Shares of Vodafone Idea Limited (VIL) cracked 25 percent in intraday trade on August 5 to hit their 52-week low of Rs 4.55 on BSE.

The stock, however, pared losses and ended 1.49 percent lower at Rs 5.94.

This stock seems to be in a tailspin and for the past few years, investors have been wondering if the company will remain a going concern, owing to its acute financial stress.

In the calendar year 2021 , the shares of the troubled telco have eroded 44 percent of their market value. The stock's all-time low is Rs 2.61, which it hit on November 15, 2019.

Remarkably stable shareholding pattern

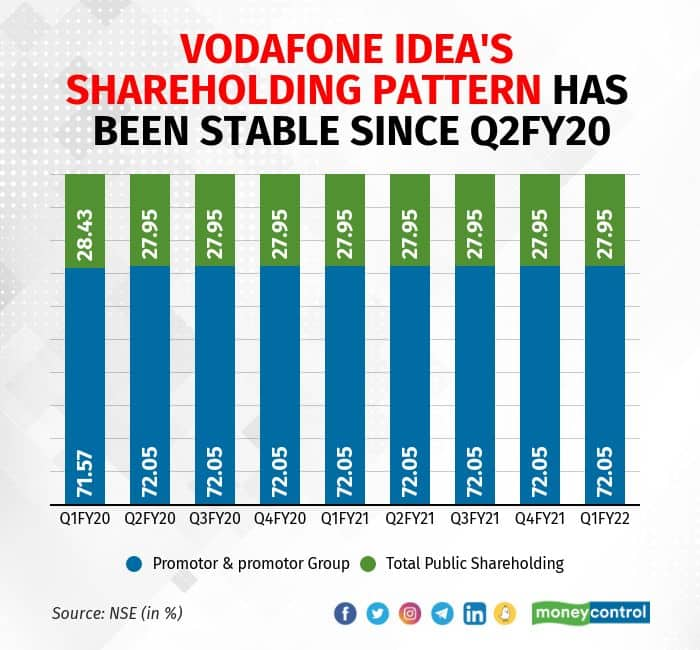

Despite the poor show, it seems retail investors still have faith in the stock as its shareholding pattern shows remarkable stability.

Since September 2019 (Q2FY20), promoters and public shareholders have maintained their stake, NSE data shows.

The recent selloff, however, indicates that they are having a second thought. The road ahead for looks to be gloomy.

Survival at stake

The company has been facing critical financial hurdles without a clear plan for revival and debt repayment.

According to official data, VIL had an adjusted gross revenue (AGR) liability of Rs 58,254 crore, out of which the company has paid Rs 7,854.37 crore and Rs 50,399.63 crore is outstanding.

Aditya Birla Group Chairman Kumar Mangalam Birla, who owns around a 27 percent stake in VIL, has offered to sell his share to the government to keep the company operational.

The billionaire businessman made the offer in June in a letter to Cabinet Secretary Rajiv Gauba.

In the letter, Birla said investors were not willing to invest in the company in the absence of clarity on AGR liability, an adequate moratorium on spectrum payments and most importantly, floor pricing regime above the cost of service.

Without immediate active support from the government on the three issues by July, the financial situation of VIL will come to an "irretrievable point of collapse," Birla said in the letter dated June 7.

"It is with a sense of duty towards the 27 crore Indians connected by VIL, I am more than willing to hand over my stake in the company to any entity- public sector/government/domestic financial entity or any other that the government may consider worthy of keeping the company as a going concern," Birla said.

This was before the Supreme Court in late July dismissed a petition from VIL and other telecom service providers for directions for a correction of alleged errors in the calculation of adjusted gross revenue dues.

Birla has now stepped down as non-executive director and non-executive chairman of Vodafone Idea. The board accepted Birla’s request to step down from August 4.

While Birla is ready to sell his stake to keep the company aloft, things are not looking good for the company, with Vodafone Chief Executive Officer Nick Read ruling out infusing fresh equity into debt-ridden VIL.

"We as a group try to provide them as much practical support as we can, but I want to make it very clear, we are not putting any additional equity into India," Business Standard quotes him as saying.

What should investors do?

Investors who have already put in money in the stock may consider exiting it, while market analysts advise new investors to stay clear of the stock.

Ashis Biswas, Head, Technical Research, CapitalVia Global Research, said Birla's exit was bad news for the stock.

"The company's financial condition is not in good shape and to improve operational efficiency, it requires at least Rs 25,000 crore to sustain Vodafone Idea as the third major player in the telecom sector," Biswas said.

"The stock is trading at Rs 4.50–Rs 4.60. Technically, the strong support for the stock is at Rs 3.80. If an investor wants to hold the stock, he/she can hold with a stop loss of Rs 3.80. For new investors, I would suggest that do not enter into this stock as fundamentals are not looking strong and until and unless money is pumped into the company, the operational viability is in question," Biswas said.

Deepak Jasani, Head of Retail Research, HDFC Securities pointed out that for any new private player to take a stake in Vodafone Idea, there has to be clarity on the AGR dues and on the setting of a floor for tariffs among all players.

Fear of quick loss of subscribers by Vodafone Idea in case the service quality deteriorates is real.

"Investors need to keep all these in mind when they think of bottom fishing in the stock. They have to give up their greed of aiming to make large sums in penny stocks," said Jasani.

"Only when there is clarity on the company sustaining for at least a year from now with major reliefs being granted, investors could take a look at the stock. Even then the comparative merits of the three listed stocks need to be made and a decision can then be taken," he said.

Finology CEO Pranjal Kamra said VIL needs a lot of cash flow to sustain itself and AGR dues remain a major concern.

"With a growing user base, better services and robust balance sheets of its competitors, it stands a minute chance of reviving itself in the long run," Kamra said.

Read more: India's Vodafone problem can’t be solved by the government

The unfolding of the Vodafone Idea saga will have far-reaching consequences for Indian businesses, including the banks which will lose a hefty amount.

Read more: Vodafone Idea: How will banks get impacted in the event of a default?

"The Supreme Court's verdict on AGR dues made the situation precarious for the company which is now heading for default on loans. If this happens, it will impact a few banks too since the debt to banks stands above Rs 23,000 crore," VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services, said.

The government should explore all options to make the hugely crucial telecom sector a three-player industry, he said. Birla's offer to give up his stake should be welcomed. “The stakes are huge," Vijayakumar said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.