Private sector lender Yes Bank posted a loss of Rs 600.08 crore during the July-September period, dented by higher provisions and one-time deferred tax assets adjustment with sharp increase in non-performing assets. Lower other income, pre-provision operating profit (PPoP) and net interest income (NII) also hit earnings.

The bank had reported profit at Rs 964.70 crore in year-ago period and Rs 113.76 crore in the June-ended quarter.

"Lower net interest income (down 9.6 percent YoY), fee income and marginal hike in operating expenses resulted in impacted bottomline. There was one-off impact of Rs 709 crore due to deferred tax assets adjustment, which resulted in a loss during the quarter gone by," the management said while addressing a conference call on November 1.

Asset quality deteriorated further with gross non-performing assets (NPA), as a percentage of gross advances, falling 238 bps sequentially to 7.39 percent while net NPAs, as a percentage of net advances, increased 144 bps QoQ to 4.35 percent.

The bank continued to see high loan slippages (Rs 5,950 crore) into NPA with 60 percent being from BB and below book and 40 percent from outside the identified stressed BB and below book, which was a key negative.

Also, the BB and below book saw a jump from nine percent of exposure to 10 percent in Q2 FY20. BBB and below also saw a jump of 21 percent QoQ to 21 percent of exposure due to downgrades from higher buckets.

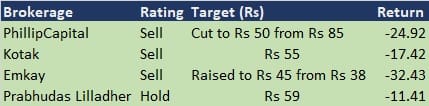

Most brokerages remain bearish on the stock with a sell rating and expect it to fall 11-32 percent after disappointing numbers on asset quality front and subdued deposits and loan growth (down six percent each YoY).

On October 31, the day before announcing its Q2 result, the lender said it received $1.2 billion binding offer from a global investor.

Here is what brokerages say about the Yes Bank after July-September quarter earnings:

Brokerage: PhillipCapital | Rating: Sell | Target: Cut to Rs 50 from Rs 85 | Return: (25 percent)

While clarity on capital raise plan is a big positive, asset quality continues to remain a key concern. With BB and below book increasing to 10 percent, we expect to continue to report higher slippages over the next few quarters.

We assume slippages of Rs 21,700 crore/Rs 9,200 crore for FY20/21, as a result, we expect GNPA/NNPA to rise to 9.3 percent/5 percent in FY20/21. We expect the bank to report a loss in FY20 and a return on asset (RoA) of 0.13 percent in FY21.

At CMP, the bank trades at 1.1x/1.0x FY20/21 ABVPS of Rs 62/64 (post-dilution). We have modelled Rs 8,000 crore capital raise at a price of Rs 50 in the second half of FY20. We maintain sell rating for the stock with a revised target of Rs 50 (Rs 85 earlier) valuing it at 0.8x FY21 adjusted book value.

Brokerage: Kotak Institutional Equities | Rating: Sell | Target: Rs 55 | Return: (17 percent)

The events that have been unfolding recently corroborate our longstanding negative stance on the stock. Balance sheet deterioration has been quick, leaving very little time to react to the situation. The recent capital infusion is insufficient for the size of unrecognized problematic loans. In this backdrop, Yes Bank surprised positively on Thursday with an announcement that it has received a binding bid from an investor committing US$1.2 bn, a significant step in the right direction.

We are still unsure of growth, excess capital, the path of RoE improvement given the changes in lending, the progress of building the bank’s liability franchise that is currently inferior to its peers and profitability. Stability of senior management is critical at this juncture. We still see a lot of headwinds, which give us discomfort to change our view on the bank despite a steep price decline. We maintain sell with fair value at Rs 55 (unchanged), valuing the stock at 0.6X September 2021E book for weak RoEs in the medium term.

Brokerage: Emkay | Rating: Sell | Target: Raised to Rs 45 from Rs 38 | Return: (32 percent)

We believe heavy capital injection, if any, may ease the current pressure on the capital front, but unabated stress flow will keep the P/L bleeding and call for prolonged dilution risk for investors. From a long-term perspective, the bank should focus on onboarding a strategic long-term investor and build/acquire capabilities on the retail front to avoid its legacy dependence on corporates for growth.

Retain sell/underweight in Emkay Alpha Portfolio (EAP) but revise its target to Rs 45 (0.7x Sep21E ABV) versus the earlier target of Rs 38, factoring in the upcoming capital infusion and rolling over to Sep’21E ABV. Key risks to our call are lower-than-expected asset quality deterioration and faster RoA expansion.

Brokerage: Prabhudas Lilladher | Rating: Hold | Target: Rs 59 | Return: (11 percent)

Higher additions to lower buckets & lumpy exposures remains a big risk to asset quality added by sluggish resolutions. By consolidating balance sheet bank has been able to conserve capital and incremental capital infusion by a large investor will help cushion large hits on balance sheet, but we worry it may not suffice. We retain hold with target price of Rs 59 (unhanged) based on 0.6x Sep-21 ABV.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.