In its latest note, domestic brokerage JM Financial reiterated that food delivery player Zomato Ltd. and financial services firm Jio Financial Services may enter the frontline Nifty 50 index in the upcoming rejig, which is due in March.

On the other hand, JM Financial expects FMCG player Britannia Industries and oil marketing major Bharat Petroleum Corporation will likely be excluded from the benchmark index. Previously, the brokerage anticipated that Eicher Motors would be removed from the index instead of Britannia Industries.

Follow our market blog to catch all the live updates

The announcement for Nifty 50 and other NSE indices constituent changes is expected later in February 2025, and the changes will take effect effect March 31, 2025 onwards. For the March rebalancing, the index provider considers the average free-float market cap from August 1 to January 31.

To be included in the Nifty 50 index, a stock must be part of the F&O segment. The potential inclusion of Zomato and JFS in the Nifty 50 follows the NSE's decision in November 2024 to add 45 stocks, including Jio Financial Services and Zomato, to the F&O segment.

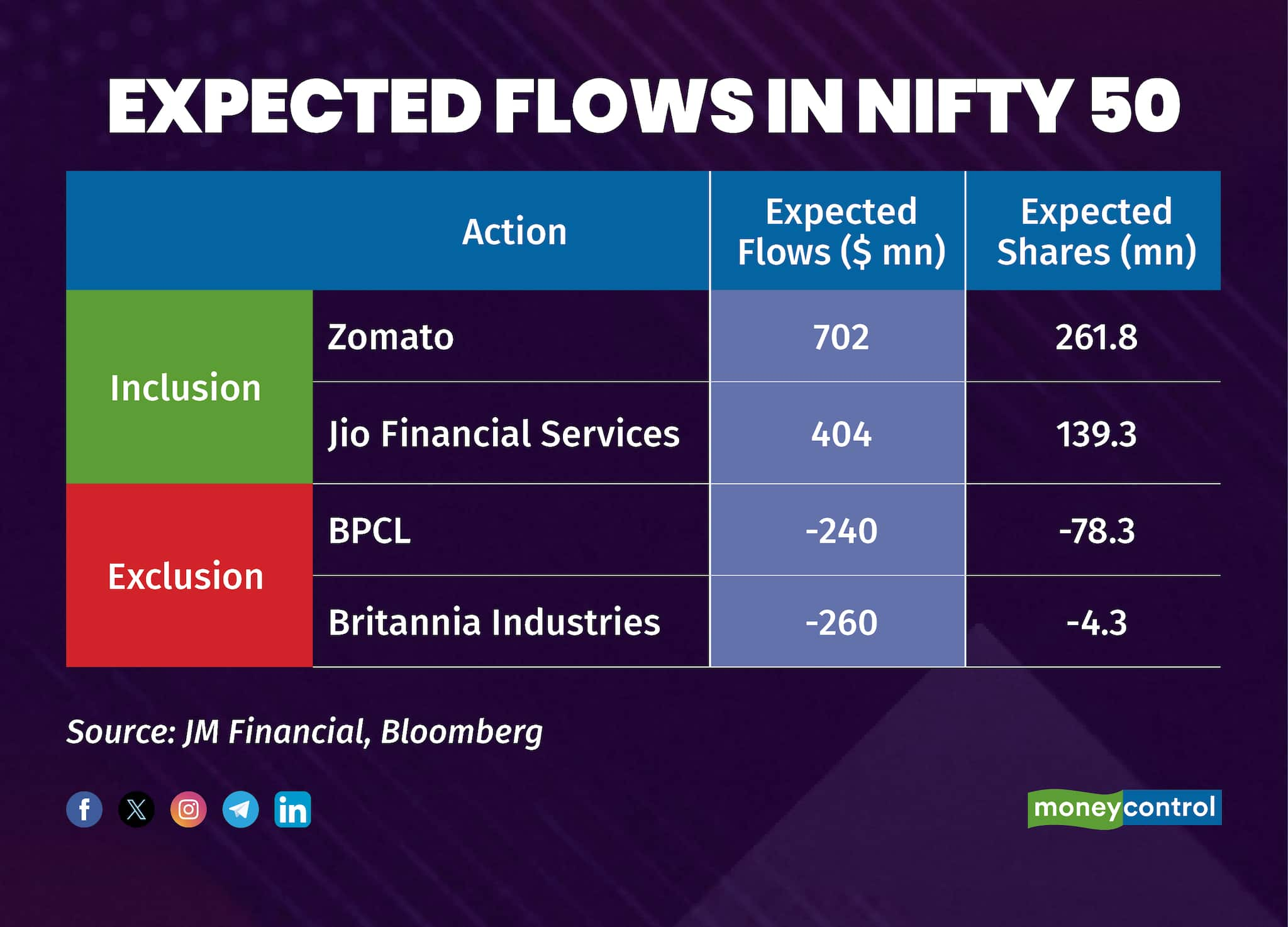

Zomato's inclusion could attract passive inflows of $702 million, while Jio Financial Services may see inflows of $404 million. Combined, the inclusion of the two companies could bring in passive flows of $1.11 billion.

Meanwhile, the exclusion of BPCL and Britannia Industries could result in outflows of $240 million and $260 million, respectively. With the exit of these two stocks, the index could see outflows of $500 million in trade.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.