Aparna Karnik

As asset managers, we believe that it is also our fiduciary duty to encourage investors on good investing behavior that leads to long-term wealth creation and helps avoid fallacies and short-termism, which ultimately are counterproductive. Good investor behavior can play an important role in encouraging good fund manager behavior – it gives fund managers the confidence to stick with good ideas through short-term pain.

We recently read an interesting analysis by Wesley Gray, PhD, on how even the most perfect fund manager (“God”) with a perfect portfolio containing the best performing stocks of the future (“Perfect Portfolio”) would face a high degree of volatility and suffer through periods of sharp price falls (which typically causes investors to jump ship).

We wanted to test this in the Indian context. Is it possible to create a portfolio that can achieve the impossible (provide high returns with significantly lower risk)? To test this, we assumed the impossible. We assumed perfect knowledge of the future and deliberately engaged in the ‘look ahead’ bias just to check whether a perfect portfolio would have been able to significantly avoid the volatility associated with long-only equity investing. We did this for a 15-year period (2003 – 2018).

Constructing the perfect portfolio

Starting Dec 2003, we identified the 50 best stocks in BSE200 (Top 50 stocks by total returns over the next five-year period from Dec 2003 to Dec 2008). We constructed a market value weighted portfolio in Dec 2003 comprising the 50 best stocks that would outperform over the next five years and held this portfolio for five years. After five years, i.e. in Dec 2008, we repeated the process and re-balanced the portfolio to reflect a market value weighted portfolio of the 50 best stocks by total returns over the next five years (Dec 2008 to Dec 2013). Again, we held the portfolio for five years and rebalanced in Dec 2013 using the same methodology. We then studied the characteristics of this “Perfect” portfolio* over the 15-year period.

To be clear, this is a completely hypothetical exercise since no one can know with certainty which stocks will be the best performers over the next five years. But the exercise does throw up some interesting insights.

Source: : Factset, Internal, BSE 200

*Note:

The Perfect Portfolio consists of 50 BSE 200 companies with best 5-yr performance (perfect hindsight) Perfect Portfolio is rebalanced every 5 years

Constituents weights are based on free-float market cap at time of re-balance

The results are hypothetical and are explicitly impossible to achieve. The “Perfect Portfolios” do not reflect management or trading fees.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of any Scheme.

- The perfect portfolio has delivered good returns. But the portfolio volatility is almost as high as that of the benchmark.

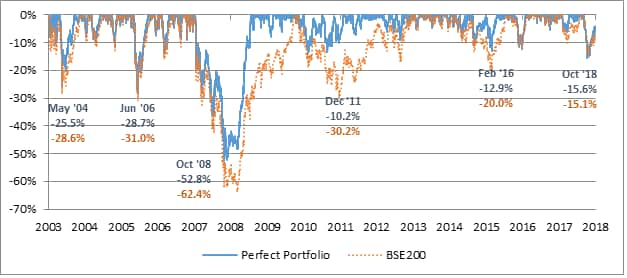

- Also, the portfolio suffers large drawdowns (declines in value, below its historical all time high) similar to the overall benchmark. The chart of drawdowns over time is given below.

Chart showing declines in value of “Perfect Portfolio*” and BSE200, below the historical all time high (drawdowns)

Source: : Factset, Internal, BSE 200

This study indicates that expecting high returns in equities without being prepared to face the inevitable risk may not be possible! Also, the above chart shows that in the past 5-6 years, perhaps investors have been lulled into a false sense of complacency with respect to equity risk since we have not witnessed large magnitude of drawdowns in the headline indices (perhaps mid and small-cap investors would be exceptions, as these portfolios have seen large price declines in the past year).

Staying invested for the long run

It is commonly thought that “Buy and Hold” is the best strategy for stocks since market prices move irrationally in the short term, but good businesses remain valuable over long periods of time. Our analysis indicates that ideal timeframes for “hold” may be less than what we may think. Given the changes in technology, competition, regulations etc., a fair degree of churn was seen in the perfect portfolios at the time of re-balancing

- 75 per cent by weight and 70 per cent by number was the portfolio churn during each re-balancing (every 5 years). Several names that featured in the ‘perfect portfolios’ subsequently witnessed huge destruction of value. Thus, investors cannot just adopt a ‘buy and hold’ approach to portfolio creation (based on past outperformers) as it is important to keep actively managing portfolios and hence the need for a good fund manager who can navigate the changing tides

-Only six names were held across the three re-balances (15 years time-frame), which made the list of top performers at every re-balance. It remains to be seen if these names will continue their outperformance in future.

To conclude, risk and returns from equity investing are two sides of the same coin and investors should be prepared for the inevitable ups and downs. A realistic and disciplined approach to investing is important in determining the investment outcome. Choosing a good active fund manager to navigate changing tides will help in generating alpha over time.

(The writer is SVP, DSP Investment Managers)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.