Excess liquidity in the market is creating havoc in the financial markets. Large Initial Public Offerings (IPOs) with issue size of more than Rs 10,000 crore are getting oversubscribed by 40x. Gold & Silver Exchange Traded Funds (ETFs) are trading at a premium to their indicative net asset value (i-NAV). Investment Trusts are being chased like they are equity shares of high growth companies.

It seems retail investors are on a frenzy of irrational exuberance. Everyone wants consistent compounders…unfortunately returns too are cyclical. Excess liquidity in hands of retail investors is leading them to take irrational decisions. Here are a few examples...

•> Silver ETFs in India recently traded at a premium of 9-13 percent compared to their i-NAV’s. Silver broke out of its previous all-time high of $50 per ounce which led to a buying frenzy among the retail investors. They felt left out as gold was already beyond their reach now they didn’t want to miss the silver bus and suffered from FOMO (fear of missing out). The frenzy to buy silver at any cost pushed the ETF’s way above their intrinsic value. Silver is already running short of supply in the physical market. This buying frenzy by retail investors in ETF market added fuel to fire.

•> A newly listed investment trusts (InvIT) with a focus on road infrastructure traded at a premium of 13 percent on the listing day recently. Investors overlooked the fact that an Invit is primarily a debt-oriented instrument where chances of capital appreciation are limited. But still went ahead and paid the hefty premium in a frenzy thinking that it will appreciate like a stock.

Not just secondary market the primary market is also showing signs of exuberance.

•> October 2025 has set a new record in fund raising through IPOs. In just the first half of the month, India saw fund raises worth Rs 36,000 crore, led by Tata Capital and LG Electronics India. While Tata Capital saw muted response. LG Electronics saw over subscription to the tune of Rs 4 lakh crore. This is the highest level of subscription received by any IPO in India.

•> The scale of funds raised is impressive but every listing has not delivered on expectations. Average listing gains have dropped sharply from more than 20 percent in 2024 to just 8-9 percent this year. Majority of IPOs have listed below their Grey Market Premium (GMP), highlighting the gap between hype and reality.

While retail investors are lapping anything that comes their way in primary market. Foreign investors are much selective.

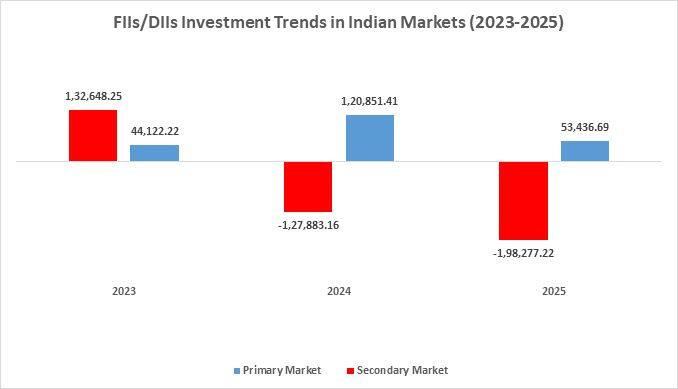

•> Foreign Portfolio Investors (FPIs), while active in debt markets, have pulled back significantly from equities, signalling that caution is warranted. For context, FPIs withdrew Rs 1.28 lakh crore from the secondary market in 2024 and invested Rs 1.21 lakh crore in the primary market. In 2025, the gap has widened significantly - FPIs have pulled out Rs 1.98 lakh crore from equities while deploying only Rs 53,400 crore into primary markets.

What Retail Investors should consider before stepping on the bandwagon

•> Don’t rely on the Grey Market Premium (GMP)

Average listing gains have declined sharply-from around 28-29 percent in 2024 to just about 8 percent in 2025. Nearly 70 percent of all the IPO listing in 2025 have happened below their estimated GMP. Many retail investors assume high listing gains based on then prevailing GMP, but not every IPO delivers returns in line with these expectations.

•> Look beyond the profitability ratios

Companies raising funds through IPOs sometimes inflate profits or report one-off revenue growth to appear more profitable. Retail investors frequently overlook whether profits are translating into cash flow and whether revenue growth is sustainable, particularly in cyclical industries. New age platform companies who are loss-making are often the ones most likely to present such adjusted numbers.

•> Don’t ignore secondary markets over IPOs

In periods of market decline, many retail investors chase IPOs and ignore opportunities in secondary markets. Waiting for allotment in “hot” IPOs often leads to opportunity costs, as already listed peers may offer better value.

•> Selling a potential multi-bagger too early

Investors who receive IPO allotments often sell it immediately for listing gains. This behaviour can result in exiting companies too soon that have strong long-term potential. One must also note that your actual take home profit reduces by paying higher short-term capital gains (STCG) tax on listing gains.

Conclusion

IPOs often generate significant hype, capturing the attention of retail investors with the allure of quick gains. However, the true potential for wealth creation lies not in chasing immediate listing-day profits, but in a disciplined, long-term approach to accumulation.

Retail investors must learn to avoid the irrational exuberance. They must carefully evaluate a company’s fundamentals, and maintain a strategic perspective and position themselves to capture meaningful returns. Patience, thorough analysis, and measured allocation are understated yet powerful drivers for creating long-term wealth.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.