Budget announcements on February 1 will not have any impact on the current tax structures. The rates, slabs, deductions, and rules remain unchanged under both the old and new tax regimes.

However, the deadline of March 31 to make tax-saver investments under the old regime is also fast approaching and there is a choice to be made. Should you opt for the new income-tax regime and let go of the tax deductions, exemptions, and rebates or should you opt for the old tax regime and start your tax planning process?

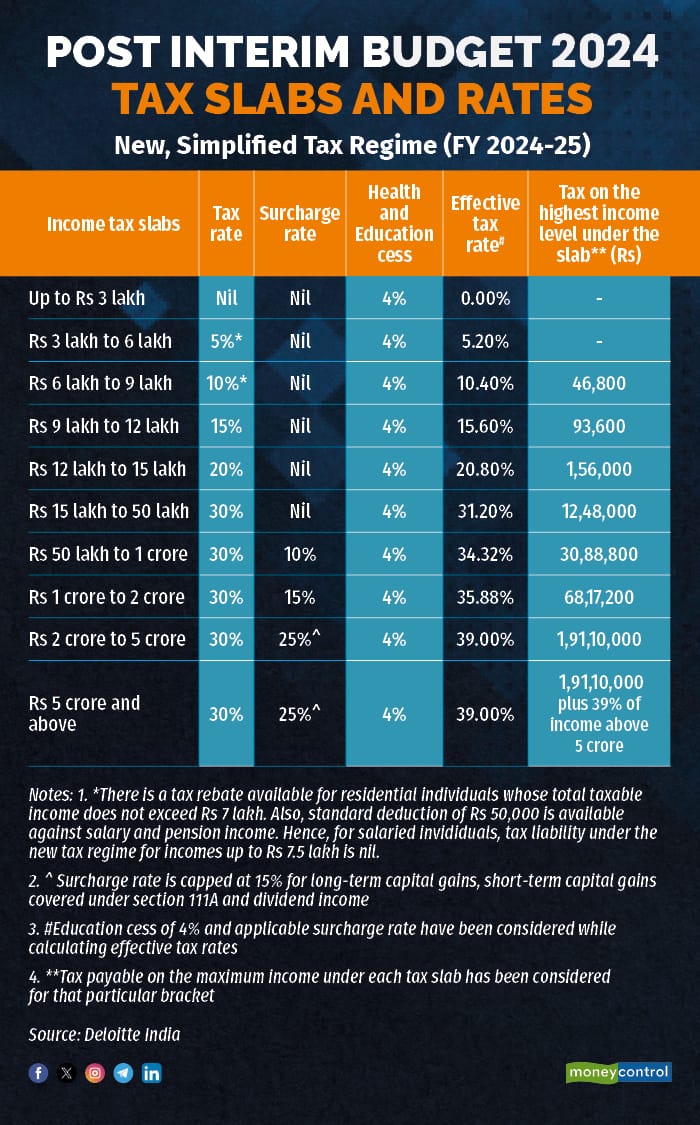

New tax regime tax slabs and rates for 2024-25

New tax regime tax slabs and rates for 2024-25

This apart, you will have the opportunity to make the final choice between old and new regimes at the time of filing income tax returns (ITR) in July. If this sounds like Hobson’s choice, then here’s a quick guide to help you choose between the two tax regimes.

