Sachin PalMoneycontrol Research

BlueDart Express reported a muted set of numbers for the last quarter of FY18. The company is facing tough competition as well as minor hiccups in is transition to the Goods & Services Tax and e-way bill era. Valuation remains expensive despite the underperformance.

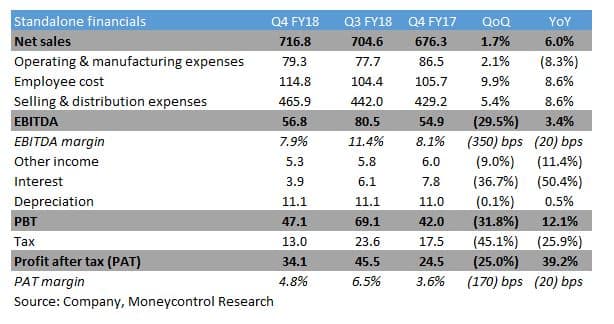

Revenue growth for the quarter gone by stood at six percent year-on-year (YoY). Earnings before interest, tax, depreciation and amortisation (EBITDA) grew 3.4 percent YoY. Higher employee and selling and distribution costs dragged operating margins lower, which fell to 7.9 percent in Q4 FY18 from 8.1 percent YoY. Profit after tax increased 39 percent YoY due to lower tax and interest expenses.

The company ended FY18 with a topline of Rs 2,799 crore representing a YoY growth of four percent. Operating performance remained muted as selling and operating expenses spiked during the year. PAT margins remained flat YoY.

On the business front, the company continues to face headwinds on multiple fronts. In-house logistics arms of e-commerce companies (such as Flipkart, Snapdeal, Paytm) are offering stiff competition to Blue Dart. These logistics subsidiaries are flush with funding from private equity players and continue to pose pressure on pricing and margins. Introduction of GST and e-way bill are throwing up near-term challenges with regard to implementation and transition.

We expect the competitive intensity in the industry to remain at elevated levels in the near-term as these logistic subsidiaries are well-capitalised and continue to gain market share.

Outlook and recommendation

Implementation of GST and e-way bodes well for the sector. We remain optimistic on its growth outlook but have a cautious stance as the business environment for Blue Dart remains challenging. We expect the company to underperform its listed peers on the financial front and post a flattish revenue in FY19. The stock, with a trailing price-to-earnings multiple of 58 times, features among the most expensive stocks. The quarterly performance of the company needs to be monitored closely for any visible signs of growth revival before turning optimistic.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!