Sachin Pal

Moneycontrol Research

Highlights:

- Demand for cybersecurity products is growing at a rapid rate

- Quick Heal enjoys a strong footprint in both the retail and enterprise segments

- The company targets over 20 percent revenue growth from enterprise segment- Valuations reasonable at 11 times FY20 estimated earnings

-------------------------------------------------

The end market of cybersecurity products is growing at a rapid rate on the back of rising digitisation and the ever-evolving nature of the cyberthreat landscape. Quick Heal Technologies, the provider of security software products and solutions, is looking to tap into the market opportunity through network expansion and new product launches. The company enjoys a strong footprint in both the retail and enterprise segments and the current valuation, after a near 50 percent correction from the top, makes the stock noteworthy at current levels.

Internet penetration levels still low in India

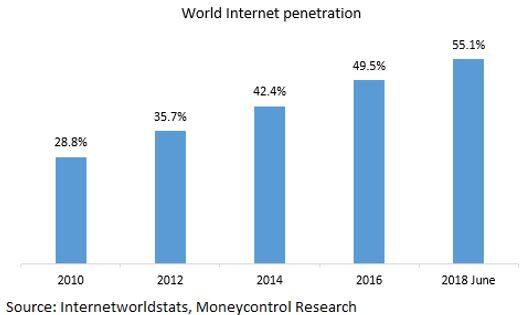

Technological disruption has aided the penetration on the internet in recent years and now more than 55 percent of the world’s population has access to an internet connection.

The emergence of Reliance Jio in the Telecom space has expanded the internet market in India. Internet penetration is growing at a rapid pace and currently stands at 34 percent of the total population. In comparison, China, which is similar to India in terms of population, has nearly doubled the number of internet users in the country. The penetration levels of China are also much higher at 57 percent.

The market opportunity for cybersecurity products and solutions is huge as there are more than 50 million mobile and laptops on the retail side. SMEs forming part of the enterprise segment has a market size of 40 million and these enterprises are gradually integrating technology into their businesses. In general, the cyber security market is vastly underpenetrated and proves ample opportunities for growth amidst growing concerns of information leakages and data privacy.

Strong operational performance in the first half

Quick Heal derives a majority of its revenues from the domestic market and has a 34 percent market share in the retail segment in India. At the end of Q2 FY19, the company had 32,000+ enterprise customers and 8.8 million active licence users.

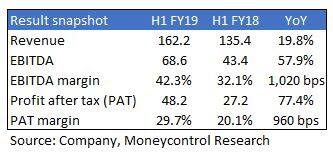

Quick Heal’s H1 sales rose 20 percent year-on-year (YoY). While the gross margins remained stable, EBITDA margins improved to 43 percent on the back of revenue growth and few cost optimisation measures.

Targeting higher revenue share from the enterprise segment

The company majorly operates in the retail and enterprise segments. It derives around 20 percent of revenues from the enterprise segment and the balance comes from retail. The renewal rate for retail segment stands at 40 percent while that of the enterprise segment is much higher at 75-80 percent. The management wants to increase the renewal rates in both the segments to aid long-term revenue visibility.

The management is targeting higher single-digit growth in top line in future from the retail segment (through penetration in tier II and tier III cities) and about 20-25 percent growth in the enterprise segment (through the penetration in the SME segment).

Scalable business with high operating leverage

Quick Heal plans to replicate the success in the consumer security segment to expand its coverage on the enterprise segment. While the business performance continues to be robust, the stock has declined a near 50 percent from its 52-week highs and is now trading at nearly 11 times FY20 earnings. The stock can be considered for accumulation on dips as the business is highly scalable, enjoys strong operating leverage and looks well positioned to grow in an increasing digitizing world economy.

(Disclosure : Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.)

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!