Akshaya Tritiya, which falls this year on Friday, May 10, considered one of the most auspicious days in the Hindu and Jain calendar, is traditionally seen as a perfect time to start new ventures or make significant purchases, especially in gold. This tradition not only holds cultural and sentimental value but also offers a practical investment perspective. Here’s a detailed guide on how to buy or invest in gold through various mediums on Akshaya Tritiya.

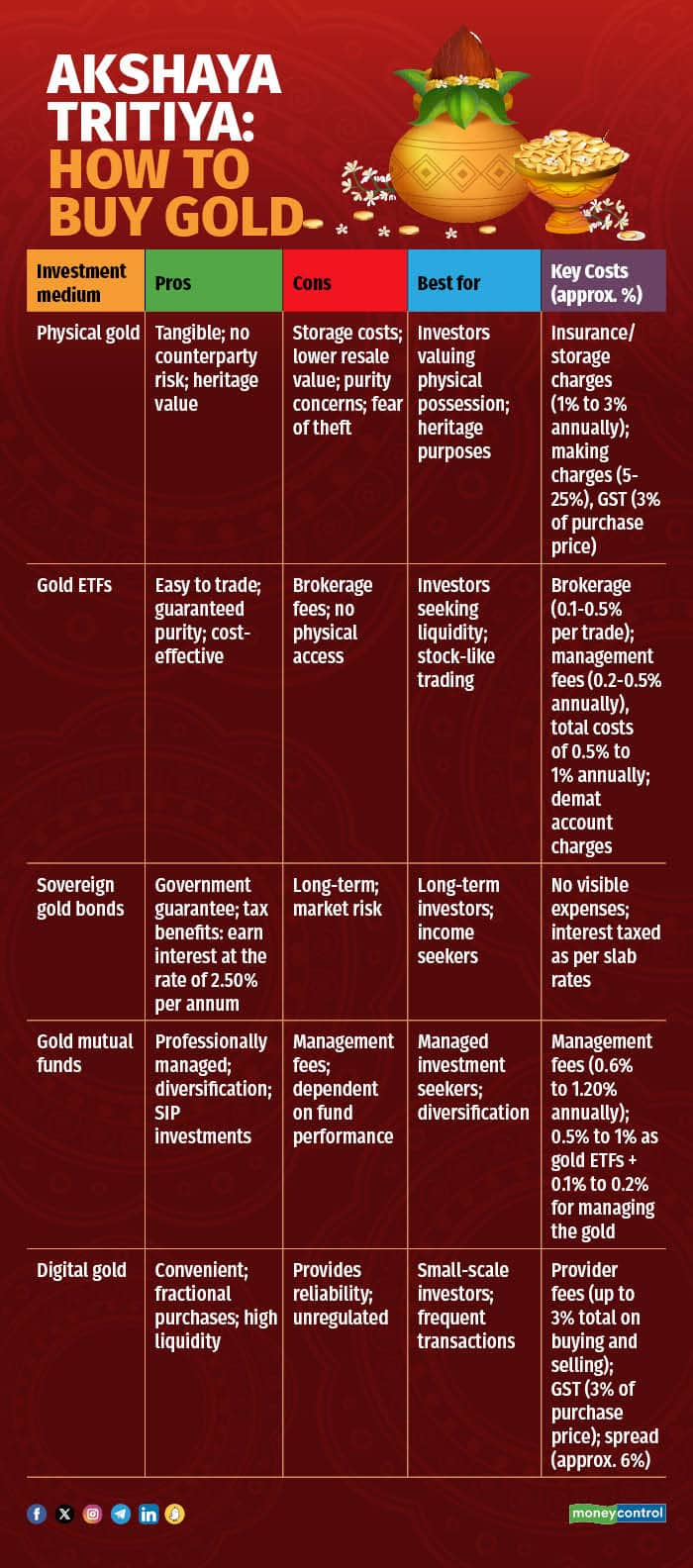

Physical gold

Jewellery and ornaments: The most traditional method of buying gold is in the form of jewellery. It's not just an investment but also a cultural emblem that can be worn and enjoyed. When purchasing jewellery, consider factors like making charges, purity (look for hallmarks), and resale value.

