Hedge always restricted as a cost paid when things go horribly wrong. While it is not entirely wrong but there is more to it. Let us start with busting a myth of Hedge and then carry on understanding how hedging with Options can help get more out of the same trades.

Litteral meaning of Hedge is a fence around the property to restrict unwanted from entering and protect valuable from leaving the property. That is exactly how it is.

I have often seen misconception that “I lost some money; can you hedge and recover the loss?” This is a myth. Hedging in anyway can not undo an already incurred loss. There are many other uses of it that are far more valuable though. We will look at 3 of such uses and how can that be incorporated in our day-to-day trading and investments.

1. Restricting Risk (Restricting Unwanted):This is the very reason why options were introduced in the financial markets. The transition of markets from Futures only to Options was primarily to restrict the risk. The way this works is easy. While entering the trade or even and investment, if we do not want to take the losses beyond a certain point, we buy an Option to close the trade at a particular price. That is called the most original form of hedge.

Let us look at it with an Example.

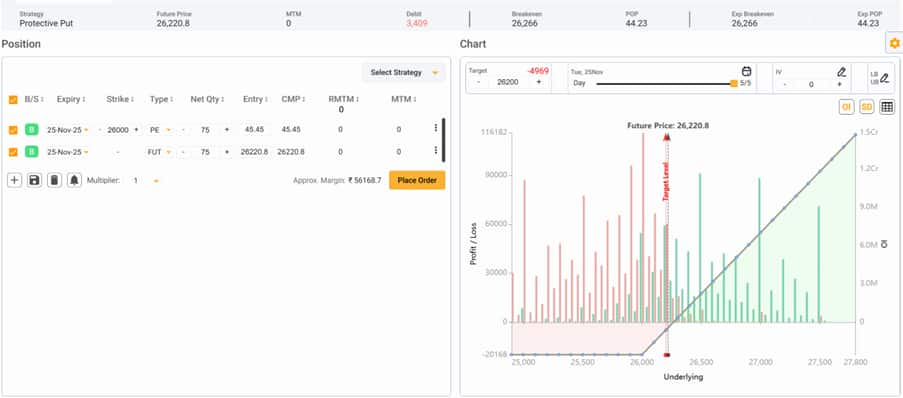

Let us say we want to Buy an Index trading at 26200. However, we do not want to lose more 200-300 points on the index Buy trade.

Buy a Future at 26220

We bought a Future here at 26220 + we bought a Put Option (option to sell) at 26000 for premium of INR 45. This means that for this trade with an expiry date of 25th November, we will not lose more than 220 (26220-26000) + 45 (Premium) = 265. However, the profit can be as high as the index can go.

Let us carry this example and see 2 more uses of the Option Hedges.

2. Locking Profits (Protecting Valuable):Locking profits works the same way. The only difference is that in 1st use case we bought both Future and Put Option exactly at the same time, for locking profits Option will be bought at a later date.

All of us encounter a time in our trading cycles where we are temped by the profits on the table and are worried about losing it. On the other hand, we do have faith that we can get more. In anxiety we get out at compromised profit.

Hedge can help here. Imagine buying same index at 25500. At 26220 when anxiety comes instead of selling just Buy Option to Sell.

3. Temp Hedges for Volatility (Right Before the flood):This is more of an umbrella kind of Option used by medium term traders, investors. Let us say there is a policy decision that can create volatility that may go for or against you.

Instead of getting out of the trade, just buy Option to Sell. Now, if it goes against you, there is protection. If it goes in favour and runs away, you are there to cash the volatility led profits.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.