The much-awaited shopping offers ahead of Independence Day are here. Amazon India’s Great Freedom Festival and Flipkart the Big Saving Days started on August 4.

This festive season, Reliance Digital has also announced the digital India sale. These companies are offering attractive deals, cashback and discounts on leading bank credit cards to lure you in.

Here is all you need to know about shopping credit cards this festive season and which ones should you use.

The perks of dedicated shopping credit cards

A shopping credit card can help you maximise your savings on most of your expenses. These cards offer benefits via rewards, cashback or discounts, across co-branded partners or selected categories like grocery and apparel, among others.

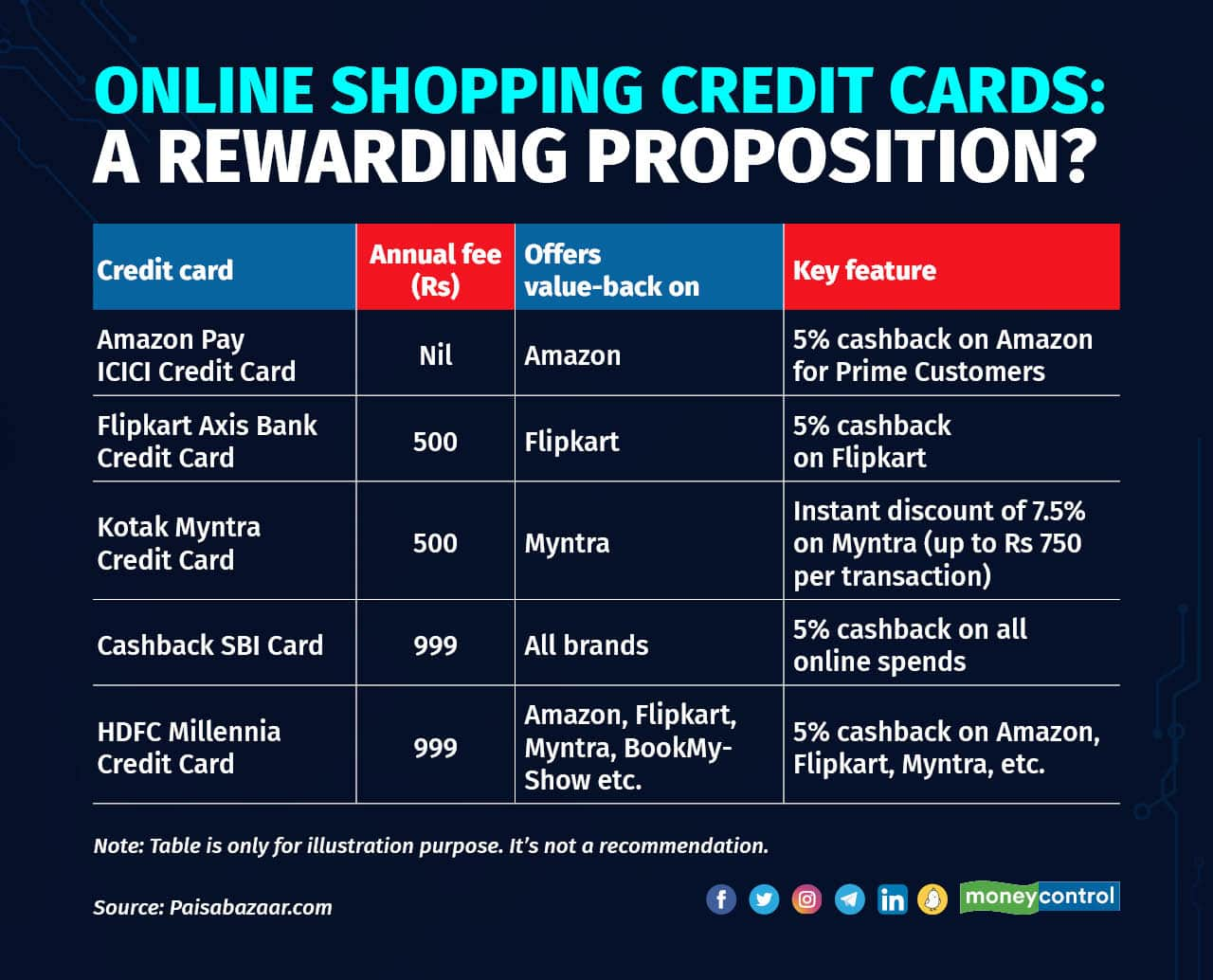

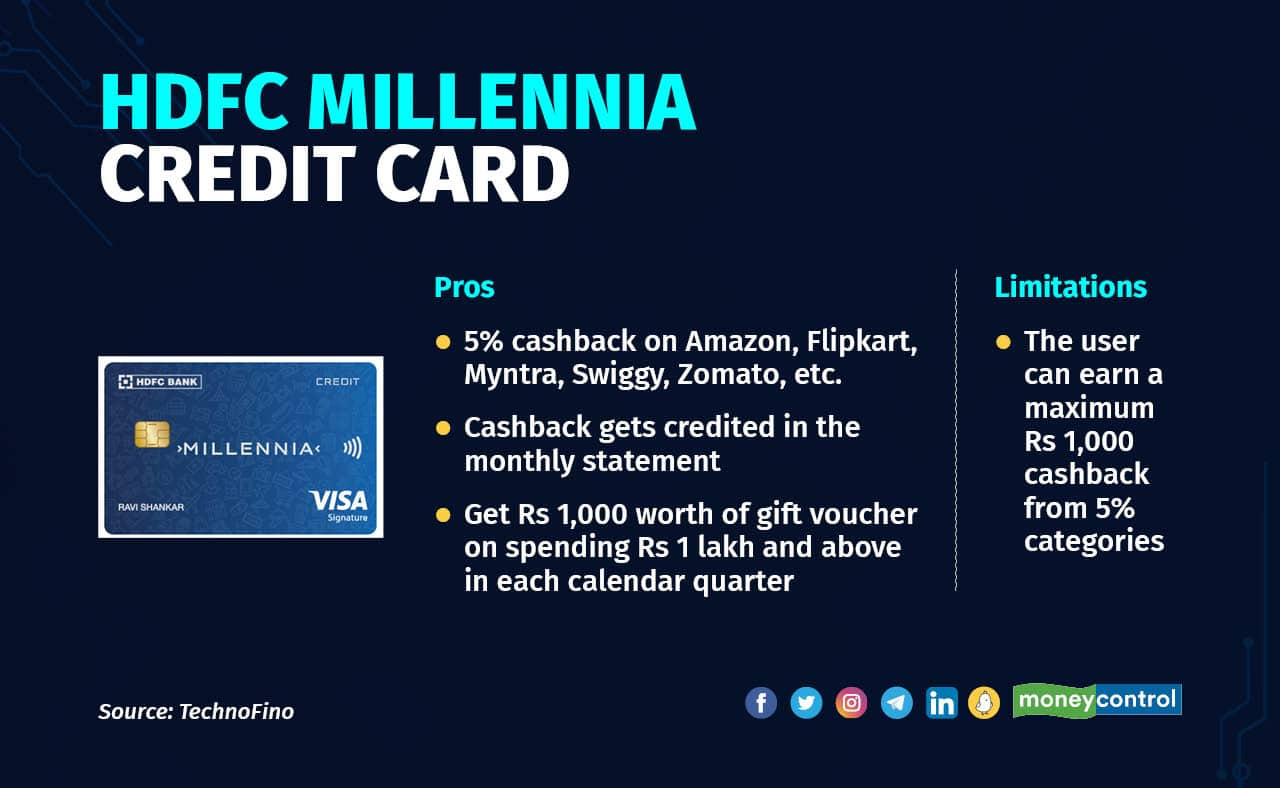

For instance, if you frequently shop at both Amazon and Flipkart, you can apply for the HDFC Millennia Credit Card to save across multiple brands like Amazon, Flipkart, Myntra and so on. If you are spending across e-commerce websites while shopping, you can pick Cashback SBI Card, which offers a 5 percent flat cashback across all online spends.