Gold coins and bars: These are preferred for their true investment value. Coins and bars come with a purity certificate and are generally available in various denominations. Purchasing from jewellers or banks ensures authenticity.

Gold ETFs

Gold exchange-traded funds or ETFs are units representing physical gold that may be in paper or dematerialised form. One gold ETF unit is typically equivalent to one gram of gold. It provides flexibility as you can buy and sell units on the stock exchange and doesn’t carry the risks associated with physical storage.

Sovereign gold bonds

Issued by the government, SGBs are a great alternative to holding physical gold. The bonds are held in electronic form and promise a fixed interest over the initial price of gold. These are also redeemable after a certain period, typically eight years, and are tax efficient.

Also read | Sold sovereign gold bonds at market highs? Here’s how to calculate your taxes

Digital gold

An increasingly popular form of investing, digital gold can be bought online and is stored in insured vaults by the seller. You can buy, sell and accumulate significant amounts by amassing small quantities over time, making it a very flexible option. This method eliminates the hassle of storage and security concerns that are typically associated with physical gold.

Also read | Rising gold prices have led to more gold loans: Shripad Jadhav, Kotak Mahindra Bank

Gold mutual funds

Gold mutual funds invest in gold ETFs and gold mining companies. They present an easy route for investors looking to get exposure to gold without directly investing in physical gold or individual stocks.

In the cost section for digital gold, you will see the term “spread”. This is the difference between the buying and selling price for the investor. This spread is implemented in order to recover costs associated with physical gold such as the costs of secure vault storage, technology, hedging, insurance, transportation, etc.

Geopolitics and gold prices

Gold prices have experienced a marked increase amid heightened geopolitical tensions following an Israeli missile strike on an Iranian city, escalating the Iran-Israel-Hamas conflict, as well as the conflict between Israel and Lebanon. The surge in gold prices reflects its status as a safe-haven asset during times of uncertainty. I suggest a "buy-on-dips" strategy. If gold and silver prices were to fall by 10 percent, that would offer another pressing ‘buy’ opportunity. Currently, international gold prices are ranging between $2,340 and $2,400 per troy ounce.

In the domestic market, the MCX gold rate today shows immediate support at Rs 72,300 per 10 grams. If the Middle East crisis escalates, it could push prices to approximately Rs 74,250 to Rs 74,300 per 10 grams shortly. Additionally, COMEX gold prices are buoyed by a weaker dollar, robust demand from Chinese consumers and central banks, and anticipation of delayed interest rate adjustments by the US Federal Reserve, amidst persistent high inflation.

Also read | Gold rewards investors. But don’t go overboard, it’s just an asset allocator

What to do with your current investments?

Indian households' equity holdings, currently at about 5 percent, will double this decade due to factors like increased awareness, government stability, GDP growth and robust economic prospects. I suggest gold investments should constitute 5-10 percent of one's portfolio. Gold is safe given rising prices due to recent geopolitical tensions in Middle East. With gold up over 1 percent since the conflict began, its appeal as a stable investment in uncertain times is reinforced by other supportive factors, making it a prudent choice for diversifying portfolios and safeguarding assets.

Gold price outlook

With gold prices near Rs 75,000 per 10 grams, you might be contemplating your next move:

If you already hold gold, consider your investment horizon and risk appetite before deciding to sell or hold. New investors might want to wait for any dips if prices seem too high or start small and average their buying price over time.

In conclusion, each gold investment option has its unique set of features and potential drawbacks. Your choice should align with your overall investment strategy, financial goals and comfort level with the associated risks. Consulting with a financial expert might also help tailor your decision to your personal financial situation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.