The first issue of sovereign gold bonds (SGBs), which are coming up for maturity on November 30, has managed to outperform other forms of investment avenues based on the precious metal.

The price for the final redemptionof Sovereign Gold Bonds-2015-Series-I has been set at Rs 6,132 per unit of SGB, which is based on the simple average of closing price of gold for the week November 20-24, 2023. The first tranche was issued at a price of Rs 2,684 per gram in 2015.

Returns matrix

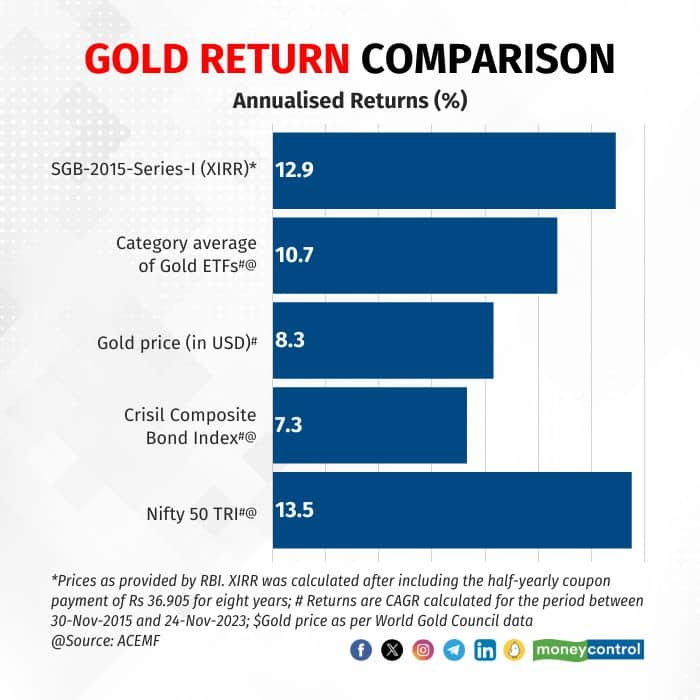

Data compiled by Moneycontrol showed that SGB-2015-Series-I has delivered 12.9 percent Extended Internal Rate of Return (XIRR) since its launch on November 30, 2015.

The simple rate of return based on the issue price and the redemption price comes to 10.88 percent.

Also read | Mutual Fund Lite regulations in final stages; SEBI may issue consultation paper soon

However, these bonds also gave an interest rate of 2.75 percent (fixed rate) per annum, which was decided at the issuance. This fixed coupon was revised to 2.5 percent in later issues of sovereign gold bonds.

Based on the 2.75 percent coupon rate, XIRR given by SGB-2015-Series-I comes to 12.9 percent.

On the other hand, the category average delivered by gold exchange traded funds (ETFs) stands at 10.7 percent for the period November 30, 2015 to November 24, 2023.

Even the returns of gold price in dollar terms lags SGBs at 8.3 percent during this period.

Notably, the returns delivered by Nifty 50 Total Return Index stands a tad better at 13.5 percent.

Gold funds versus SGBs

Financial experts are unanimous in suggesting that sovereign gold bonds are the best way to invest in gold if an individual is ready to hold the investment till maturity, which is eight years.

“SGB returns are tax free, if you hold till maturity. So that's a substantial benefit, which other gold forms such as gold funds or gold ETFs do not have. SGBs also give you around 2.50 percent fixed return per annum. In the financial gold category, it is the only product that gives you interest over and above the price movement. Third, gold funds and ETFs, both have expense ratios, which is not the case in SBGs,” said Amol Joshi, Founder, PlanRupee Investment Services.

Also read | Are Indians retirement ready? 67% say yes, but there’s a catch, PGIM India MF Survey shows

Harshad Chetanwala, Co-founder, MyWealthGrowth.com highlighted that SGBs are backed by the government, which makes them a safe option to invest in. “SGBs are also liquid in nature, as you can you can sell them on the exchange. But keep in mind that the taxation benefit is only available for those who buy at the opening of the tranche and hold it till maturity,” said Chetanwala.

Financial advisors suggest keeping 5-15 percent of one’s portfolio in gold depending on the kind of risk profile or investment horizon that an investor has.

As per Kalpesh N Ashar, a SEBI-registered investment advisor and Founder of Full Circle Financial Planners and Advisors, SGB remains the best bet in gold for the long term.

“But I'm emphasising on the word 'long term' here. If the liquidity aspect is in contention, then probably people should not put everything they have in an SGB just to derive better returns compared to other gold-based options. Surely, for liquidity purposes, gold-based funds remain the best fit,” said Ashar.

Also, keep in mind that while gold-based investment avenues have delivered decent gains over a long-term period, gold in itself can through cycles of underperformance.

Also read | Removal of debt tax benefit is fuelling equity market rally: Trust Mutual Fund’s Sandeep Bagla

Investors should consider their investment goals, risk tolerance, and preferences when choosing between Gold ETFs and Sovereign Gold Bonds. Both options provide exposure to the price of gold, but the choice depends on factors such as liquidity needs, taxation considerations, and the desire for interest income.

Dhuraivel Gunasekaran contributed to the story.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.