After Kumar Mangalam Birla’s letter to the central government offering to hand over the stake in Vodafone Idea, there is a rising concern among banks over the potential impact of a payment default by the telecom company.

Banks have offered fund exposure (direct loans) and guarantees to the telecom company. The combined exposure is substantial for the sector. What's going to happen to this exposure?

To be sure, the company is not a non-performing asset (NPA) for banks yet as per the latest available information. But considering the huge payment obligations, the risk of a default looks high. Also, if the company defaults on the spectrum payment obligations to the government against which banks have issued guarantees, banks' exposure to that extent could be deemed bad.

What did Birla say?

In a letter to Cabinet Secretary Rajiv Gauba on June 7, Birla sought clarity on AGR, adequate moratorium on spectrum dues and floor pricing, adding without immediate and active government support Vi’s operations would be at an "irretrievable point of collapse".

Birla said investors had also sought clarity on these issues. He said that, with a “sense of duty” towards 27 crore customers, the telecom giant was willing to hand over its stake to a public sector unit (PSU), a government entity or a domestic financial entity.

Total AGR dues as assessed by the department of telecom (DoT) is estimated to be Rs 58,254 crore. So far, the company has paid Rs 7,854 crore and its self-assessment of dues stand at Rs 21,533 crore. AGR dues are to be paid in 10 annual instalments starting FY22.

Impact on banks

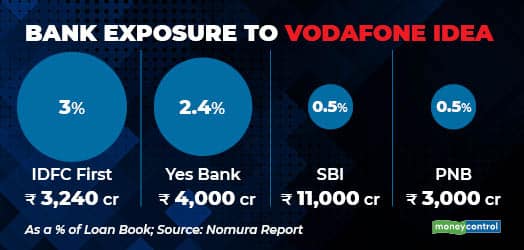

Vodafone Idea's gross debt, as on March 31, 2021, is estimated to be at least about Rs1.8 lakh crore. Eight top banks led by SBI have large exposure to the firm. In terms of percentage to book, IDFC First Bank, YES Bank and IndusInd Bank top the list. SBI has around Rs 11,000 crore exposure to Vodafone Idea which constitutes 0.5 per cent of its loan book whereas IDFC First has Rs 3,240 crore exposure which is around 3 per cent of the loan book.

Bank Exposure to Vodafone Idea (Graphic: Moneycontrol)

Bank Exposure to Vodafone Idea (Graphic: Moneycontrol)

Others include Yes Bank (Rs 4,000 crore or 2.4 percent of the book), PNB (Rs 3,000 crore or 0.5 percent of the loan book), Axis Bank (Rs 1,300 crore or 0.2 percent of the loan book), ICICI Bank (Rs 1,700 crore or 0.2 percent) and HDFC Bank (Rs 1,000 crore or 0.1 percent). The numbers are based on a Nomura report.

Larger banks may not have to worry much because as a percentage of the book, exposure is not very high. Also, most banks had started providing for likely losses from Vi. Banks have been preparing for this for a while. But, that may not be the case with smaller lenders. "Most of the larger banks will absorb the hit given their very large balance sheet size. However, smaller mid-sized banks will have some issues," said Jyoti Roy, analyst at angel broking.

In a recent conference call with media, PNB Managing Director and CEO, Mallikarjuna Rao admitted that banks were concerned about the potential problems from the telecom sector including the Vodafone account. The bank will discuss the way ahead with other lenders after the letter from Birla to the Government, Rao said.

"Developments in the last few days are areas of concern for the banking industry to look at. Even SBI chairman has given a statement that considering these factors probably banks will not be willing to fund telecom companies in the absence of clarity with respect to these issues," said Rao in a conference call on August 3.

Birla’s letter came after the Supreme Court on July 23 rejected Bharti Airtel, Vodafone Idea and Tata Teleservices' plea seeking re-computation of the adjusted gross revenue (AGR)–related dues. In 2020, the court had given 10 years to telecom service providers to pay Rs 93,520 crore of AGR-related dues to clear their outstanding amount to the government.

"Having said that as of today, the exposure of PNB is not very high to impact the balance sheet. However, we will be definitely discussing with other bankers to see what kind of action we need to take looking forward, considering the statement given by Mr Birla," said Rao, adding that there were no defaults so far.

As mentioned above, while large banks may not be impacted much, Birla's letter may cause worries for mid-sized lenders having exposure to the firm. But, in this segment too, many have made provisions already which may limit the impact, analyst said.

"VI has about INR 923 billion of deferred spectrum payment obligations, against which we believe banks would have issued guarantees only for the portion of current liabilities," said Nomura in a note. According to Nomura calculation, the gross non-funded exposure of banks is around Rs 237 billion (Rs 23,700 crore).

"In case of a default, only these current non-funded exposures are converted into debt and thereafter treated as an NPL. However, we are not entirely sure whether the DoT calls in the bank guarantees resulting in an actual loss for banks," said Nomura.

The IBC aspect

In the current situation, Vodafone defaulting on its payment obligations and consequently going down the bankruptcy route appears to be the only way out for Vodafone Idea, said Deepak Thakur, Partner, L&L Partners.

"If this happens then this would be catastrophic for Indian economy for many reasons including Government (for its AGR dues on one hand and attracting foreign investments on the other by creating one more example of regulatory uncertainty), banks (for their mounting debts) and general public (due to loss of job opportunities on one hand and lack of competition on the other)," Thakur said.

While there is a possibility that banks may push Vodafone Idea to the bankruptcy court if there is no clarity on the payments, even then it will not be easy for the lenders to get a buyer, said analysts.

"Getting a buyer will be very tough even if this account is pushed to IBC. Nobody will come forward unless the Government waives off AGR dues, at least partially in terms of past dues," said a Mumbai-based analyst who didn't want to be named.

"Fundamentally speaking, telecom has not made money in India, this is not an attractive proposition for any investor. Vodafone and Birla will not put in any money. Unless the government changes the rules drastically, there won't be a way out from the mess. Now it is up to the regulator and government to decide," said the analyst.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.