“Those purchasing from certain merchants or brands can find value in co-branded credit cards of those merchants like Flipkart Axis Bank Credit Card or Amazon Pay ICICI Credit Card,” said Ankur Mittal, Co-Founder and Chief Technology Officer, Card Insider, a platform that tracks the Indian credit card industry.

If you are an online shopping enthusiast but do not have a dedicated card, you can scout for cards that will help you get maximum rewards out of your spending. The festive season is all set to kick in, and such cards could help if you were to use them judiciously and wisely.

“When applying for a credit card that offers benefits for online shopping, your first port of call should be the fees and charges associated with the card, such as the annual fee, foreign transaction fees, late payment fees, and cash advance fees,” Adhil Shetty, CEO, BankBazaar.com said.

Pay attention to the rewards and cashback structure. Ensure that the value of the rewards or benefits you will receive outweighs the cost of the annual fee. The credit limit offered on the card should be aligned with your spending habits and requirements.

“If you are someone, who puts most of their expenses on credit cards, getting a shopping credit card can help you save on your day-to-day expenses along with benefits on big-ticket purchases,” Rohit Chhibbar, Head of Credit Cards, Paisabazaar said. To get the maximum value back, you must get a card that can help you earn substantial returns on your major purchases, he added.

“While choosing a credit card for yourself, don't just consider your shopping spends, but also take into account your overall expenses per month or year. This includes your monthly utility bills, grocery expenses, travel costs, fuel expenses, offline spending, insurance payments, and more,” said Sumanta Mandal, Founder, TechnoFino, another platform that tracks the Indian credit card industry.

After analysing all your spending behaviour, you might find a credit card that offers better rewards for your specific spending patterns.

Variants in shopping credit cards

Cashback cards offer rewards in the form of real money as statement credit. Traditional credit cards offer varied benefits, including reward points and accelerated reward points on certain categories which get accumulated over a period and can be used against different redemption options.

