Tata Motors’ (CMP: Rs 167.75, Mcap: Rs 52,217 crore) numbers for the September quarter came in better than expected on strong performance of its Jaguar Land Rover (JLR) business. JLR business was back in the black, thanks to new launches and cost cutting efforts undertaken by the company.

However, JLR is expected to continue to face challenges in various regions, including the UK, Europe and China. Domestic market conditions also continue to deteriorate, adding stress to the financials. Our valuation analysis suggests that the stock is currently at fair valuation.

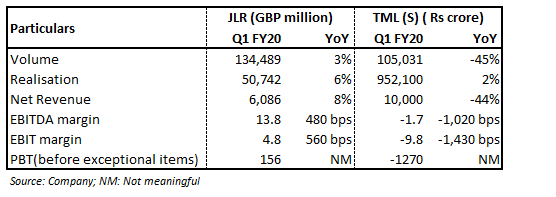

September quarter snapshot

JLR’s (ex-Chery JV) wholesale volumes grew 2 percent year-on-year (YoY) and Chery JV volumes saw a recovery and grew 11.6 percent. The new product launches helped volume growth. Realisation also witnessed a YoY growth of 6 percent, led by a rich product mix.

Notably, earnings before interest, tax, depreciation and amortisation (EBITDA) margin stood at 13.8 percent, the level which JLR used to achieve in the past. This is also one of the highest in the last four years. The feat was achieved on the back of its cost reduction and the turnaround plan.

Interestingly, JLR came back to profit and posted a profit before tax of £156 million, an improvement of £246 million over the same quarter last year.

Free cash flow, however, continues to be negative and read £64 million, an improvement of £559 million on a YoY basis.

Domestic business – Subdued numbersAmid multiple macroeconomic challenges, the standalone business posted a very weak set of numbers. September quarter volumes declined 45 percent, hit by 53 percent drop in the commercial vehicle (CV) segment.

EBITDA margin came at -1.7 percent in Q2 FY20, down 1,020 bps on YoY basis. This was due to negative operating leverage and write off of Rs 233 crore in passenger vehicle business.

OutlookOutlook continues to be challenging for JLR JLR has been operating under tough market conditions globally that has hit demand across segments. Despite the good performance in the quarter, the management indicated that outlook continues to be tough for the company. Though China, a key market for the company, witnessed recovery, there continues to be challenges because of trade war. Uncertainty regarding diesel vehicles in Europe continues to be a big challenge.

However, there are green shoots for the company. Improved product mix coupled with new launches are expected to improve realisation. Furthermore, the cost control efforts would drive operating margin recovery.

Domestic outlook – Very weak in near term Macro challenges led by diminishing liquidity, financing issues, rising interest rates, lagged impact of new axle load norms and slowdown in economic activity ahead of elections have dampened demand for CVs.

We expect demand to remain weak in the short term, but the long-term growth outlook remains promising on the back of economic growth, rising income levels, lower penetration, the government’s thrust on increasing rural income and focus on infrastructure and construction.

The upcoming BS VI emission norms are a near-term driver for the company. This is expected to lead to pre-buying as new BS VI compliant vehicles would be more expensive than current ones. Additionally, the government’s scrappage policy would potentially lead to replacement of 200,000-300,000 trucks which are over 20 years old, which should also augur well for the company.

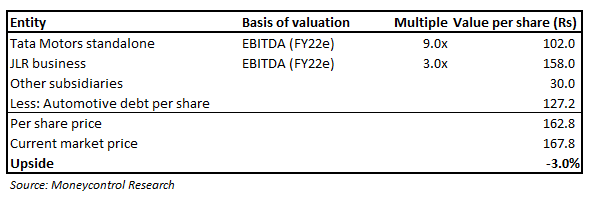

Valuation Our sum-of-the-parts (SOTP) valuation suggests little downside from the current level.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.