The benchmark indices took a breather after a 1.6 percent rally on the Nifty 50 in the previous session, closing 0.2 percent lower on May 16. However, the overall sentiment remains favourable for bulls, with healthy market breadth. About 1,790 shares saw buying interest compared to 827 shares that were under pressure on the NSE. The market is expected to remain in positive terrain despite intermittent consolidation. Below are some short-term trading ideas to consider:

Rajesh Palviya, Senior Vice President Research (Head Technical Derivatives) at Axis Securities

NHPC | CMP: Rs 89.71

Since October 2024, NHPC has been consolidating within the Rs 88–70 range, accompanied by significant volumes. This represents strong accumulation with increased participation. With the last weekly close, the stock has decisively surpassed the multiple resistance zone at Rs 88 on a closing basis.

It is well-positioned above its 20-day, 50-day, 100-day, and 200-day Simple Moving Averages (SMAs), and these averages are also inching up along with rising prices, which reconfirms bullish sentiments. The daily, weekly, and monthly strength indicator RSI suggests that buying may occur at current levels. The weekly Bollinger Bands buy signal indicates increased momentum. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 97, Rs 105

Stop-Loss: Rs 85

TVS Motor Company | CMP: Rs 2,841.5

On the daily chart, TVS Motor has confirmed a "Flag" continuation pattern breakout at Rs 2,810 on a closing basis, supported by huge volumes. The stock is well-positioned above its 20-day, 50-day, 100-day, and 200-day SMAs, and these averages are also rising along with prices, reaffirming bullish sentiments. The weekly Bollinger Bands buy signal suggests increasing momentum. The daily and weekly RSI strength indicators indicate that buying may occur at current levels. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 2,955, Rs 3,085

Stop-Loss: Rs 2,790

Central Depository Services | CMP: Rs 1,408.8

On the daily chart, CDSL has confirmed a breakout of the "Inverse Head & Shoulder" pattern at Rs 1,375 on a closing basis. This breakout is accompanied by high volumes, indicating increased participation. The stock is well-positioned above its 20-day, 50-day, and 100-day SMAs, and these moving averages are rising along with prices, reaffirming bullish sentiments. The daily and weekly RSI strength indicators suggest that buying may occur at current levels. Investors should consider buying, holding, and accumulating this stock.

Strategy: Buy

Target: Rs 1,530, Rs 1,650

Stop-Loss: Rs 1,375

Riyank Arora, Technical Analyst at Mehta Equities

Angel One | CMP: Rs 2,800.6

Angel One is showing strong upward momentum, trading well above all major moving averages, indicating continued strength in the trend. The RSI (14) is at 72, reflecting solid buying interest. The stock has maintained higher highs and higher lows on the daily chart, confirming bullish sentiment. The current levels offer a favourable risk-to-reward entry point. A stop-loss should be placed at Rs 2,700 to limit downside risk, while the stock is expected to move towards Rs 2,950 in the near term.

Strategy: Buy

Target: Rs 2,950

Stop-Loss: Rs 2,700

PB Fintech | CMP: Rs 1,756.2

PB Fintech has broken above a key resistance zone and is currently retesting its 200-day EMA and DMA, both of which are acting as reliable support levels. The RSI (14) at 60 signals stable bullish momentum. The stock is also sustaining above all major moving averages, indicating strong trend confirmation. Volume activity has picked up on the breakout, further supporting the bullish outlook. This retest offers a favourable entry with a stop-loss at Rs 1,700 and potential upside towards Rs 1,850 and beyond.

Strategy: Buy

Target: Rs 1,850

Stop-Loss: Rs 1,700

Tech Mahindra | CMP: Rs 1,617

Tech Mahindra has successfully moved above its 200-day moving average and is now undergoing a healthy retest near the breakout zone. The RSI (14) at 73 suggests strong momentum and investor confidence. The stock is also holding above key short- and medium-term moving averages, which adds further strength to the setup. With the broader trend turning positive and price action confirming support, the current level presents a good risk-managed buying opportunity.