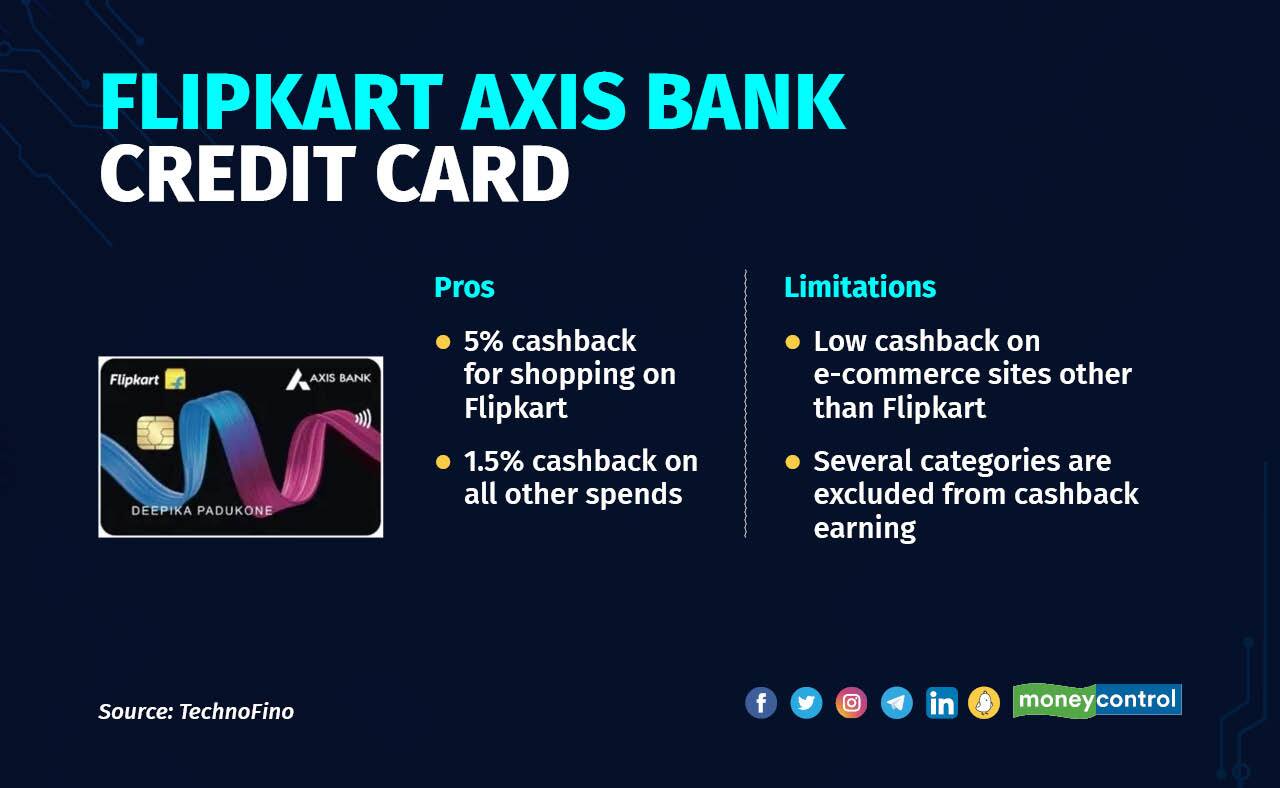

“With a cashback card, you earn a portion of your purchases as direct cashback, such as the Flipkart Axis Bank Credit Card, which offers you 5 percent unlimited cashback on shopping at Flipkart,” Chhibbar said.

On the other hand, a rewards credit card offers you reward points that can later be redeemed in exchange for products, vouchers, air miles and more. For instance, SBI SimplyClick Credit Card offers you 5 reward points for every Rs. 100 spent on online shopping.

Rama Mohan Rao Amara, MD & CEO, SBI CARD said, “Both cashback-focused and accelerated rewards credit cards might offer different benefits and the card user should look at the complete benefit that can be derived from the card before using it for a particular purchase.”

Some cards also offer direct discounts on partnered brands - Kotak Mahindra Bank Myntra card offers an instant discount of 7.5 percent on shopping at Myntra.

Also read | Higher fees, lower reward points: Axis Bank cuts back on Magnus, Reserve credit card benefits

