Revenue for the third quarter of the current financial year at IT major Wipro Ltd is likely to fall 4 percent quarter-on-quarter (QoQ), weighed by higher than usual furloughs, particularly in the banking, financial services, and insurance (BFSI) and hi-tech verticals, said analysts. This, along with weak discretionary demand and cross-currency tailwinds in Q3 FY24, is expected to keep net profit muted. The company is scheduled to announce October-December results on January 12, 2024.

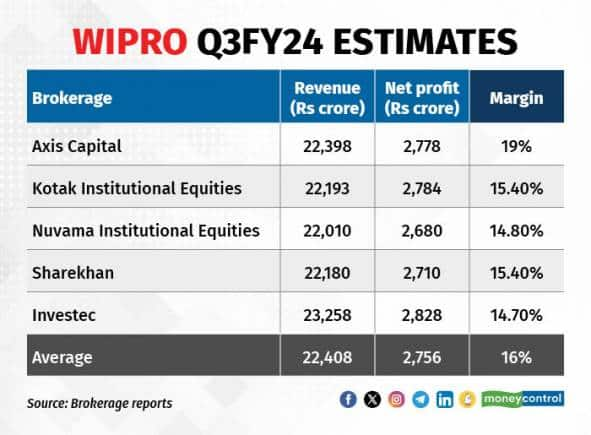

According to an average estimate of five brokerages, revenue is expected to decline 4 percent QoQ to Rs 22,408 crore. This would be worse than the far end of the management guidance band of -1.5 percent to -3.5 percent revenue growth in the quarter. On the other hand, Wipro's net profit is likely to see a drastic fall of 9 percent QoQ to Rs 2,756 crore.

Going ahead, Wipro may share -1 percent to 1 percent revenue growth guidance for Q4 FY24 in constant currency (CC) terms, said analysts.

ALSO READ: Infosys Earnings Preview Q3 FY24: Lower pass-through revenues, higher furloughs to drag down performance

Wipro margins hit on revenue fall, wage hikes

The muted revenue growth will also likely hit Wipro's earnings before interest, tax, depreciation, and amortisation (EBITDA). The firm’s EBITDA is expected to remain flat at Rs 4,245 crore in Q3 FY24, compared to Rs 4,231 crore in Q2 FY24, said analysts at Axis Capital.

Further, wage hikes are likely to hit Wipro's earnings before interest and tax (EBIT) margins by 30 basis points (bps) on a QoQ basis to 16 percent in Q3 FY24 compared to 16.3 percent in Q2 FY24, as per an average of five brokerage estimates. The wage hikes were implemented from December 1 onwards. Hence, it would be a one-month impact.

ALSO READ: Daily Voice | Q3 updates indicate positive result trend will continue, says this investment expert

What to watch in Wipro’s Q3 results

On the deals front, analysts at Kotak Institutional Equities said that Wipro's total contract value (TCV) and annual contract value (ACV) will remain muted in Q3 FY24 as no major deals were announced.

Meanwhile, some of the key monitorables for investors are Wipro's outlook for client IT spend in key verticals like financial services, along with geographies in Europe, TCV bookings and the likely path to translation of bookings to revenue growth, and any impact from senior-level exits in recent months, said analysts.

The Wipro stock jumped 13 percent during the October-December period, outperforming the Nifty IT index, which remained flat. However, it rose 15 percent in the last one year, sharply underperforming the IT index, which rallied 22 percent in one year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.