Finance Minister Nirmala Sitharaman presented the Union Budget 2024 on July 23, 2024, her seventh consecutive Budget, and announced some major changes on the personal taxation front.

Let us look at some key amendments proposed around personal taxation:

1. Tax rates under new tax regime

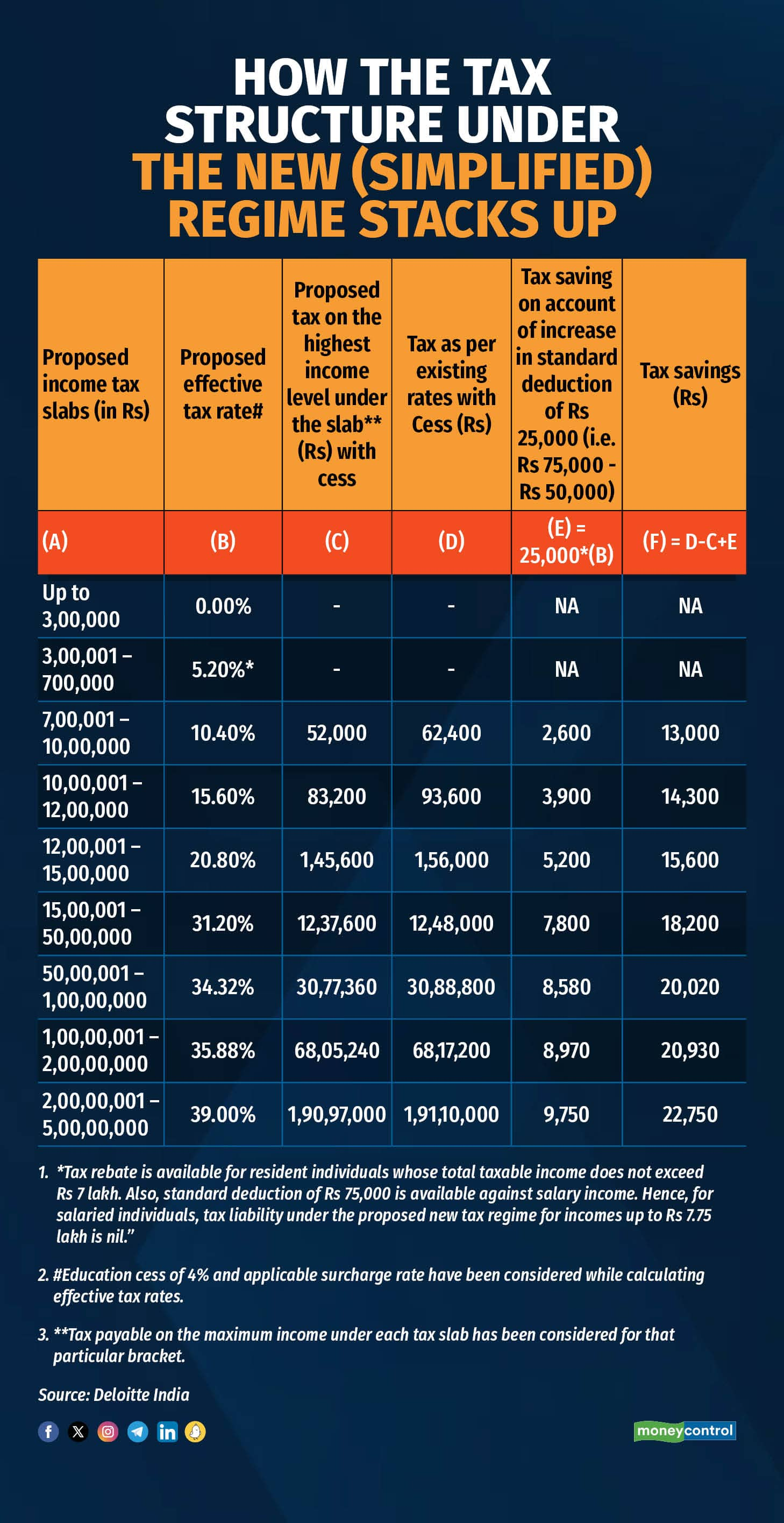

The finance minister revised the tax rate structure under the new tax regime while keeping the rate structure under the old tax regime unchanged. Additionally, the standard deduction for salaried employees is proposed to be increased from Rs 50,000 to Rs 75,000.

Also read: Old vs new (simplified): Which income tax regime will help you save more on tax outgo?

Here’s the revised tax rate structure along with a comparison with the tax rate structure as per the existing simplified tax regime and tax savings to a resident salaried individual (not being a senior citizen).

2. Boost to NPS

• To improve social security benefits and bring parity between government and private sector employees, all employees will now be allowed a deduction of expenditure incurred by the employers towards NPS, to the extent of 14 percent of the employee’s salary.

This deduction will be allowed only where the employee is opting for the new regime. In case the employee is opting for the old regime, the deduction will continue at 10 percent for private sector employees.

• NPS-Vatsalya, a plan for contribution by parents and guardians for minor children in NPS can be started. The said plan can be converted into a normal NPS account on the child attaining majority.

