Edelweiss Mutual Fund has put limits on subscriptions in seven of its schemes that invest in global securities. The limits kick in from February 27.

The mutual fund house, which had about Rs 1.43 lakh crore worth of assets at the end of the December quarter, said in a note that some schemes were reaching closer to the head room available for overseas investment limit.

Therefore, the fund house, India’s 13th biggest asset management company (AMC), had decided to limit subscriptions via lumpsum, switch-in, systematic investment plan (SIP), systematic transfer plan (STPs), etc at Rs 1 lakh PAN a day with effect from February 27.

“This restriction will be applicable based on the transaction reporting date. Further, transactions reported till February 25, 2025 before cutoff time including switches where switch-in scheme is any of the below will not be considered for such limit restriction. The existing systematic transactions viz. SIPs/ STPs etc. will remain unaffected,” the fund house said.

Also read | Here's how the new Income Tax Bill will change the rules for taxpayers

The seven schemes are Edelweiss ASEAN Equity Off-shore Fund, Edelweiss Greater China Equity Off-shore Fund, Edelweiss US Technology Equity Fund of Fund, Edelweiss Emerging Markets Opportunities Equity Offshore Fund, Edelweiss Europe Dynamic Equity Offshore Fund, Edelweiss US Value Equity Off-shore Fund and Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund.

While six of these funds are fully focused on overseas securities, the Edelweiss India domestic & world healthcare fund invests in leading companies in India and the United States.

In February 2022, the Securities and Exchange Board of India (SEBI) asked domestic mutual fund companies to stop further investments in foreign stocks. It was to prevent a breach of the Reserve Bank of India’s industry-wide limit of $7 billion on investments in overseas securities and funds. The central bank also capped at $1 billion the limit for individual fund houses and $1 billion for investing in overseas exchange-traded funds (ETFs).

Later, the capital market regulator allowed mutual funds to invest in foreign stocks as long as their fund deployment adhered to the RBI ceilings.

Also read | Have Rs 10 lakh to invest? Flexicap, midcap, gold, US equity funds can make a well-rounded portfolio

Since then, many fund houses have sporadically accepted, stopped, or capped subscriptions.

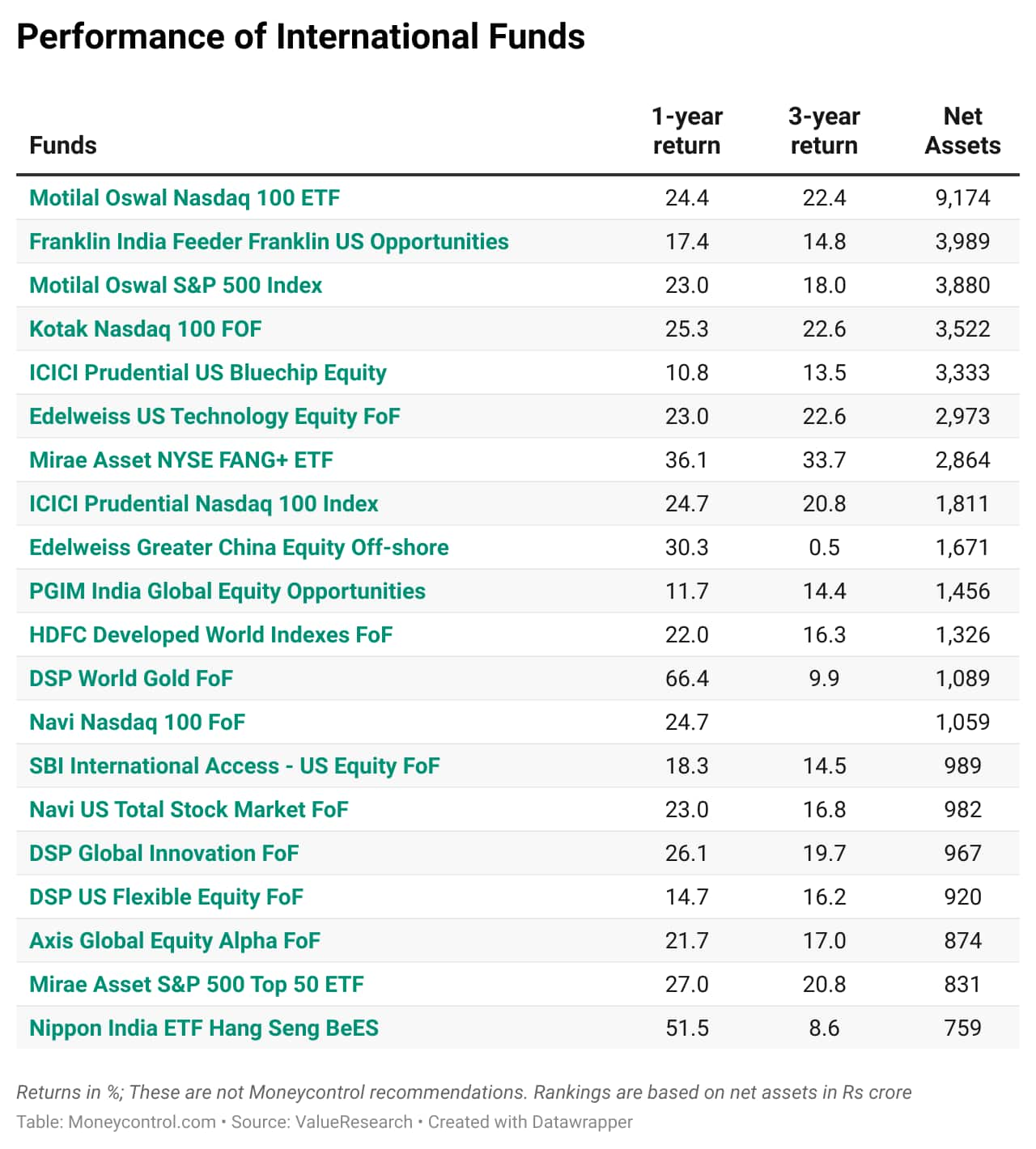

There are various categories of overseas funds available in the market. From the US technology funds to US diversified funds, from China and Brazil to the ASEAN region, overseas funds have delivered varied returns over the years.

Data available with Value Research shows that China equity funds have delivered 55.38 percent returns on average over the past year, till February 21.

US-based funds that included Nasdaq 100, S&P 500 and NYSE FANG have gained 26 percent on average on a one-year period. Funds that invest in global equities are up 17.48 percent.

Also read | Helios MF launches mid-cap fund - should you invest?

At present, there are around 70 Indian schemes, with assets under management (AUM) of around Rs 65,000 crore, which focus on themes such as artificial intelligence, emerging technologies, semiconductors, and electric vehicles in overseas markets.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.