Know how rewards rates work using credit card

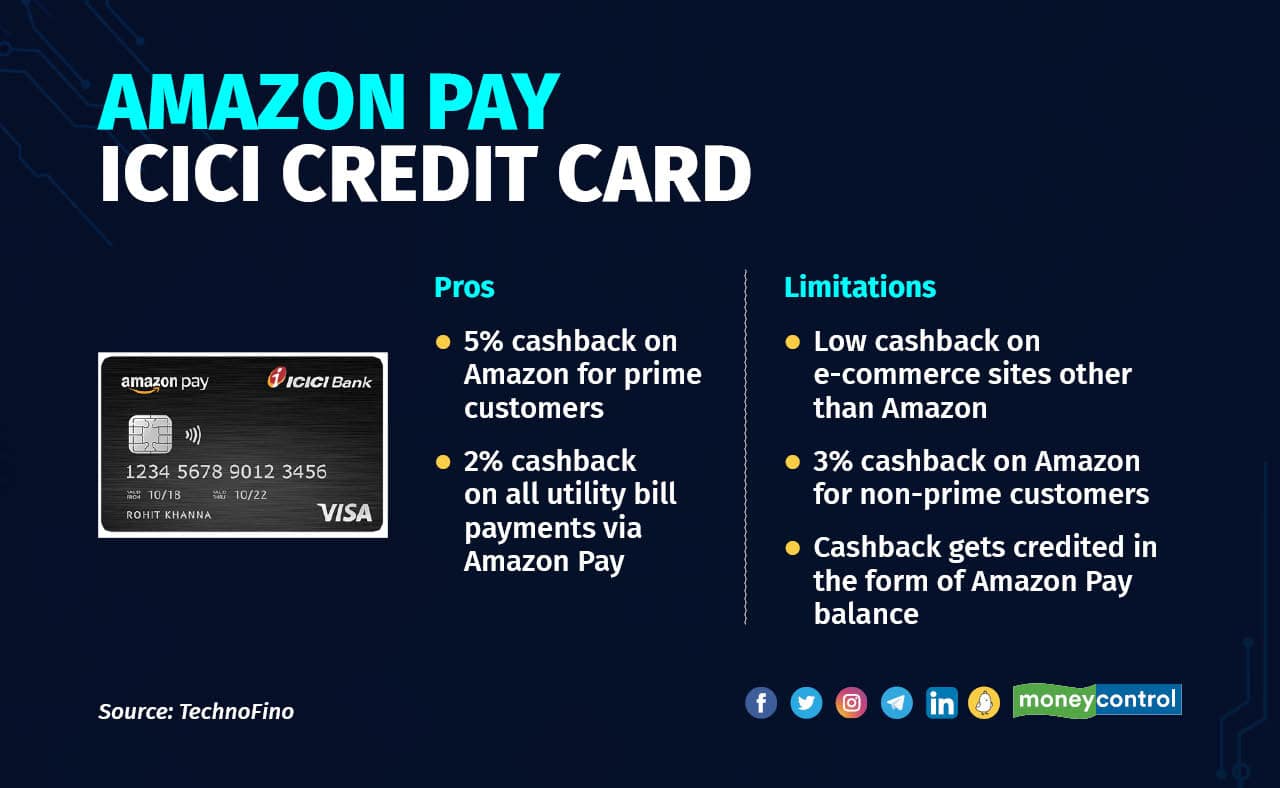

Some shopping credit cards are transparent on the rewards mechanism and it is easy to calculate the rewards earned. For instance, through Amazon Pay ICICI Bank credit card, you get 5 percent cashback on whatever you shop for on Amazon, if you are a prime customer. Every cashback value is equal to one rupee. For instance, if you are an Amazon Prime member and using Amazon Pay ICICI Bank credit card for shopping worth Rs 1,000 on Amazon. You will get a cashback of Rs 50. So, the user doesn’t have to do the math and cashback gets credited to Amazon's pay wallet after they generate the statement.

“During festive shopping offers, there are several cards offering 10 percent cashback, but there are conditions applied. The condition is that you can earn only in two categories and they exclude 20 types of other spending,” said Mayank Jain, Director, Credit-Lending, Amazon Pay India.

“Some credit cards don't offer cashback on select items, so you have to check those terms before using the card for such items,” said Mandal. For instance, ICICI Amazon Pay doesn't offer 5 percent cashback if you purchase an Amazon Pay gift voucher from Amazon, and Axis Flipkart doesn't offer 5 percent cashback on jewellery purchases on Flipkart.

Jain added that a credit card that can give a user a straightforward proposition without any conditions attached is the card you should opt for. For instance, if you shopped on an e-commerce website for Rs 10,000, you got Rs 500 as cashback, assuming 5 percent cashback is simple math for the users.

But, in reality, there is a lot of complexity involved in these shopping credit cards, as there are conditions applied to earning cashback while spending on co-brand partner websites and other e-commerce websites (refer to graphic).

Key terms and conditions you must know

Understand how rewards or cashback are earned for shopping transactions. Check if there are any spending thresholds or limitations on the types of purchases eligible for rewards.

“Be aware of the expiration date of earned rewards or cashback. Some credit cards have a validity period for redeeming rewards, and unused rewards may expire after a certain period,” said Shetty.

He added that users must check if there are any minimum spending requirements to qualify for rewards or bonuses and meet them to avail themselves of the benefits. Understand the various redemption options for earned rewards or cashback, and also check if you can redeem them for cash, statement credits, gift vouchers, or merchandise.

Many shopping cards come with an annual fee. Evaluate whether the rewards and benefits offered justify the annual fee or if there are fee waiver conditions. Mandal cautions that some issuers of cashback credit cards can be strict regarding business spending.

For instance, using your Axis Flipkart credit card for business transactions, such as ordering multiple items from Flipkart for someone else and repeatedly breaching the assigned credit limit, can lead to credit card cancellation. Axis Bank and ICICI Amazon Pay credit cards have stringent policies.

Also read | Don't make these five credit card mistakes or you'll be in debt forever

Make timely repayments

“One should also ensure timely payments as payment default can lead to an impact on credit score,” Amara said. While spending through credit cards it is important to be mindful of one’s credit limit. Amara added, consumers can also leverage the EMI facility, in case of large spending, if required, and reduce their payment burden by distributing the payment over several months.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.