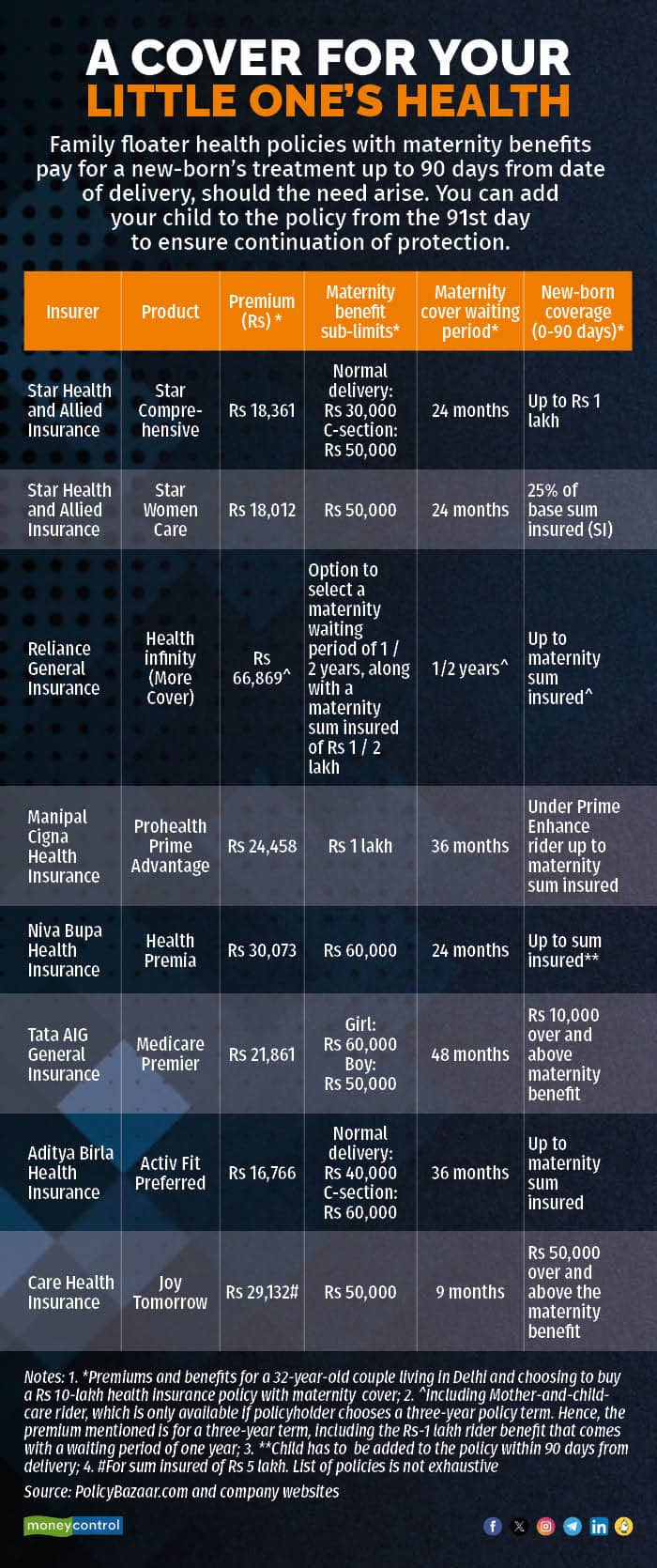

And, if your floater policy also offers maternity benefits, even your new-born’s treatment in case of any delivery-related complications or any other condition will be paid for until 90 days post delivery. Beyond this, you will have to include your child in the floater policy after paying the premium applicable.

Under group as well as individual, and floater health insurance policies, new-born cover is offered as part of maternity benefits or an add-on cover. Typically, new-born children are insured for the first 90 days under such plans. So, if infants have to undergo treatment at hospitals during the period due to, say, delivery-related complications, the insurance plan will take care of the expenses. While congenital diseases are usually excluded, some plans, like Star Health’s Woman Care policy, pays for such conditions too.

Most insurers link the cover to the maternity benefit sub-limit (varying from Rs 50,000 to Rs 2 lakh, per the insurer’s terms and conditions), though some products like Niva Bupa’s Health Premia plan offers coverage up to the base sum insured. In such cases, parents must add the the new-born to the policy within 90 days of delivery.

Also read: Moneycontrol-SecureNow Health Insurance Ratings: Your definitive guide to picking the right policy

This apart, health insurers will also pay for the cost of the baby’s initial vaccination, as prescribed by the Government of India’s National Immunisation Schedule. Depending on the insurer and the product, there could be sub-limits of Rs 5,000-15,000 on vaccination costs.

If a child is added to the plan in the middle of the policy year, is the premium pro-rated?Yes. You can include your child in your family floater policy once s/he is over 90 days old. You will have to pay the applicable premium. If you are adding your child in the middle of the policy year, it will be calculated on a pro-rata basis. Put simply, the insurer will charge the premium only for the period for which the cover is provided.

What are the minimum and maximum age limits for children to be covered under family floater policies?With most family floater policies, progeny over the age of 25 are not covered. “New-born babies are covered only under insurance policies with maternity benefits. The minimum age at entry in a regular health policy is 90 days,” says Siddharth Singhal, Business Head, Health Insurance, Policybazaar.com.

Yes. “Only children who are dependent on parents will be eligible to be included. Generally, married children have to exit the policy,” says Singhal.

How are premiums determined for family floater policies?In the case of most policies, the age of the eldest policyholder will matter the most. “When determining premiums for family floater policies, insurers consider the ages of all family members. However, the age of the eldest member is a critical factor in setting premium rates. Typically, the older the eldest member, the higher the premium. From an insurers’ perspective, this age-based premium structure helps ensure that the policy remains affordable and viable,” says Indani.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.