Highlights

- Near-term caution for ABS, fluorine, amine, adhesives makers

- Positive for basic chemical manufacturers

- 5-10% shift in demand from China to India a game changer

The world is on edge after the Coronavirus scare. So far, the deadly virus has claimed more than 1,700 lives.

As economies struggle to contain the spread of the epidemic, its impact on India is still being assessed.

In continuation of our two-part series on the potential impact of the flu on the Indian chemical industry, here are a few more observations on select value chains and takeaways for investors.

Also read: The impact of the coronavirus epidemic in China on India’s chemical industry Part-1

ABS (Acrylonitrile butadiene styrene): The domestic ABS market dominated by Ineos Styrolution and Bhansali Engineering may be adversely impacted by the supply chain disruption. As ABS finds application in autos, whitegoods, electronics and cellphone industries, the key challenge comes from the disruption in these end markets.

According to the management of Ineos, a lot of components for consumer durables are sourced from China. As a result, some of these companies may operate at lower utilization levels, thus affecting demand.

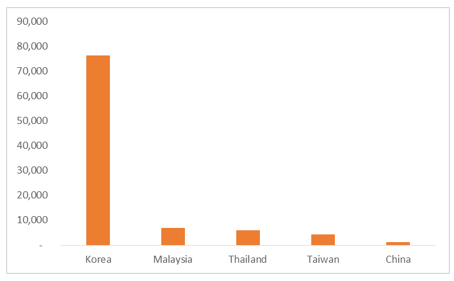

Further, imports of ABS, which constitute about 30 percent of the demand, is likely to remain stable as it is primarily taken care of by countries other than China, including Korea. The fear is the already adverse supply-demand situation due to the auto slowdown is likely to get worse. On the positive side, there has been a substantial drop in prices for key raw materials --styrene, butadiene and acrylonitrile, which can provide some respite.

Chart: ABS Imports in FY18 (tonne)

Source: Moneycontrol Research, Chemical and Petrochemical Statistics at a Glance – 2018

Surfactants: Companies in this segment are relatively immune to imports from China. However, the advantage is on the raw material front. China is the second-largest palm oil importing nation in the world. Its annual import is in the range of 70 lakh tonnes. A sudden drop in demand of palm oil has pulled down its prices. This also translates into lower prices for palm oil derivative such as lauryl alcohol, which is utilised by the surfactant industry as a key raw material that makes up 50 percent of the input cost.

Amines: In the case of amine players Balaji Amines and Alkyl Amines, the China situation can pose a daunting challenge as both the players have a significant exposure to end markets – APIs (active pharmaceutical ingredients) and agri-chemicals, which are staring at significant supply chain disruption. According to Balaji Amines, the situation towards the end of February 2020 needs to closely watched. Any extension of production shutdown in China to March and beyond may spell trouble for the availability of matching ingredients required for the production of respective pharma drug and agri-chemicals.

Fluorine chemistry: As for fluorine twins – SRF and Navin Fluorine – companies need to be watchful about prices of the key raw material – fluorspar. To give you a context, fluorspar constitutes about 60 percent of the input cost for Navin Fluorine. As the company does not depend on China for fluorspar and SRF has alternative sources for the same, sourcing itself don’t appear to be a big issue. However, as China is the largest producer of fluorspar, production curtailment can lead to jump in prices. Having said that, the impact of higher raw material pricing is likely for inorganic fluoride and refrigerant gas business. In the case of specialty and contract research and manufacturing services (CRAMS), any increase in input cost is likely to be passed over to clients.

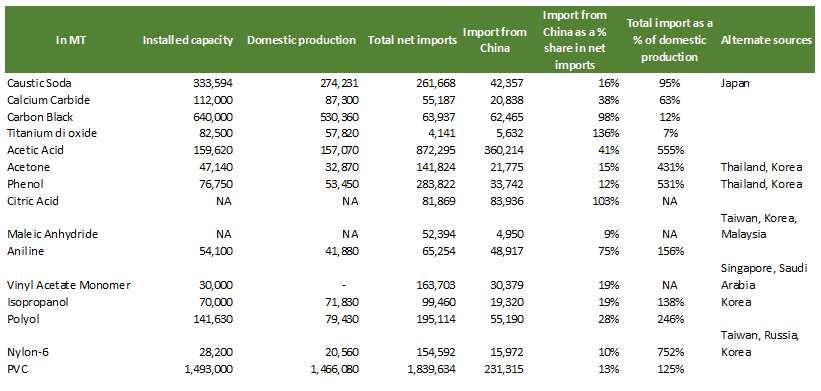

This review also analyses dependence on China for other key chemicals. Some of the chemicals where India’s dependence on China is higher are titanium di oxide, carbon black, acetic acid, citric acid, aniline and calcium carbide. Chemicals where total imports are quite substantial compared to domestic production are caustic soda, acetic acid, acetone, phenol, aniline, isopropanol, PVC and nylon.