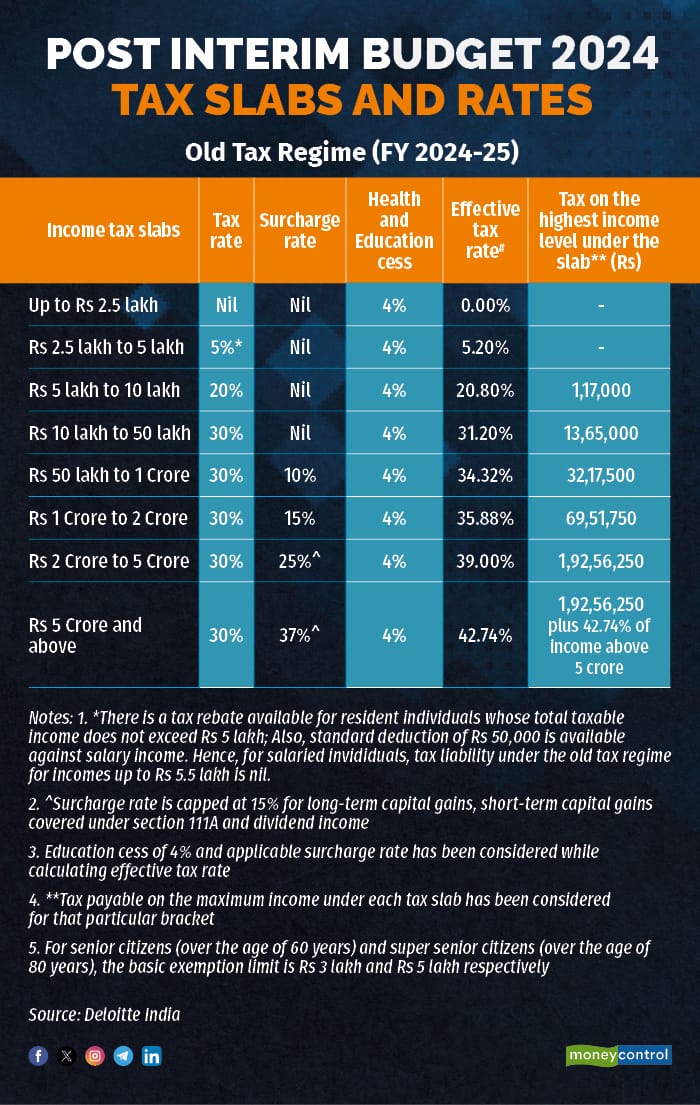

Old tax regime tax slabs and rates for FY 2024-25

Old tax regime tax slabs and rates for FY 2024-25

The deduction level – equaliser – that matters

The answer to the question of how to identify the regime that ensures minimal tax outgo depends on your income level and exemptions.

Deloitte India calculations show that for most income tax slabs, the higher the number of total deductions (under sections 80C, 80D, 24b on home loan interest paid, and so on) claimed, the less lucrative the new regime will be. This is because tax breaks reduce the taxable income and tax payable under the old regime.

For example, if you are a salaried individual with an income of Rs 11 lakh, and your total deductions amount to less than Rs 3.25 lakh, the new regime will be better suited for you, ensuring lower tax outgo (see graphic). If your total deductions are higher than this amount, then the old regime will be more beneficial.

This break-even point is referred to as ‘equaliser’ in the table (see graphic). It will vary as per the tax slab. For example, this break-even point is Rs 4.25 lakh for incomes between Rs 15 lakh to Rs 5.5 crore. This is the point at which the tax payable under both regimes is the same.

Your deductions can easily cross Rs 4.25 lakh assuming you exhaust the Rs 1.5-lakh tax deduction limit under section 80C via employee’s provident fund (EPF), housing loan principal repayment, or other tax-saver investments. In addition, you can claim deductions on health insurance premiums under section 80D (maximum limit for non-senior citizens is Rs 25,000) and housing loan interest paid under section 24b (Rs 2 lakh). Then, there is a flat standard deduction of Rs 50,000.

New regime better for high-income earners

For individuals who attract the highest tax slab rate and surcharge (effective tax rate), largely, it’s the new tax regime that will result in more savings, unless you avail of a significantly higher house rent allowance (HRA). Take the case of a salaried individual with an income of over Rs 6 crore. If she lives on rent in a luxurious apartment in a metro city, and shells out rent of, say, Rs 5 lakh a month, her HRA could hand her substantial tax savings under the old regime.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!