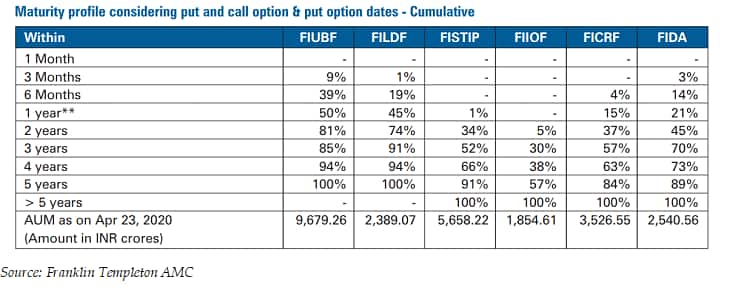

After winding up six of its debt funds, Franklin Templeton AMC has released the details of the maturity profile of the schemes as on April 23, 2020. Put simply, if everything goes according to expectations, these are the likely timelines for investors to get their money back.

From the table, the maturity profiles of securities held by the funds can be known. For example, it is clear that nine percent of the amount invested in Franklin Indian Ultra Short Bond Fund (FIUBF) matures in three months, starting April 23, 2020. FIUBF and Franklin India Low Duration Bond Fund (FILDF) should return all the money before the end of five years.

Why does it take so long?

You must be wondering why the AMC would take so long to return the money, when the fact sheet always mentioned lower average maturities and Macaulay duration (MD) compared to what is shown in the table. There are two factors that you should take into account. First, to honour redemptions over the last one year, the fund house has already sold some of the short maturity liquid papers. This has increased the MD of the scheme. Second, the MD connotes the weighted average maturity of the bonds factoring in all the cash flows. This is not the time where the last bond matures. Typically, the average maturity of the portfolio exceeds the MD.

So you have to be patient with your money. However, there are a few steps that can accelerate the process.

How do I get my amount faster?

The maturity profile of the bonds suggests that it will be a painful wait for many investors, especially for those who parked their funds in FIUBF and FILDF. If the macroeconomic situation remains as it is for a prolonged period of time, then investors may have to wait till the bonds mature. “However, if the situation improves and financial markets turn buoyant, then the fund house will actively seek opportunities to sell bonds in the secondary market. This should ensure that the investors get their money much before the maturity timelines of the bonds,” says Anup Bhaiya, MD & CEO of Money Honey Financial Services.

“The lockdown has curtailed the trading hours in the money market. Also, Yes Bank’s restructuring has hampered investors’ appetite for perpetual bonds,” observes Rupesh Bhansali, head of mutual funds, GEPL Capital. After the lockdown ends, if the markets recover with good volumes, then the fund house may consider selling some of the bonds ahead of maturity for a fair price. “The quantum of such secondary market sale will decide if the investors can get money faster,” says a cautious Bhansali.

Investors must note that the sale value in secondary market will differ from the maturity value.

If any of the issuers chooses to pre-pay the bonds outstanding, you may get the money faster. But the chances are very low given the possibility of corporates going tight-fisted during the COVID-crisis.

Don’t ignore the assumptions

Bonds with put and call options are treated differently. For a bond with a put option, the date of first put option is considered as the date of maturity. Put simply, a bond option allows the investors to surrender the bond to the issuer in exchange for a predetermined amount. In the case of perpetual bonds that have call options, the forthcoming call date is considered maturity date. A call option gives the issuer the right to recall the bond on payment of a predetermined amount of money. The projections also do not account for any coupon receipts on the bonds held in the scheme as well as cashflows from segregated portfolios. In case of defaults by issuers, then the quantum of money coming back to you would be lower.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.