Strategy: Buy

Target: Rs 1,700

Stop-Loss: Rs 1,560

Osho Krishan, Chief Manager - Technical & Derivative Research at Angel One

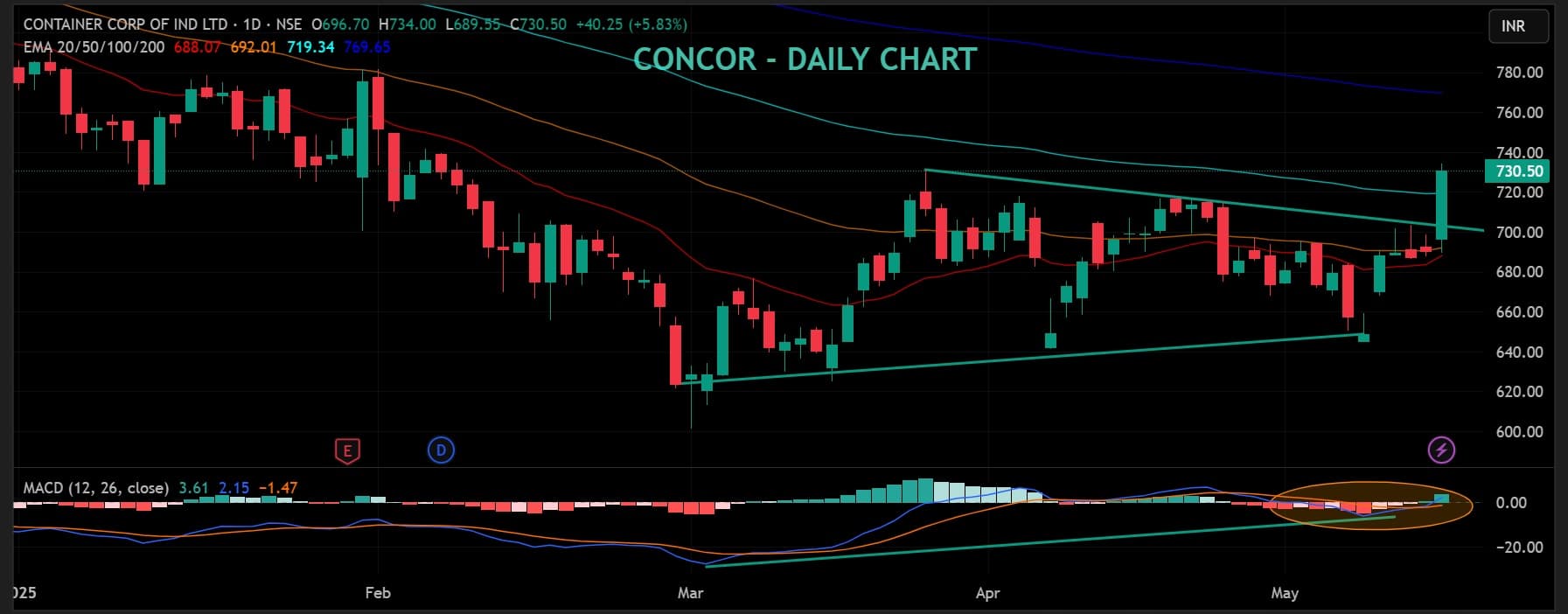

Container Corporation of India | CMP: Rs 730.5

Container Corporation has shown impressive growth, surging over 12 percent in the past trading week. This surge has been accompanied by an increase in average trading volumes, suggesting growing market interest and the possibility of a trend reversal. The stock has surpassed its 100-day Exponential Moving Average (DEMA) after a long period.

Additionally, the MACD (Moving Average Convergence Divergence) line shows a positive crossover near its zero line, further indicating bullish momentum. Overall, these technical indicators suggest that Container Corporation may be entering a period of sustained growth, making it an intriguing investment option. Hence, we recommend buying the stock around Rs 720.

Strategy: Buy

Target: Rs 800, Rs 820

Stop-Loss: Rs 668

Adani Green Energy | CMP: Rs 1,020.10

Adani Green Energy has experienced a significant resurgence in the last trading session, leading to a strong weekly close. The stock is firmly positioned above its 50-day DEMA on the daily timeframe after a prolonged period, indicating inherent strength and the potential for continued upward momentum. Additionally, it has broken out from its consolidation phase and is supported by a positive crossover on the 14-day RSI, reinforcing its bullish stance. Hence, we recommend buying Adani Green Energy around Rs 1,000–Rs 1,010.

Strategy: Buy

Target: Rs 1,120, Rs 1,140

Stop-Loss: Rs 920

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.