Soon, salaried individuals will start receiving emails from their employers’ human resources (HR) or finance departments asking them to file their proposed investment declarations for the financial year 2024-25.

That is, you need to choose between old and new tax regimes and in the case of the former, indicate the tax deductions you would be claiming during the year under sections 80C, 80D, 24(b) and so on. Your employers will take these indicative deductions into account, compute taxes for the year and withhold tax deducted at source (TDS) accordingly.

Tread carefully while choosing the right regime

Like 2023-24, you need to be more vigilant while submitting these declarations. This is because the new tax regime is the default system starting 2023-24. If you do not make your choice of the regime clear, your tax outgo will be computed as per the new regime or concessional tax regime (CTR) rates. Salaried employees can switch between the two regimes every year, even at the time of filing income tax returns in July.

“CTR (new regime) will be the default regime and taxpayers desiring the old regime are required to opt out of the CTR regime. The option has to be exercised every financial year where the taxpayer does not have business or professional income. Such taxpayers need to exercise the option in the tax return to be filed on or before the due date,” says Amarpal S Chadha, Tax Partner and Mobility Leader, EY India.

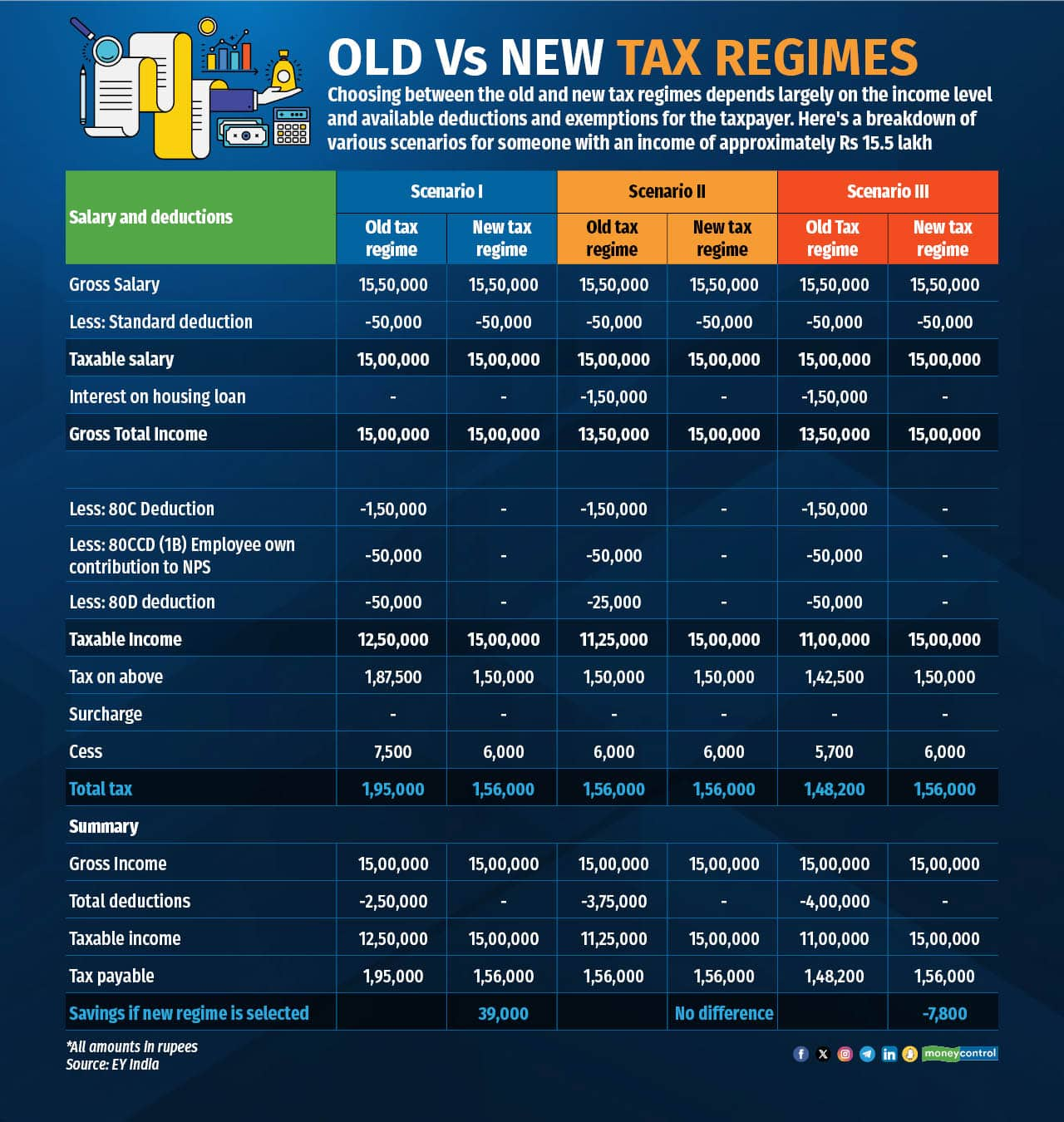

The primary distinction between the two tax regimes lies in the tax rates: the new tax regime offers lower or concessional tax rates compared to the old regime. However, under the old regime, taxpayers are allowed to claim tax deductions and exemptions for various investments and expenses, whereas such deductions and exemptions are minimal under the new regime (see graphic).

