Anubhav Sahu

Moneycontrol Research

Highlights:

- Pricing-led growth, but weak volume growth on a high base

- International business witnesses sharp margin erosion

- Household Insecticides remains stagnant

- Q4 to see improved margin as crude oil impact eases

- Re-rating potential hinges on credible international performance

-------------------------------------------------

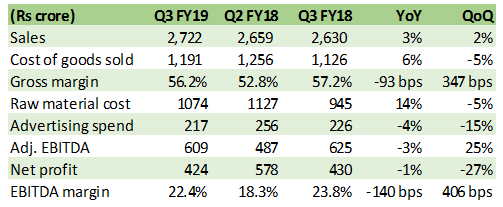

Godrej Consumer Products has reported a comparable constant currency growth of 8 percent, aided by 10 percent and 6 percent growth in the international and India business, respectively. While the India business benefitted from pricing effect, cost saving initiatives helped in EBITDA margin expansion of 140 bps YoY (100 basis points=1 percentage point).

Result snapshot

Source: Company

Key negatives

In terms of volume growth -- the key metric for FMCG companies -- its domestic business performance was disappointing. Volume growth of just one percent came on a base of 18 percent. Its two-year CAGR volume growth stands at 10 percent. In terms of segments, soaps (2 percent year-on-year) and hair colours (flattish YoY) witnessed a moderate sales performance on a high base of 24 percent and 33 percent, respectively. In Q2, the soaps segment posted five consecutive quarters of double-digit sales growth.

Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) margin for the international business of 14.6 percent ( down 300 bps YoY) was weighed by both crude oil and currency depreciation. Overall, comparable constant currency EBITDA growth of two percent was weaker than its FMCG peers.

Key observations

Household insecticides segment (38 percent of India sales) continued to see stagnate with two year sales CAGR of a mere 3 percent. The company noted flat growth in Q3 mainly driven by unfavourable season in south India, which accounts for one-third of segment sales. However, this is in contrast to growth seen by Jyothy Laboratories in this segment in Q3 (12 percent YoY). The management highlighted that the share of growth is getting diverted to incense sticks, which is a new sub-segment initiated by the company recently.

The management estimates that on account of illegal incense stick business growth of around 4-5 percent has been taken off from the household insecticides business. The category should have seen 6-8 percent growth if there was no adverse effect of illegal products on this business. Godrej Consumer has also embarked in this sub-segment with the launch of Goodknight Naturals Neem Agarbatti, in Andhra Pradesh and Telangana.

International topline is improving on a sequential basis led by Indonesia (32 percent of international sales). The management expects near-term growth to be aided by series of new launches. Key challenge here is the gestation period required for creating a credible position. Currently, a significant share of operating cost goes towards upfront marketing and sales promotion.

In case of South Africa, the management said the worst is over and that the company should be able to tackle competitive intensity going forward.

OutlookSales growth in the quarter under review was guided by pricing effect. However, the same was expected to taper in the near term, in line with the sector. Volume growth should rebound in Q4 as the base effect is favourable. On account of better crude oil pricing, the management is hopeful of a margin improvement. Moreover, demand conditions remain stable.

As far as the stock is concerned, it has consolidated from its recent highs, broadly in line with its peers. It currently trades at 36 times FY20 estimated earnings, which is a discount of about 8-10 percent to the likes Marico and Dabur.

We feel a relatively higher exposure to international markets (50 percent of sales), wherein growth visibility and earnings stability are lower than the Indian domestic market, warrants a lower multiple. Hence, we stay on the sidelines.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.