Krishna Karwa

Moneycontrol Research

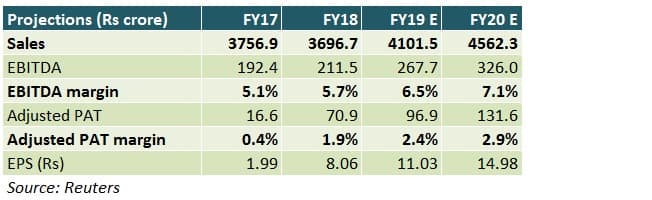

Shoppers Stop’s (SSL) FY18 performance showed a visible improvement compared to last year. However, the final quarter’s performance was subdued. With several new initiatives, including recent tie-ups to bolster its online presence, the earnings-linked weakness could be an opportunity for long-term investors to buy the stock. For FY18, the company failed to meet its same-store sales growth guidance of four percent due to maximum retail price revisions, re-positioning of own brands and mall renovations.

Weak Q4 FY18

The company faced several headwinds in the quarter gone by. These include: corrections in its private label portfolio, drop in same store sales, subdued offtake of exclusive brands and decline in volumes. Nonetheless, it maintained its net profit margin during Q4 and FY18 on the back of lower finance costs (due to debt repayments and closure of non-profitable outlets), fewer discount days and significantly lower effective tax rates.

Why Shoppers Stop is an attractive franchise??

Expansion

To boost revenue growth, the management plans to add five departmental and 12 specialty stores in FY19. The company’s capex plan for the ongoing fiscal is as follows:

Omnichannel focus

SSL, by virtue of its tie-up with Amazon, will be allowed to market its products online through an exclusive web page created at the latter’s end. A low revenue base in online retail and enhanced visibility on India’s largest e-commerce platform should enable the company to gain robust topline momentum.

Private labels

The management aims to increase share of its in-house brands from 8.5 percent in Q4 FY18 to 10 percent by FY19-end. Simultaneously, it has been working on growing its exclusive brands portfolio through better in-store customer experiences and loyalty schemes. These measures are likely to yield better margins.

Cost control

By selling Hypercity to Future Retail in the middle of FY18, SSL exited one of its major loss-making entities. Proceeds from the same are being used to pare debt. In Q4, the company shut three of its Home Stop stores in southern states too. These initiatives will strengthen the company’s bottomline in FY19.

Should you invest for the long-term?

A rejig in positioning and pricing of private label brands, initiation of digital programmes (through Amazon), expense rationalisation decisions and conclusion of store refurbishment issues by Q1 FY19 will be decisive in driving SSL’s near-term margins. To address problems associated with tepid same-store sales growth, the management’s strategy entails achieving 7.5 percent growth through a combination of price (5 percent) and volume (2.5 percent) growth in FY19.

At 37.6 times FY20 projected earnings, SSL’s steep valuation discounts the moats stated above. Nevertheless, a subdued quarterly performance-linked weakness could provide an opportunity to accumulate.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.