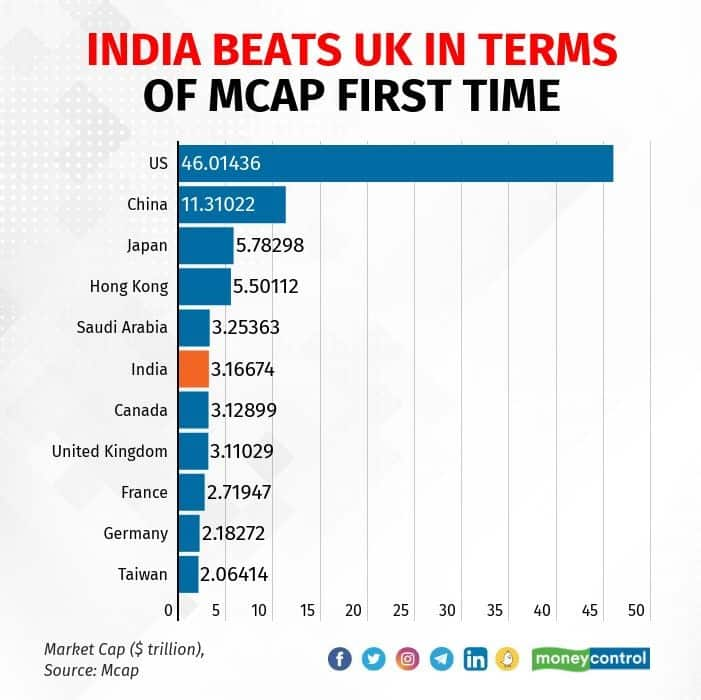

India has outgrown the United Kingdom in terms of market capitalisation for the first time to become the sixth biggest stock market amid a sustained slump in global equities triggered by the Russian onslaught on Ukraine.

India’s market cap stood at $3.16674 trillion on Thursday as against $3.1102 trillion for the UK, according to Bloomberg data.

India lost nearly $357.05 billion in market cap (MCap) since the geopolitical tensions flared up last month, while the British markets suffered an erosion of $410 billion since February 1.

The US is the world's biggest market with an MCap of $46.01 trillion followed by China at $11.31 trillion, Japan at $5.78 trillion, Hong Kong at 5.50 trillion, and Saudi Arabia at $3.25 trillion.

In Saudi Arabia, the world's second-largest exporter of crude oil, stock markets saw a jump in MCap after crude oil surged to historic levels. It added around $442 billion in MCap in the last one month.

World markets swung back in the black in the last two sessions after Ukraine President Volodymyr Zelensky said he was no longer pressing for the NATO membership. On Thursday, Indian markets opened in the green with a close watch on the outcome of poll results in five states.

Crude oil, too, took a breather from the rally on hopes of positive talks in a meeting of foreign ministers of Ukraine and Russia scheduled on Thursday in Turkey.

"The recent rebound (in Indian markets) is in line with the global counterparts and it would be too early to call it a reversal. Besides, the geopolitical updates, domestic factors like state election results will also be in focus. We expect volatility to remain high, so participants should prefer hedged trades," said Ajit Mishra, VP - Research at Religare Broking.

The Indian equity markets gained for the third session after a four-day losing streak. This was also the second best session since Russia's invasion on Ukraine on February 24. Both the benchmark Sensex and Nifty have lost nearly 6 percent, while both fell 6.2 percent so far this year. Year to date, foreign investors sold around $14.20 billion in the local equity markets.

With more central bank meetings coming up in the next week, analysts expect headline indices to move primarily based on macro news.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.