Krishna Karwa

Moneycontrol Research

Highlights:

- AC brands are outsourcing their manufacturing activities

- Revenue will be driven by higher volumes and product launches

- Higher utilisation levels and product mix should aid margin

- Seasonality and pricing pressure are key risks

- Amber Enterprises offers strong upside at current valuations

-------------------------------------------------

Amber Enterprises hasn’t lived up to the hopes reposed in it during its initial public offering (IPO) in January last year, when the issue was massively oversubscribed. The stock is currently trading around three percent lower than the upper end of its IPO price band (Rs 859 per share).

Why then should investors continue to repose faith? All the good things that investors saw in the company during its IPO continue to be present -- the difference is that, at current levels, the stock provides a great entry opportunity.

Amber is a contract manufacturer of room air conditioners (RACs). It is both an original design manufacturer (ODM) and an original equipment manufacturer (OEM). It manufactures RACs and components thereof for eight out of the top 10 RAC brands (such as Daikin, LG, Panasonic etc) in India.

The company also manufactures components for washing machines, refrigerators and television sets. Around 85 percent of its revenue are derived from ODM processes, which earn higher margin than OEM activities.

Going forward, client stickiness, higher sale volumes, introduction of new products and favourable industry prospects should help Amber bolster its top-line. Also, increasing utilisation levels at manufacturing facilities, higher contribution from inverter RACs to overall revenue and benefits of backward integration (through inorganic growth strategies undertaken in the past) should augur well in terms of margins.

Why consider Amber?

Industry dynamics are shifting

AC brands are going asset-light and focusing more on retailing. Therefore, they are outsourcing a greater chunk of their manufacturing operations to players like Amber.

The company has been a trusted RAC manufacturer for eight of the top 10 AC brands in India. Since there is a high degree of technical expertise involved, Amber’s contracts with RAC brands are long-term in nature. This ensures client stickiness.

To promote ‘Make in India’ initiatives, the government has imposed steep custom duties on imported RACs and its components. This should help Amber bag new contracts.

RAC demand trends

Penetration of ACs is very low in India. Higher disposable incomes, shorter replacement cycles, increasing electrification and availability of financing schemes have led to a spurt in demand.

Higher capacity utilisation

By securing new orders, the management hopes to increase utilisation levels at its factories from the current 67 percent. This should result in RAC volumes increasing to about 2.2-2.5 million units by FY20 from nearly 1.15 million units in the first nine months of FY19.

Capex plans

In tandem with the growth in its order book, capex of Rs 75-80 crore was incurred in FY19 on R&D and an additional manufacturing line. Amber plans to set up a new manufacturing facility in south India. For this, the company will invest in land and building (worth Rs 30-40 crore) in FY20 and Rs 55-60 crore on a new assembly line in FY21.

Inverter RACs

The management is working towards developing more energy-efficient inverter RACs (especially those based on the internet-of-things) since they fetch better margins compared to regular RAC variants. Since inverter RACs are the trend in the industry, Amber stands to benefit noticeably.

Inorganic acquisitions to enhance capabilities

Amber has been pretty active in acquiring businesses in recent years, as seen below:-

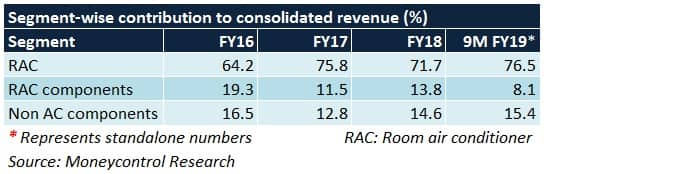

By virtue of these deals, the company aims to increase the contribution of AC components to its consolidated revenue, reduce dependence on RAC raw material suppliers, enter into new product categories and diversify its client exposure.

Moderation in input prices

For some critical RAC components such as compressors, which are almost entirely imported, procurement costs are slated to stabilise. This is because, of late, the rupee has been appreciating versus the dollar. Commodity (metal) prices appear to be softening as well. These two factors may have a positive rub-off on gross margin.

Debt repaymentFrom the IPO proceeds, Rs 475 crore was utilised to repay long-term borrowings in FY18 itself. Besides improving the capital structure, the move could yield better bottom-line margins going forward.

Risks

Owing to stiff competition in the consumer durables business, RAC brands are forced to take price cuts in a bid to gain market share. This could put Amber's margin under pressure since its contracts are B2B (business-to-business) in nature. Weaker-than-expected summer conditions, as seen during the course of FY19, can impact revenue.

Outlook

Like all other cooling device manufacturers, Amber will end FY19 on a subdued note. This is predominantly because of a weak first quarter, usually the strongest quarter of the fiscal in terms of sales traction. Steep raw material costs, inventory build-up across trade channels and delayed winters in the fourth quarter also hurt the business.

Nevertheless, tie-ups with marquee RAC brands, improving efficiency in operations, strong ODM capabilities and gradual regularisation of orders (mainly from southern and western India) should work in favour of Amber.

The stock trades at 19.5 times its FY21 projected earnings. Given the current price weakness, investors may consider going long.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.