Among others, Vinyl Acetate Monomer, the key raw material for adhesives, is mainly imported from China. This means companies such as Pidilite and Astral Poly may have to keep tabs on the sourcing of this raw material.

Prices of isocyanates (raw materials for Polyurethane used for footwear and mattresses) can also see an upward push after a sharp correction over the past one year. This could be a result of a likely shortfall in supply. Additionally, TDI (toluene di isocyanates) in domestic market is under review for anti-dumping investigation. Investors would do well to keep track of GNFC and Sheela Foam in this space.

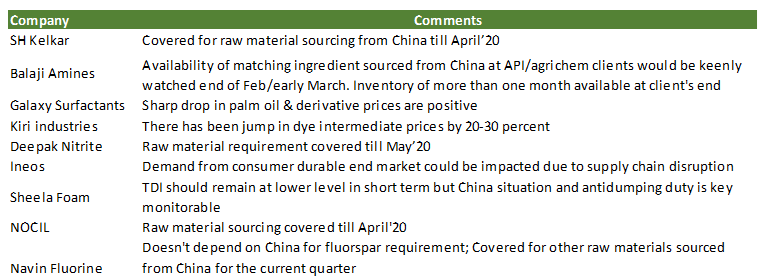

While most Indian chemical companies have their raw material inventory requirements covered till April 2020, there are expectations that the Chinese production would resume by the end of February or early March. This taking account of logistics should be just in time. But any delay beyond this would have an impact on Q1 FY21 results.

Table: Management commentary

Source: Moneycontrol Research

Chart: Dependence on China for select chemicals

Source: Moneycontrol Research, Chemical and Petrochemical Statistics at a Glance – 2018

Note: Data updated till 2018; Doesn’t account for few capacity additions by Deepak Nitrite, Himadri Specialty and the like

Given this context, in the short term, companies that may appear attractive here are those dealing in some of the basic chemicals. For instance, GNFC (Aniline, Acetic Acid, TDI, Nitric Acid), Tata Chemicals, Gujarat fluorochemicals, GHCL, Gujarat Alkalies and Chemicals (Caustic Soda, Soda Ash), Deepak Nitrite (Acetone and Phenol), Amal (Sulphuric acid) and Deepak Fertilizers (Isopropanol). Basic chemicals which particularly caught out attention are aniline and acetic acid that have diverse applications and act as a starting point for many value chains.

Other chemical names which can be beneficiaries of this tactical opportunity are NOCIL, Himadri Speciality, Phillips Carbon, HEG, Graphite India and Dye manufacturers.

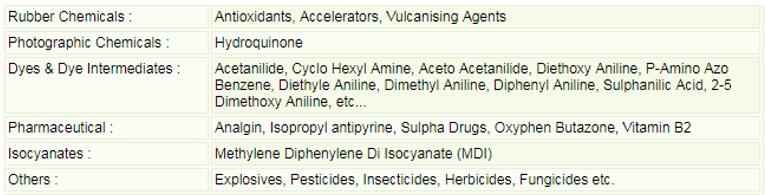

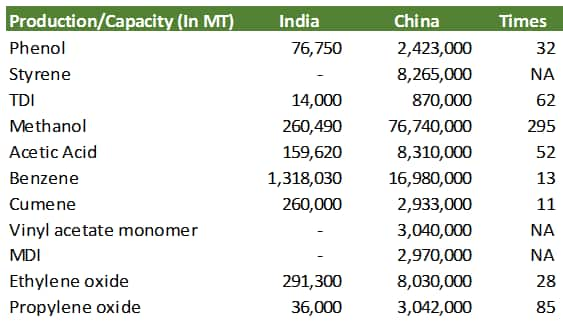

Table: Aniline applications

Table: Acetic acid applications

Source: GNFC

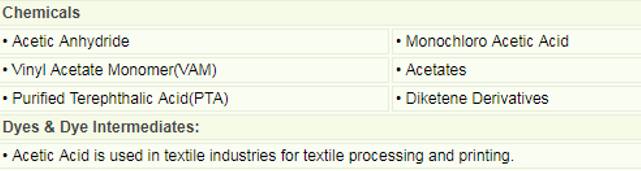

On the structural level and for the long term, scale of few basic/bulk chemicals production capacity between India and China gives some hint about the opportunity. To put into perspective, India’s share in global chemical trade is still around 3 percent. This is about one fourth the share of China in global trade.

Source: ICIS, Moneycontrol Research

For integrated chemical manufacturers such as Aarti Industries and Atul Industries, it could mean new opportunities because of the growing preference for India as an alternative reliable supplier of chemicals. Over the years, supply chain disruptions in China due to operational hazards, environmental compliance issues and higher cost of operations have made the case for this likely shift. A 5-10 percent business shift to India can actually more than double the opportunity size for many chemical companies.

(This is the concluding part of the two-part series on the impact of the coronavirus epidemic in China on India’s chemical industry.)

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.