The Supreme Court's recent judgement on Adjusted Gross Revenue (AGR) case has huge ramifications on the well-being of two of the three largest telecom operators in India: Bharti Airtel and Vodafone Idea. The apex court rejected the definition of AGR used by the companies and agreed to the government’s computation. As a result, these companies are liable to pay Rs 21,700 crore and Rs 28,300 crore, respectively, to the exchequer. Given the state of their finances and indebtedness, it is clear that their promoters/parents should infuse money.

These liabilities put further pressure on both companies, especially Vodafone Idea, which is already under so much of stress. While the companies have appealed to the government for a rethink, the fact remains that both companies are mired in a mess. Remember that both companies are already carrying on their book – close to Rs 1.25 lakh crore each as on March 2019. Now, the moot question is how much money their promoters/parent firms can bring to the table to help them.

Let us first go back and see what kind of equity infusion both Bharti Airtel and Vodafone Idea have received in the past 2-3 years.

In September 2016, Vodafone Idea (erstwhile Vodafone India) received Rs 47,700 crore of equity infusion from its British parent, Vodafone Group Plc, to help it buy more spectrum, invest in infrastructure and reduce debt. The investment was done just before the aggressive launch of Reliance Jio (RJio).

In January 2018, the Aditya Birla Group also infused Rs 3,250 crore in Idea Cellular just before the merger with Vodafone amid a challenging environment. Moreover, in the recent rights issue (April 2019) done by Vodafone Idea, its promoters contributed Rs 17,920 crore. The money was raised to partially repay debt and have some cash to expand its 4G operations to close the gap with RJio and Bharti Airtel.

Post infusion, the Vodafone Group’s stake increased from 44.78 percent in September 2018 to 53.57 percent in September 2019 whereas the Indian promoters’ stake has come down by 8.18 percent. This indicates that the parents of Vodafone Idea have infused money to keep the company competitive whereas the AB group has taken a back seat.

Similarly, earlier this year, Airtel announced fresh equity infusion through a combination of rights issue (Rs 25,000 crore) and foreign currency perpetual bond issue (Rs 7,000 crore). This new share issuance was at a price of Rs 220 per share, a steep discount to the prevailing stock price.

Bharti Telecom Ltd, owned by the Sunil Mittal family, also pumped in Rs 2,500 crore. However, the quantum of investment by the promoter group company was relatively small compared to the overall expansion of share capital of the company. As a result, there was a significant dilution of stake for Bharti Telecom. Its stake in Bharti Airtel has reduced from 50.1 percent to 41.24 percent, post the capital infusion.

But, looking at the current scenario, can promoters invest more money in these firms?

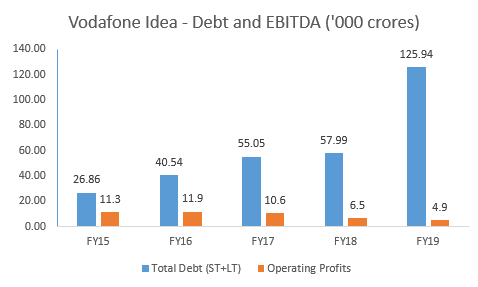

Between FY15 and FY19, Vodafone Idea’s operating profit has halved whereas its total debt has swelled five times by FY19 to Rs 1,20,000 crore. And, given the current financial performance, it won’t be able to service the interest burden post couple of quarters. Hence, it is in dire need of capital.

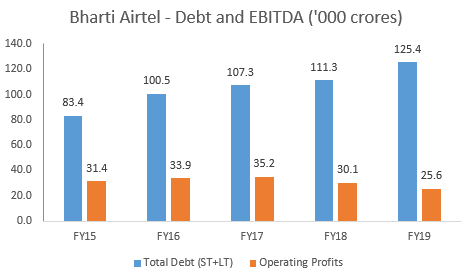

Bharti Airtel’s performance has been much better than Vodafone Idea's. Between FY15 and FY19, the company has generated more than Rs 1,50,000 crore of operating profit, but the capital allocation has been inappropriate and the total debt has swelled from Rs 83,000 crore in FY15 to more than Rs 1,25,000 crore in FY19.

Both firms had to suffer falling market shares and blows to profitability in the price war and disruption caused by the entry of Reliance Jio in the telecom sector.

Now, Vodafone Group Plc is a highly levered company with debt-to-equity of 82 percent and is presently loss making. It had posted a €7.6-billion loss in the year gone by. In fact, it recently cut its dividend to get some financial bandwidth to repay its debt and invest in the expansion of the business. Vodafone Idea’s other promoter – the Aditya Birla Group – is also not in a good place. As this report points out, the group firms reported a combined loss of Rs 6134 crore in FY19 while the combined gross debt-Ebitda touched 7.4 times.

Bharti Airtel is relatively placed better as it has made contingent provisions (Rs 13,000 crore) against the upcoming liability. However, the penalty liability (Rs 21,700 crore) is higher than the provision. Hence, it can manage the money to pay the penalty and interest on the same. It may also sell its stake in Infratel which could fetch Rs 25,000 crore.

But the fact remains that promoters have to cough up money to salvage the situation, given the high debt. A recent Moody’s report sums it up best: “Given their lack of free cash flow, we do not expect that the telcos will be able to generate enough cash to pay down debt and reduce their elevated leverage. We expect that Bharti Airtel will continue relying on capital raising activities to reduce debt, including equity raising ($3.5 billion) and asset sales.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.