Also read: Old vs new tax regime: What to choose and how?

What is the difference in the taxation structures of the two regimes?

Both regimes are available for taxpayers to choose from, and while each has its own advantages, the decision depends on the taxpayer's income level and individual circumstances to determine which is beneficial for them. “The new tax regime offers concessional/ lower tax rates as compared to the old regime, which can result in reduced tax liability for many taxpayers,” says Suresh Surana, Founder, RSM India. Further, “the new regime has a simpler tax structure with fewer deductions and exemptions, making it easier for taxpayers to understand and comply with tax laws and requires maintenance of less documentation as compared to the old regime,” adds Surana.

On the other hand, the old regime offers higher deductions and exemptions, making it beneficial for individuals who can maximise the benefits from the old regime by claiming the deduction and exemption in full. “The old tax regime allows for a wide range of deductions and exemptions such as HRA, LTA, section 80C deductions, etc., which can help taxpayers reduce their taxable income significantly,” says Surana.

How does one determine which tax regime is more beneficial?

To ascertain which tax regime is more advantageous, individuals should begin by documenting their anticipated total income for the financial year (2024-25), along with the exemptions and deductions they are eligible to claim, and then proceed with the calculation. “One should calculate the tax liability on taxable income as per the old tax regime after deducting exemptions and deductions, and then compare the tax liability as per the concessional tax regime,” says Chadha.

Look at the table for a better understanding; the scenarios provide a comparison of the old tax regime and the new or concessional tax regime in the case of a salaried individual having a salary income of Rs 15.5 lakh along with various deductions like interest on housing loan, deductions under section 80C, 80D etc, ranging from Rs 2.5 lakh to Rs 4 lakh.

For your individual calculation and comparison, you can use Moneycontrol’s Income Tax Calculator 2024-25.

I tend to exhaust deductions under sections 80C and 80D every year. Should I stick to the old regime?

The advantage of sticking with the old regime hinges on the extent of deductions and exemptions that one can claim or is eligible to claim. “As shown in the table, an individual taxpayer with an income of Rs 15.5 lakh will benefit more from choosing the old tax regime if the total eligible deductions to be claimed in the tax return is more than Rs 3.75 lakh,” says Chadha. It is easier for those who claim deductions on home loan interest [under section 24(b) of up to Rs 2 lakh] to exceed this threshold.

Also read: Tax-saving: Exemptions you can claim under the new and old tax regimes

If your calculations give you clarity on which regime is beneficial, you must go ahead with it. However, if salaried employees are not certain, then they would be better off choosing the old tax regime while filing proposed investment declarations, feels chartered accountant Nitesh Buddhadev, Founder, Nimit Consultancy.

“This is particularly true if you are eligible for exemptions such as house rent allowance (HRA) and leave travel allowance (LTA) that are not allowed under the new regime. If you choose the new regime, such allowances will not reflect in your Form-16. Now, if, at the time of filing your returns, you realise that the old regime is beneficial for you and go ahead and claim these deductions (and seek a refund of excess TDS), it could give rise to queries from the income tax department due to the differences in your Form-16 and actual returns,” he adds.

Are there specific scenarios or income brackets where one tax regime is clearly more advantageous than the other?

The new tax regime, with its concessional tax rates, may be clearly beneficial in certain scenarios, even if a taxpayer is eligible to claim most of the available tax deductions and exemptions.

Under the new tax regime, “Salaried individual taxpayers or pensioners earning up to Rs 7.5 lakh can utilise the standard deduction under section 16(ia) of the Income Tax Act, amounting to Rs 50,000, and subsequently claim a rebate under section 87A of up to Rs 25,000, effectively reducing their tax liability to zero,” says Chadha.

This would also be the case with high-earners. “In the case of individuals earning over Rs 5 crore, the highest tax surcharge rate under the new regime has been reduced from 37 percent to 25 percent, thereby lowering the effective tax rate from 42.74 percent to 39 percent. Hence, those with total income exceeding Rs 5 crore can opt for the new tax regime to benefit from this reduced tax rate,” adds Chadha.

Are there any long-term implications to consider when opting for one tax regime over the other?

The rules for opting in and opting out of the tax regime differ for salaried individuals and those with income from business and profession. Therefore, evaluate the long-term implications of selecting a tax regime carefully.

“An individual taxpayer with business income as a component of their total income must carefully assess their decision before going out of the new regime. As once the option of opting out of the new tax regime is exercised, you could exercise the option of opting back to the new tax regime only once. Individual taxpayers without any business income will have the option to choose the regime for each financial year. So, they can choose the new tax regime in one financial year and the old regime in another year and vice versa,” says Yeeshu Sehgal, Head, Tax Markets, AKM Global.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.