3. Proposed changes in capital gains

Long-term capital gains

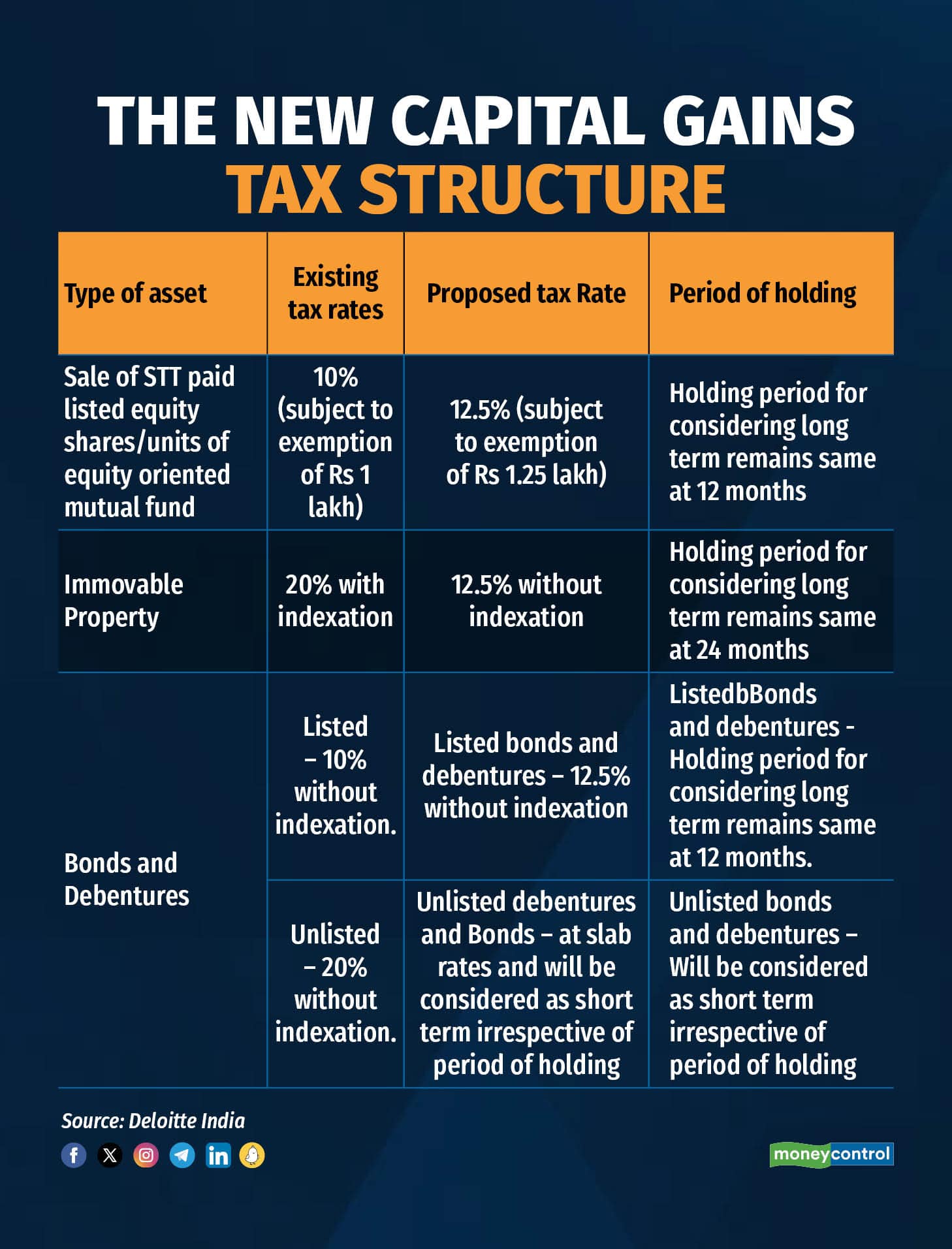

Change in holding period and tax rate for long-term capital gains: Earlier indexation benefit was available for sale of any long-term assets (except for a few exceptions). Henceforth, for such long-term capital gains no indexation benefit will be given.

Further, the rates for taxability of long-term capital gains are changed as under (illustrative list only):

Short-term capital gains

Earlier, short-term capital gains on sale of equity shares on which securities transaction tax (STT) is paid/units of equity oriented mutual fund was taxable @ 15 percent. This low rate of tax was benefitting high networth individuals.

Hence, the government has proposed to change the tax rate from 15 percent to 20 percent. For any other asset, short-term capital gains continue to be taxed at applicable rates.

4. Ease in claiming credit for TCS collected or TDS deducted by salaried employees

In order to ease compliances and to mitigate cashflow issues for salaried individuals, it has been proposed to amend section 192 to expand its scope to allow credit of any tax deducted or collected while computing the amount of tax to be deducted on salary income.

5. No penalty under Black Money Act for failure to disclose foreign assets up to Rs 20 lakh in ITR

Resident individuals owning foreign assets are required to report these assets in their India tax returns. Failure to report such foreign assets attracts a penalty of Rs 10 lakh under the Black Money Act, 2015.

The government has rationalised the reporting of such foreign assets and there would be no penalty if the aggregate value of unreported foreign asset (except immovable property) does not exceed Rs 20 lakh. The above amendment will take effect from October 1, 2024.

Overall, the Budget has aimed to simplify the taxation structure for individuals and has also proposed further tax measures for the adoption of the new tax regime.

(With inputs from Niji Arora, Director, Tarika Agarwal, Manager and Ami Rathod, Deputy Manager with Deloitte Haskins & Sells LLP)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.