Bajaj Corp’s second quarterly result was hit by channel clearance on the relaunch of ADHO (Almond Drops Hair Oil). Consequently, volume growth was subdued. While a Nielsen survey suggests healthy offtake at the retail level, management commentary on weak rural wholesale offtake is worrisome.

Weak set of results as volume moderatesThe company’s reported sales were up 4.2 percent (1 percent like-for-like) year-on-year (YoY) due to the transition effect on supply chain from the relaunch of ADHO and destocking in the rural wholesale channel. Implied volume growth was flattish. Normalcy in ADHO supply/restocking is expected to restore by early November.

Operating margins were broadly the same as last year with an improvement in gross margins and lower advertising spend run rate offset by adverse operating leverage.

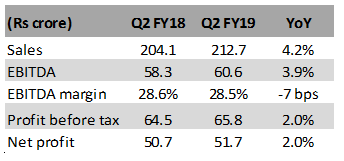

Quarterly performance

Weaker offtake in the wholesale channel is one concerning aspect. It’s noteworthy that this distribution was severely impacted by the disruptions caused by demonetisation and GST implementation. In the case of Bajaj Corp, wholesale channel sales contribution has shrunk from ~60 percent to 33 percent. Weak sales offtake from the wholesale channel last quarter can be attributed to destocking before the festive season or some underlying weakness in rural demand.

A re-emergence of weakness in rural demand is plausible given the weak management commentary from the consumer durable counters. However, if this is true it would be contrary to positive commentary heard from other FMCG players (HUL and Jyothi laboratories).

Management commentary for monsoon impact was negative, particularly, for the central parts of the country. In general, management sounded a bit cautious towards the improving demand sentiments.

Other channels performance are mixedCSD (Canteen Sales Department) channel performance has deteriorated but expected to settle at a lower base. E-commerce growth (0.5 percent of sales) is encouraging, however, both the channels (CSD + e-commerce) don’t contribute significantly to topline. Modern trade posted a decent growth number of 23 percent and share about 7 percent of total sales.

The company has undertaken a price hike of 3.5 percent which will reflect in Q3. Including ~1 percent hike in the month of April, quantum of pricing effect would be about 4.5 percent in this fiscal so far. Price hikes have been necessitated by the increase in raw material prices.

Adjusted landed cost of Light Liquid Paraffin (LLP), which is ~30 percent of total cost, was ~20 percent higher than last year. Sequentially, however, LLP landed prices have increased by 2 percent only. The price of another important cost input namely refined oil (13 percent of total cost) has improved 3 percent sequentially.

Competitive intensity and limited portfolio range are key constraintsHowever, the pricing power of the company would be tested in the coming quarters.

A key thing to watch for is volume offtake from rural areas and consumer response post-relaunch of ADHO. Additionally, pricing power would be tested as the company goes ahead with the recent hike.

To give a context, the company’s key challenge comes from the changing hair oil industry dynamics which includes competition from the low-cost manufacturers. While there is an improved traction for light hair oil industry in this quarter we reiterate that it needs to be seen if there is a reemergence of the trend in favour of light hair oil.

What keeps us cautious despite inexpensive valuation multiple -- 20x FY20e (estimated) earnings -- is the mediocre implied volume growth, competitive intensity and limited portfolio range.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.